Using the Bloomberg Excel Add-in

12/11/2018

In an earlier post we explained how to install the Bloomberg Office add-in which allows data to be exported from the Bloomberg terminal to Excel.

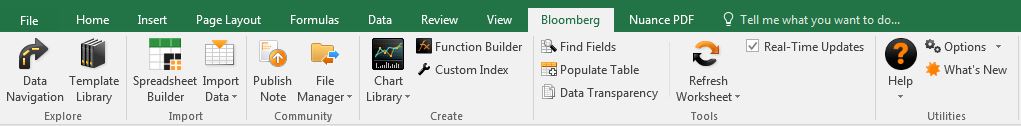

Within Excel, the Bloomberg add-in toolbar has various tools you can use to draw data from the Bloomberg terminal directly into Excel.

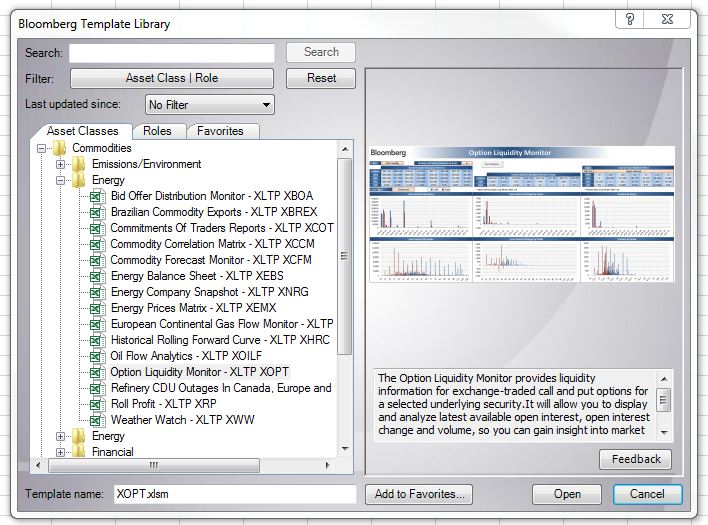

One of the tools, the Template library, provides predefined templates covering different financial areas to allow you to pull relevant data from Bloomberg. Highlight any template name to get a description of what it covers.

Another useful tool is the Import Data option. This uses a Bloomberg Data Wizard to guide you through several steps where you specify the security, the data you need and the dates you need it for. This is the easiest way to extract data from Bloomberg as it writes the Bloomberg API formulas for you.

However if you need more flexibility than the wizards allow, you can write your own formulas.

The detailed help function <HELP DAPI> guides you through this:

When creating a formula, you need to specify the security (ticker, market sector), e.g. IBM US Equity; and the field (datatype), e.g. PX_LAST and a field. You can use the Field search tool (<FLDS>) on the Bloomberg tab to find the field mnemonic by category or keyword.

Depending on the type of data you want to download, you can use one of the following:

BDP (Bloomberg Data Point) – This returns data to a single cell. It contains only one ticker and one field.

= BDP (Security, Field) e.g. =BDP(“IBM US Equity”, “Px_Last”) retrieves the price of the last trade on IBM stock.

BDH (Bloomberg Data History) – This formula returns the historical data for a selected security.

=BDH (Security, Field, Start Date, End Date) e.g. =BDH (“IBM US Equity”, “Px_Last”,”01/01/01″, “12/31/01”) retrieves the closing prices for IBM from the first to the last day of 2001.

BDS (Bloomberg Data Set) – This formula returns multi-cell descriptive data.

=BDS(Security, Field) e.g. =BDS (“IBM US Equity”, “CIE_DES_BULK”) retrieves IBM’s company business description.

As always, if you need any assistance with Bloomberg, please contact the Library.

Categories & Tags:

Leave a comment on this post:

You might also like…

My journey to Cranfield as an FIA Motorsport Engineering Scholar

"You don’t need to fit a stereotype to succeed in engineering or motorsport. You need curiosity. Resilience. And the confidence to take up space." In this blog, Sanya Jain, current MSc student and FIA ...

‘Getting started with Bloomberg’ training – discover the power of Bloomberg terminals

Perhaps you've heard people talking about Bloomberg or heard it mentioned in the news and are wondering what all the fuss is about? Why not come along and find out at our Getting started with ...

Commonwealth Scholarships play a critical role in developing sustainability and leadership in Africa

Q&A with Evah Mosetlhane, Sustainability MSc, Commonwealth Distance Learning Scholar What inspired you to pursue the Sustainability MSc at Cranfield? I was inspired to pursue the Sustainability MSc at Cranfield because of the university’s ...

How do I reference a thesis… in the NLM style?

You may be including theses within your research. When you do so you need to treat them in the same way as content taken from any other source, by providing both a citation and a ...

Introducing… Bloomberg Trade Flows

Are you interested in world trade flows? Would it be useful to know which nations are your country's major trading partners? If so, the Bloomberg terminal has a rather nifty function where you can view ...

Cranfield alumni voyage to the International Space Station

Seeing our alumni reach the International Space Station (ISS) has a ripple effect that extends far beyond the space sector. For school students questioning whether science is “for them”, for undergraduates weighing their next ...