Finding credit ratings for companies

07/08/2025

A credit rating (or score) is a measure of a company or corporation’s ability to meet their financial commitments based on their previous dealings. It can also be viewed as a measure of a company’s credit worthiness when issuing bonds. Scores are calculated by reference to various items, for example cash flow, profits, equity and financial ratios.

Credit ratings are issued by three main agencies:

- Standard & Poor’s (S&P)

- Fitch

- Moody’s.

The rating system and calculations vary between each however generally they range from AAA+ [Good] to CCC [Poor].

On Bloomberg you can get to a company (equity) credit rating by entering the code <CRPR> which will give you the credit rating profile. An example is shown below.

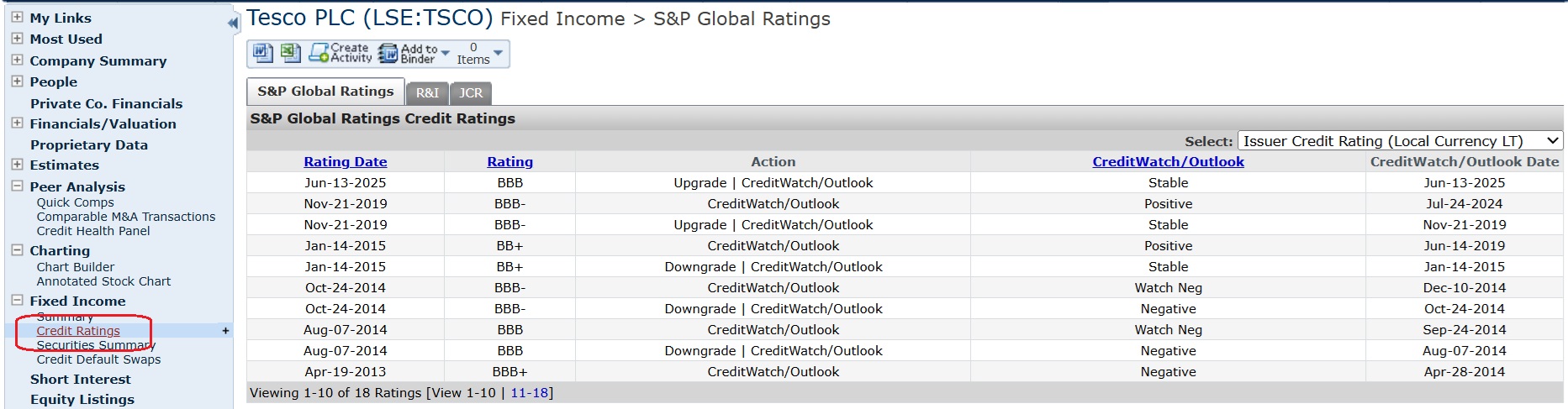

You will also find S&P Credit ratings on their Capital IQ platform. Simply select credit ratings from the ‘Fixed Income’ menu that can be found at the left hand side of the company profile. Remember to create an account if you wish to use Capital IQ. This blog post explains how to register.

