Performance Reporting Measures vs Performance Management Measures

29/11/2019

You may have read my blog from last week about A&E Wait Times. We indicated that the way these kinds of figures are reported, out of context, is hopeless in actually understanding what is going on.

But the problem doesn’t stop there. There is a fundamental problem with performance reporting, and the measures you see being utilised there, versus performance management and the measures being utilised here!

Let me explain.

Performance management requires you to understand the behaviour of business processes and make interventions to improve them. This implies that you use a small set of specific measures that we’ve blogged about before – see previous bloghttps://blogs.cranfield.ac.uk/leadership-management/cbp/the-future-of-operational-performance-management-part-3

For example, these performance management measures would include number of items coming into a process, number leaving a process, throughput time and so on.

Performance reporting is littered with measures that may appear to carry meaning for some people, but in our observations, have been misleading and impenetrable to many. And certainly don’t help understanding nor how to improve!

Here are some examples of reporting measures:

- % items completed: % implies a ratio – with a numerator and denominator. E.g. % Repairs Completed defined by (Number of Repairs Completed / Total Number of Repair Calls) * 100

- % completed within some timeframe: E.g. From last week’s A&E Figures, we saw % A&E attendants seen in 4 hours or under.

- Complicated Measure Combinations: E.g. % Forecast Accuracy in Supply-chain

- Applying sophisticated statistical treatment to raw performance measures that only stats specialists can read: E.g. Exponentially weighted moving averages

- Statistical representation of a population of people or things: E.g. Electric Car Use by Country

In today’s blog, we’ll look at why %’s are a problem (the argument is exactly the same for ratios) in trying to understand what is going on?

