Finding a company’s market value

30/01/2025

If you had to find a company’s market value, would you know where to look? Now, before you ask, we’re talking listed companies only here, so solely those which have shares actively traded on a stock exchange. This kind of figure is notoriously difficult to calculate for privately-owned enterprises but can easily be found for public companies worldwide. You just need to know where to look!

The market value of a publicly-traded company is known as its market capitalisation, or ‘market cap’ for short. The market cap itself is a fairly simple figure, generated by calculating the market value of the company’s outstanding shares (so we take the current share price and multiply it by the quantity of shares currently in circulation). It will therefore vary from day to day, minute to minute depending on a company’s share price.

If you don’t have the time or the inclination to do the calculation yourself, the figure can be found in various online services including Capital IQ, Bloomberg, Fame, and Workspace. Read on to find out more.

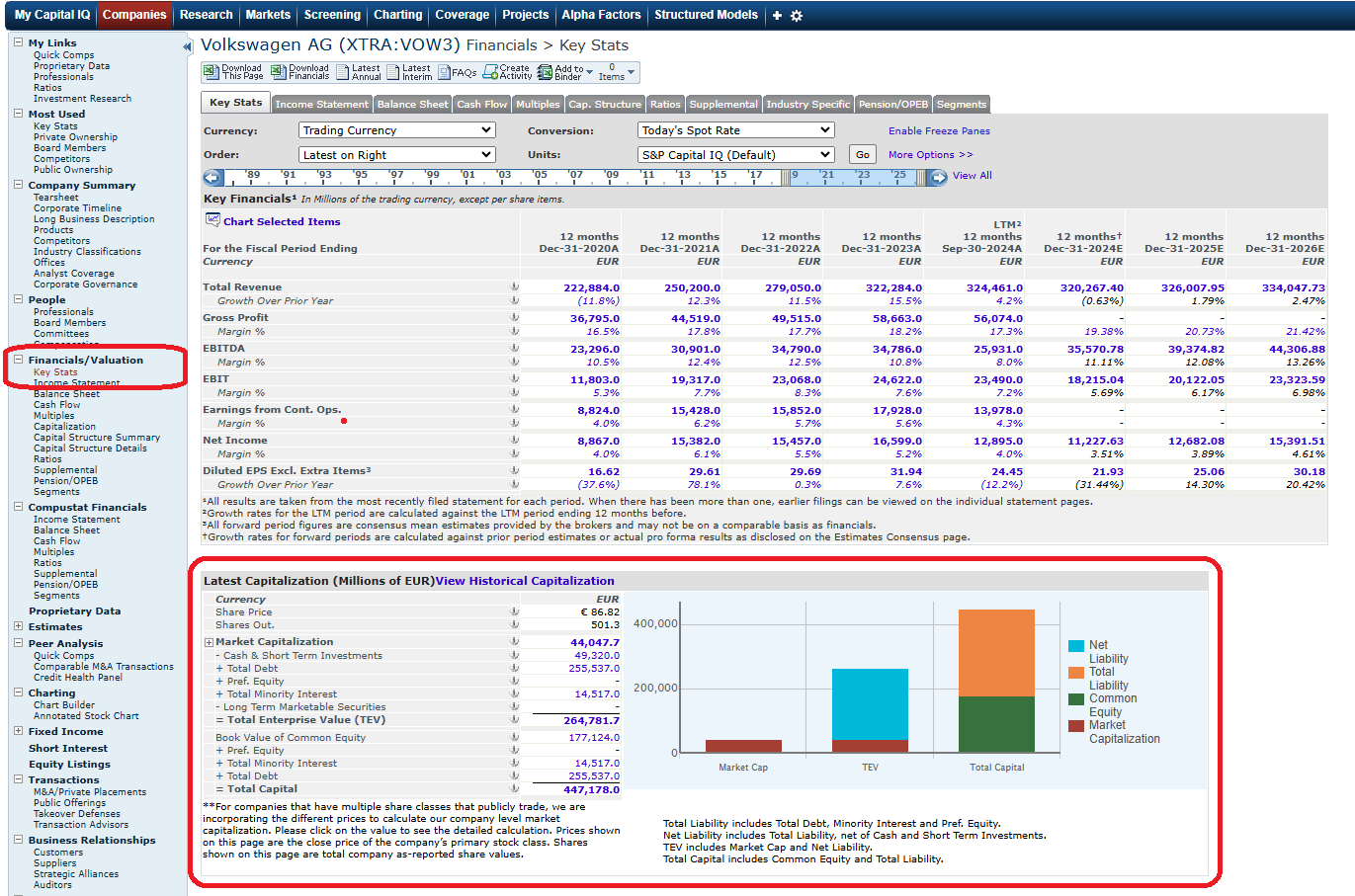

Capital IQ

In Capital IQ you will find Market Cap in the company record. It is featured on the company summary page and the Key Stats option in the ‘Financials/Valuation’ menu will give you a more in-depth breakdown.

