Library resources for due diligence

05/09/2024

If you’re researching a company with a view to an investment or acquisition, due diligence will be of utmost importance. Although much of the data and information required for this exercise will come from the target company itself, there are various areas here where our library resources can help. Also bear in mind that library resources might be more comprehensive than the (possibly selective) data the target company provides.

Financial Data:

The chances are that the company you are looking at will be private. Financials for firms – public and private, large and small – in the UK and Ireland are available in Fame, and Capital IQ provides some coverage internationally. Publicly listed companies worldwide are best covered by Capital IQ and Bloomberg. Links to these resources are available on our financial resources pages.

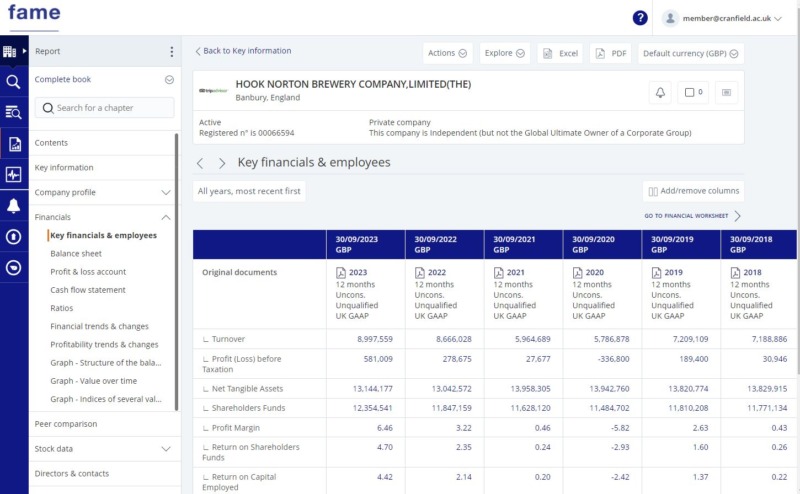

Fame:

Through Fame, you can access up to ten years of financial data – including balance sheets, profit and loss and cash-flow where appropriate. Copies of original Companies House filings are available too. You can also view data on comparable companies via Fame’s Peer Comparison and Peer Analysis tool. Check out our blog post on Competitor Analysis too.

Capital IQ provides financials for companies worldwide. Peer analysis is available for both public and larger private firms. Financials – including balance sheets and income statements (for private companies) and a huge amount more for listed companies are available back to the 1980s along with a wide variety of ratios, transaction information and details on business relationships. For more information, check out our blog posts. Find out how to sign up for your Capital IQ account here

Bloomberg:

Bloomberg’s <FA> (Financial Analysis) function gives you access to a wealth of company financials including estimates and forecasts for listed companies worldwide – such as stock data, balance sheets, cash flow, income statements, profit and loss and ratios. Comparables are accessible through any company report, as are segmentation data and brokers’ reports. Bloomberg is also a main source of ESG data for listed companies. This area, environmental, social and governance, covers what Investopedia refer to as “a set of standards for a company’s operations that socially conscious investors use to screen investments”. Bloomberg is only accessible from dedicated terminals in the School’s Bloomberg Suite.

Industry & Market Research:

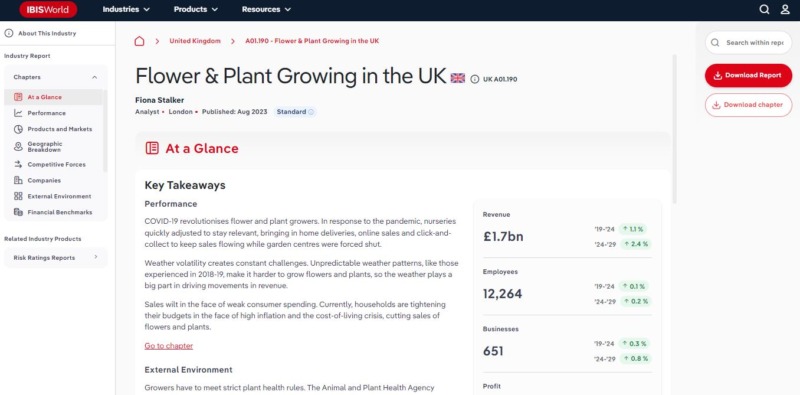

You will also need a thorough knowledge and understanding of the industry and market in which the company operates along with its technologies and operations. Use industry research available via IBISWorld to research the key drivers, industry performance and outlook and major players. BMI may be useful here too. When it comes to the market, you need to know that there are customers out there who want to buy your company’s products or services. Use Mintel (UK) and Passport for market research. Links to all of these services are accessible here.

Resources listed below will also provide information on the business environment, both legal and environmental, that the company operates in. If you’re interested in ESG filings, use Bloomberg or Workspace.

IBISWorld provides concise industry reports for global markets, covering performance and outlook (including some forecasts), competitive landscape, and operating conditions. It also situates a company within its supply chain, highlighting demand and supply industries which will impact on yours.

BMI:

FitchConnect’s BMI service provides quarterly industry reports on a wide range of major industries worldwide. Reports are much broader in outlook to those in IBISWorld, but include both 5 and 10 year forecasts for the sector.

Mintel covers many of the UK’s consumer markets. Reports are updated every 12 to 24 months. Within a report you will have access to analysis on the UK market, including market drivers, size, segmentation and forecasts; consumers and their attitudes, and research on major brands and players in the market. Downloadable databooks and infographics are also available to accompany most reports.

Passport’s country-specific ‘category briefings’ are concise market reports for most consumer goods markets worldwide which cover headlines, trends, competitive landscape and prospects. They include links to related reports and statistics.

People:

When you invest in a company, you also invest in its people. You will want to know everything you can about the company management team, their business interests and what they bring to the organisation.

Fame:

Run a Director search on Fame from the homepage. From there you can view other directorships individuals may hold (both past and present) within the UK and Ireland.

Bloomberg:

Biographies are available for prominent business people, global figures along with Bloomberg users. Research their life and work both past and present – education and career history, board memberships and publications. Use the <BIO> function to find these.

If you have any questions at all about any of the resources mentioned here, please contact the Library.

Feature image from Pixabay. Available at: https://cdn.pixabay.com/photo/2016/09/19/18/30/calculator-1680905_960_720.jpg

Categories & Tags:

Leave a comment on this post:

You might also like…

Introducing… Bloomberg Trade Flows

Are you interested in world trade flows? Would it be useful to know which nations are your country's major trading partners? If so, the Bloomberg terminal has a rather nifty function where you can view ...

Cranfield alumni voyage to the International Space Station

Seeing our alumni reach the International Space Station (ISS) has a ripple effect that extends far beyond the space sector. For school students questioning whether science is “for them”, for undergraduates weighing their next ...

From classroom to cockpit: What’s next after Cranfield

The Air Transport Management MSc isn’t just about learning theory — it’s about preparing for a career in the aviation industry. Adit shares his dream job, insights from classmates, and advice for prospective students. ...

Setting up a shared group folder in a reference manager

Many of our students are now busy working on their group projects. One easy way to share references amongst a group is to set up group folders in a reference manager like Mendeley or Zotero. ...

Company codes – CUSIP, SEDOL, ISIN…. What do they mean and how can you use them in our Library resources?

As you use our many finance resources, you will probably notice unique company identifiers which may be codes or symbols. It is worth spending some time getting to know what these are and which resources ...

Supporting careers in defence through specialist education

As a materials engineer by background, I have always been drawn to fields where technical expertise directly shapes real‑world outcomes. Few sectors exemplify this better than defence. Engineering careers in defence sit at the ...