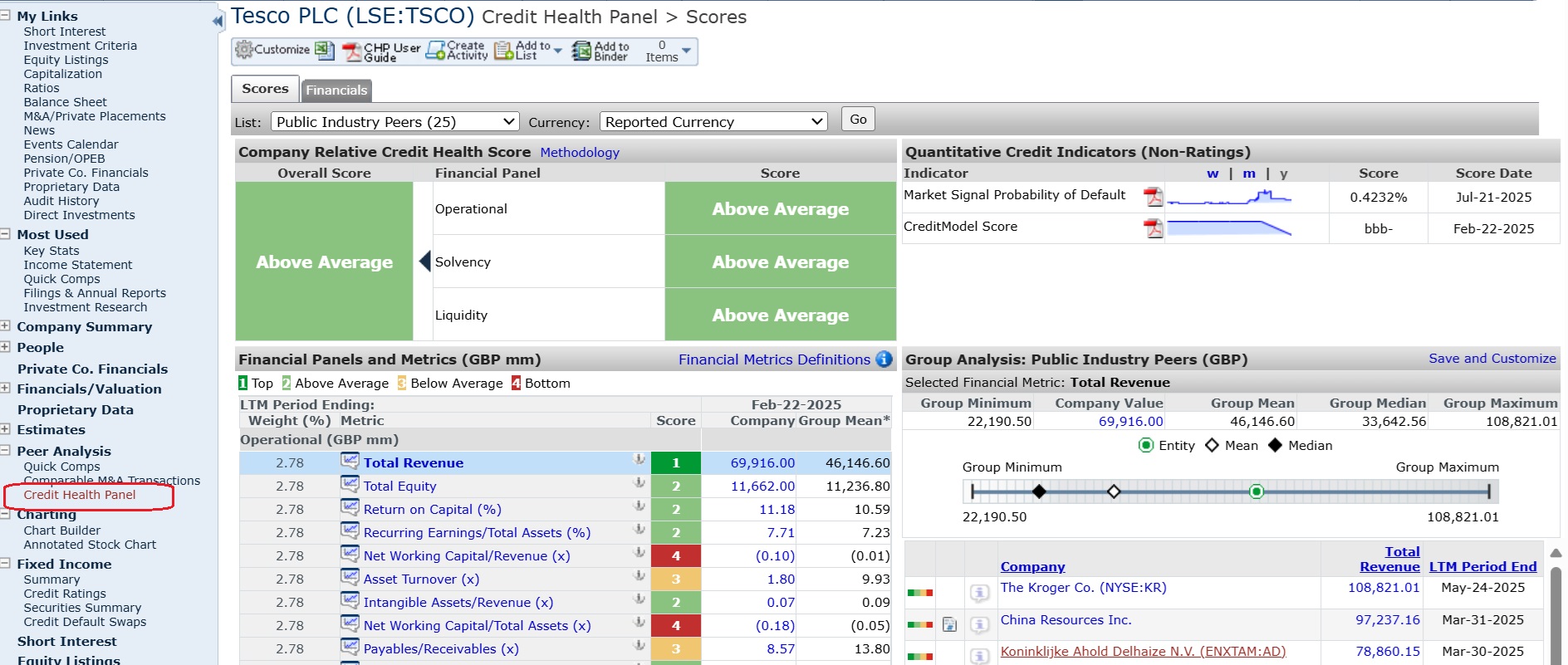

A Credit Health Panel for the company is listed in the ‘Peer Analysis’ menu which compares a company’s credit rating with others in its peer group.