Market Capitalization in Capital IQ

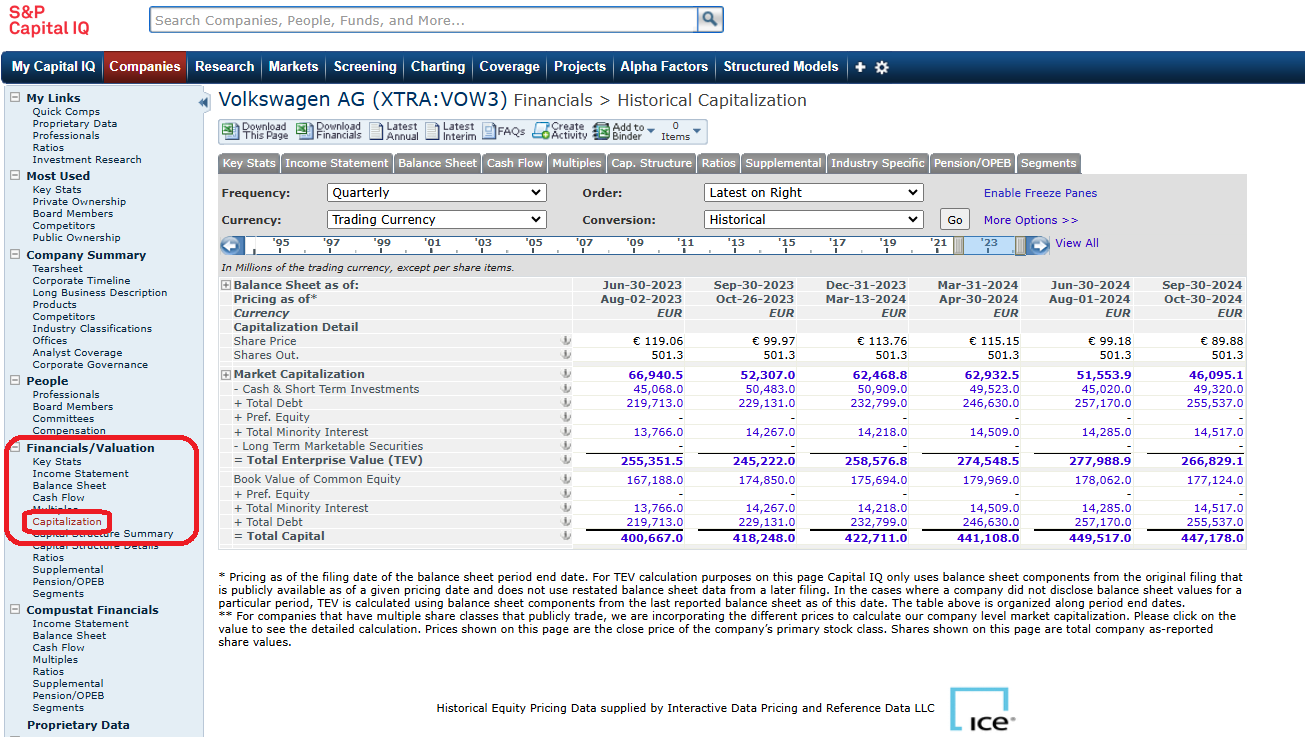

For historical Market Cap, select ‘Capitalization’ from the left hand menu, again under the ‘Financials/Valuation’ heading. You will find figures for both the most recent Market Cap and historical values.

Historical Capitalization in Capital IQ

For more information about Capital IQ, including how to set up your own account, see our previous post here.

Bloomberg

Bloomberg’s Market Cap can be found on the Company Description (DES) for any company, beneath the price chart.

Market Capitalization in Bloomberg

For more information on Enterprise Value, which includes more than just Market Cap, click on the Market Cap figure.

Enterprise Value in Bloomberg

If you’re new to Bloomberg, we recommend reading our post on Bloomberg basics before you set up your account.