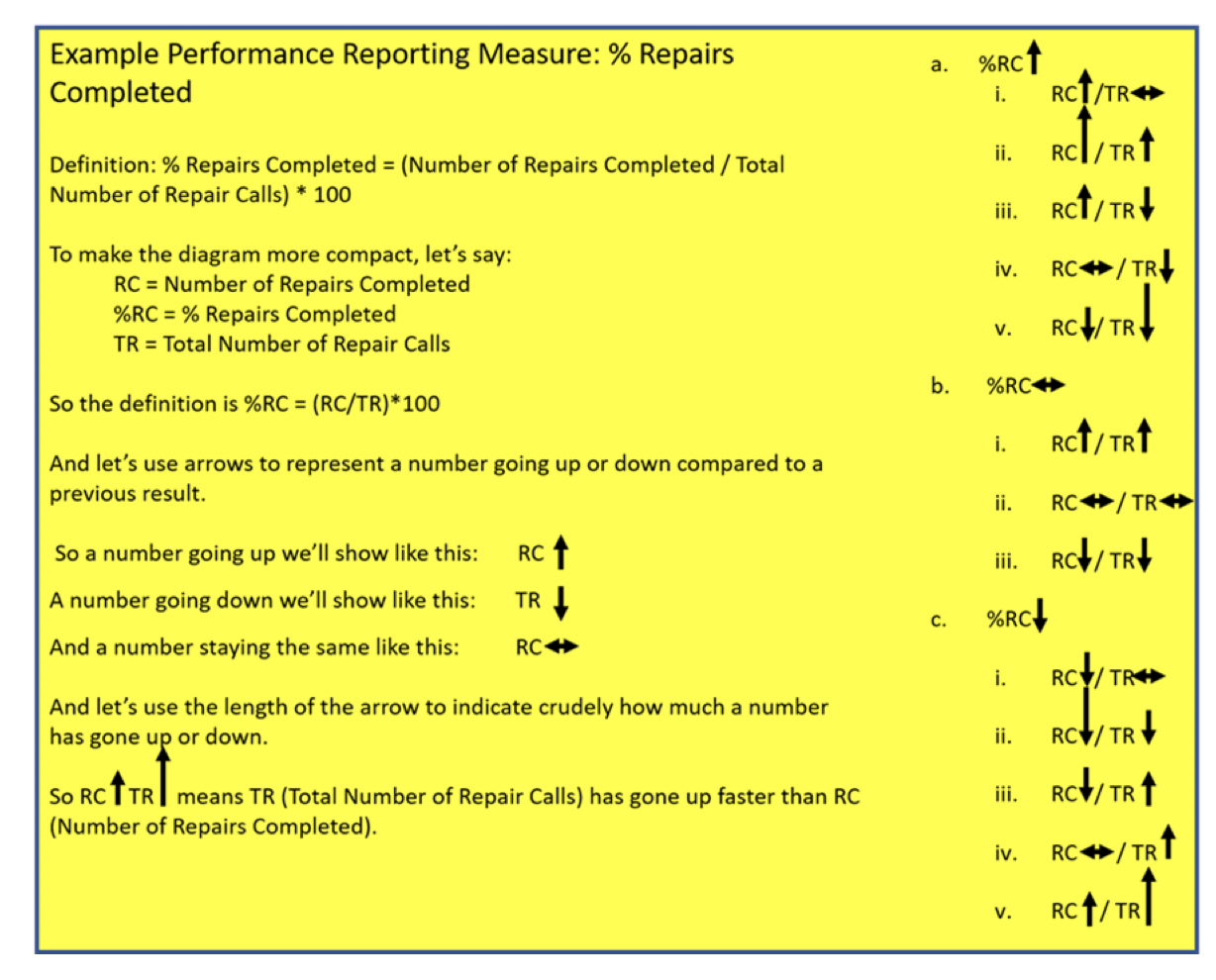

- % Repairs Completed: Let’s assume more is good and less is bad. Here’s how complicated we have made it to understand what is going on (see yellow box):

- % Repairs Completed has gone up (since it was last reported on). There are five different combinations of Number of Repairs Completed vs Total Number of Repair Calls:

i. Number of Repairs Completed has increased; Total Number of Repair Calls stays the same

ii. Number of Repairs Completed has increased; Total Number of Repair Calls increases, but at a slower rate

iii. Number of Repairs Completed has increased; Total Number of Repair Calls has decreased

iv. Number of Repairs Completed stays the same; Total Number of Repair Calls has decreased

v. Number of Repairs Completed has decreased; Total Number of Repair Calls decreases, but at a faster rate

- % Repairs Completed remains the same (since it was last reported on). There are three combinations of Number of Repairs Completed vs Total Number of Repair Calls:

i. Number of Repairs Completed has increased; Total Number of Repair Calls also increases at the same rate

ii. Number of Repairs Competed stays the same; Total Number of Repair Calls also stays the same

iii. Number of Repairs Completed has decreased; Total Number of Repair Calls also decreases at the same rate

- % Repairs Completed has gone down (since it was last reported on). There are five different combinations of Number of Repairs Completed vs Total Number of Repair Calls:

i. Number of Repairs Completed has decreased; Total Number of Repair Calls stays the same

ii. Number of Repairs Completed has decreased; Total Number of Repair Calls decreases, but at a slower rate

iii. Number of Repairs Completed has decreased; Total Number of Repair Calls has increased

iv. Number of Repairs Completed stays the same; Total Number of Repair Calls has increased

v. Number of Repairs Completed has increased; Total Number of Repair Calls increases, but at a faster rate

So, when we are performance managing, each of our two performance management measures can move one of 3 ways – go up, stay the same or go down. Simples!

But, when we are performance reporting, our one % reporting measure can move through any one of the 13 different combinations above! And I think Dilbert would have something to say about that!

And where %’s do come into their own is when drilling down using tools such as Pareto Charts to find root-causes of signals or drivers of patterns – more on this in our future blogs.

Why is the second example above – A&E attendances seen within 4 hours – a problem in trying to understand what is going on? For that you’ll need to read our next blog…

Categories & Tags:

Leave a comment on this post:

You might also like…

Commonwealth Scholarships play a critical role in developing sustainability and leadership in Africa

Q&A with Evah Mosetlhane, Sustainability MSc, Commonwealth Distance Learning Scholar What inspired you to pursue the Sustainability MSc at Cranfield? I was inspired to pursue the Sustainability MSc at Cranfield because of the university’s ...

How do I reference a thesis… in the NLM style?

You may be including theses within your research. When you do so you need to treat them in the same way as content taken from any other source, by providing both a citation and a ...

Introducing… Bloomberg Trade Flows

Are you interested in world trade flows? Would it be useful to know which nations are your country's major trading partners? If so, the Bloomberg terminal has a rather nifty function where you can view ...

Cranfield alumni voyage to the International Space Station

Seeing our alumni reach the International Space Station (ISS) has a ripple effect that extends far beyond the space sector. For school students questioning whether science is “for them”, for undergraduates weighing their next ...

From classroom to cockpit: What’s next after Cranfield

The Air Transport Management MSc isn’t just about learning theory — it’s about preparing for a career in the aviation industry. Adit shares his dream job, insights from classmates, and advice for prospective students. ...

Setting up a shared group folder in a reference manager

Many of our students are now busy working on their group projects. One easy way to share references amongst a group is to set up group folders in a reference manager like Mendeley or Zotero. ...