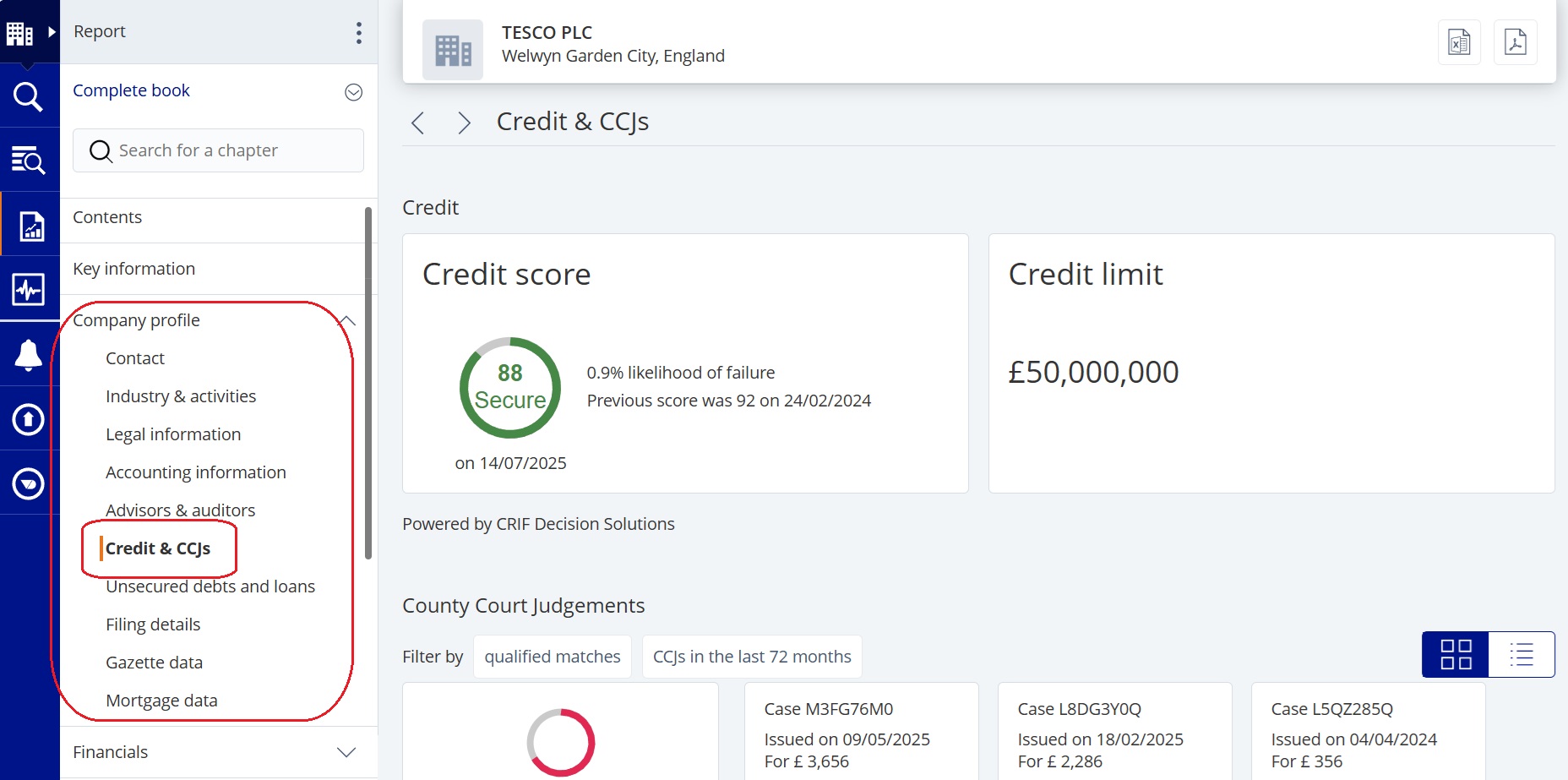

Fame has a credit rating system for UK and Irish companies, developed by CRIF Decision Solutions in collaboration with Jordan’s. It provides a numerical score and the likelihood of a company becoming insolvent. To view the credit rating for a company, open the ‘Company profile’ section of the left-hand report menu and select ‘Credit & CCJs’.