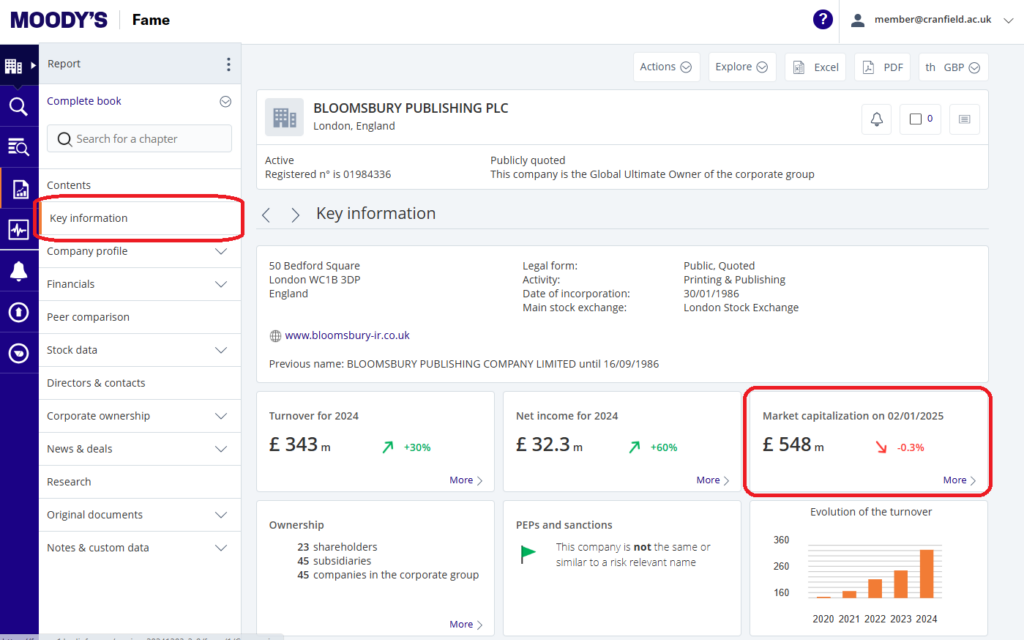

Fame

Fame displays Market Cap on its company report. This can be found on the Key Information section of any publicly traded company’s report. Click on ‘More’ for a more comprehensive ‘Stock profile’.

Key Information screen in Fame

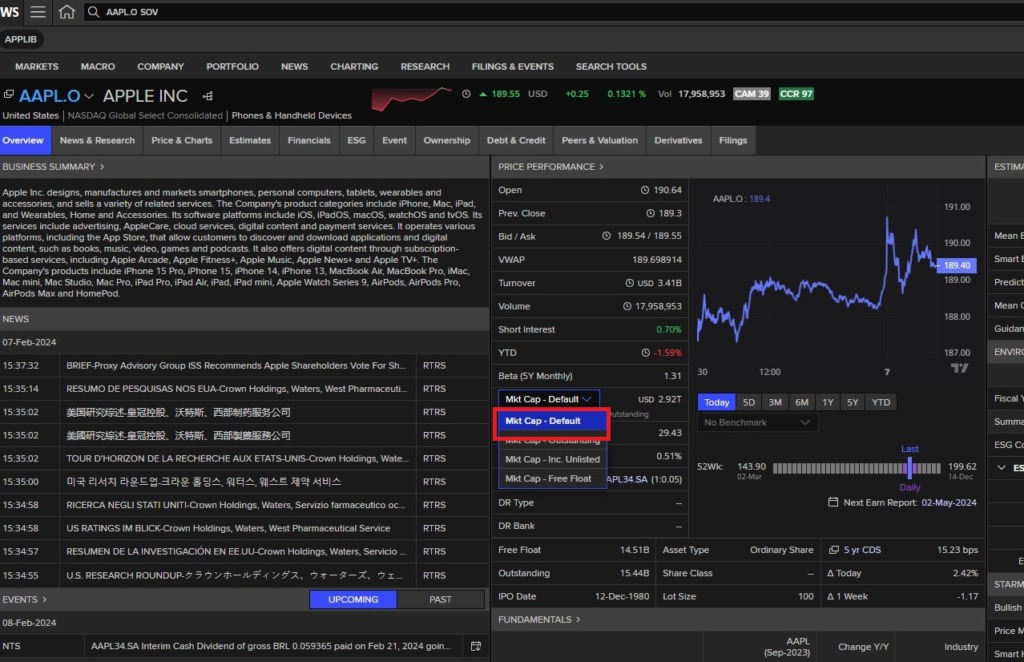

Workspace

In Workspace we can access Market Cap from the summary screen. A default, free float and outstanding share value is available with default share type being the most commonly stated.

Workspace summary screen

If you don’t have a Workspace account, you need to register for one. Follow the instructions here.

Contact us at library@cranfield.ac.uk if you need any help doing this or any other similar searches.

Feature image from Pixabay. Available at: https://cdn.pixabay.com/photo/2016/09/19/18/30/calculator-1680905_960_720.jpg

Categories & Tags:

Leave a comment on this post:

You might also like…

Commonwealth Scholarships play a critical role in developing sustainability and leadership in Africa

Q&A with Evah Mosetlhane, Sustainability MSc, Commonwealth Distance Learning Scholar What inspired you to pursue the Sustainability MSc at Cranfield? I was inspired to pursue the Sustainability MSc at Cranfield because of the university’s ...

How do I reference a thesis… in the NLM style?

You may be including theses within your research. When you do so you need to treat them in the same way as content taken from any other source, by providing both a citation and a ...

Introducing… Bloomberg Trade Flows

Are you interested in world trade flows? Would it be useful to know which nations are your country's major trading partners? If so, the Bloomberg terminal has a rather nifty function where you can view ...

Cranfield alumni voyage to the International Space Station

Seeing our alumni reach the International Space Station (ISS) has a ripple effect that extends far beyond the space sector. For school students questioning whether science is “for them”, for undergraduates weighing their next ...

From classroom to cockpit: What’s next after Cranfield

The Air Transport Management MSc isn’t just about learning theory — it’s about preparing for a career in the aviation industry. Adit shares his dream job, insights from classmates, and advice for prospective students. ...

Setting up a shared group folder in a reference manager

Many of our students are now busy working on their group projects. One easy way to share references amongst a group is to set up group folders in a reference manager like Mendeley or Zotero. ...