FAME credit ratings

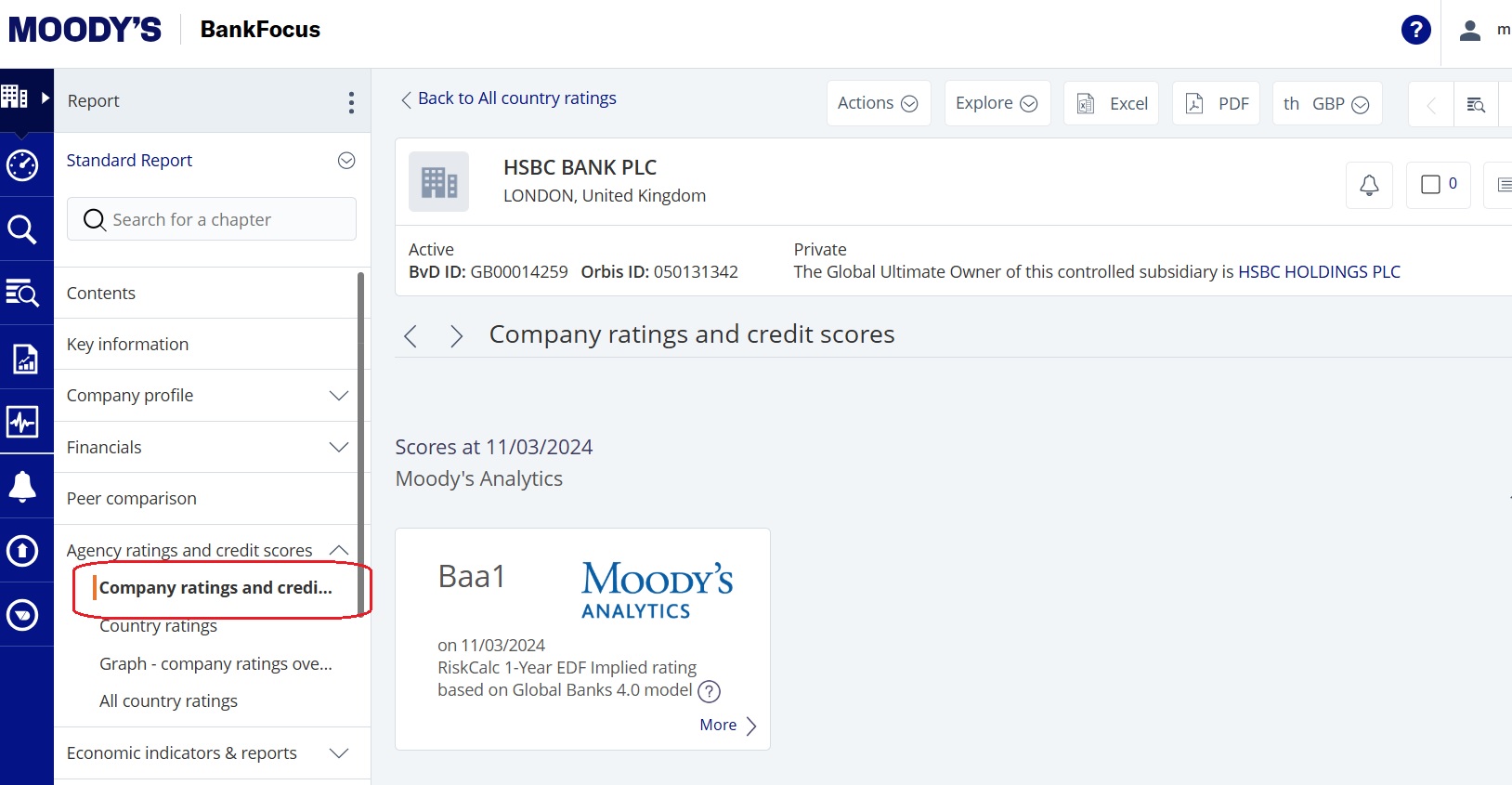

BankFocus, our global financial accounts database for banks and financial institutions, has Moody’s ratings listed for companies. These appear under the ‘Agency ratings and credit scores’ heading on the left hand menu of a bank’s report screen.

BankFocus credit rating

Any questions, please contact the Library.

Feature image from Pixabay. Available at: https://pixabay.com/photos/savings-budget-investment-money-2789112/

Categories & Tags:

Leave a comment on this post:

You might also like…

Introducing… Bloomberg Trade Flows

Are you interested in world trade flows? Would it be useful to know which nations are your country's major trading partners? If so, the Bloomberg terminal has a rather nifty function where you can view ...

Cranfield alumni voyage to the International Space Station

Seeing our alumni reach the International Space Station (ISS) has a ripple effect that extends far beyond the space sector. For school students questioning whether science is “for them”, for undergraduates weighing their next ...

From classroom to cockpit: What’s next after Cranfield

The Air Transport Management MSc isn’t just about learning theory — it’s about preparing for a career in the aviation industry. Adit shares his dream job, insights from classmates, and advice for prospective students. ...

Setting up a shared group folder in a reference manager

Many of our students are now busy working on their group projects. One easy way to share references amongst a group is to set up group folders in a reference manager like Mendeley or Zotero. ...

Company codes – CUSIP, SEDOL, ISIN…. What do they mean and how can you use them in our Library resources?

As you use our many finance resources, you will probably notice unique company identifiers which may be codes or symbols. It is worth spending some time getting to know what these are and which resources ...

Supporting careers in defence through specialist education

As a materials engineer by background, I have always been drawn to fields where technical expertise directly shapes real‑world outcomes. Few sectors exemplify this better than defence. Engineering careers in defence sit at the ...