Where can I find… Company financial ratios?

15/12/2024

Financial ratios are often used to measure the performance of a company. These can be found ‘ready-made’ in several of our finance resources.

Company ratios can be categorised into different types:

- Profitability ratios – e.g. profit margin or return on capital employed. These analyse profitability.

- Liquidity ratios – e.g. cash ratio. These indicate how quickly a company’s assets can be converted into cash in order to pay creditors.

- Solvency (or debt) ratios – e.g. debt equity ratio. These show how well a company can deal with its long term financial obligations.

- Valuation ratios – e.g. price earnings ratio. These are used to measure the attractiveness of an investment in a company.

Analysis of financial ratios can be used to show how well a company is doing relative to its competitors. In this post, we are highlighting resources where the ratios come pre-calculated. Bear in mind however that ratios are calculated using standard formulae from data in the company’s financial statements – and if you are doing some in-depth analysis, you will be expected to do such calculations yourself.

If you need quick ratios, the best resources to look at are:

- Capital IQ

- Fame

- Bloomberg.

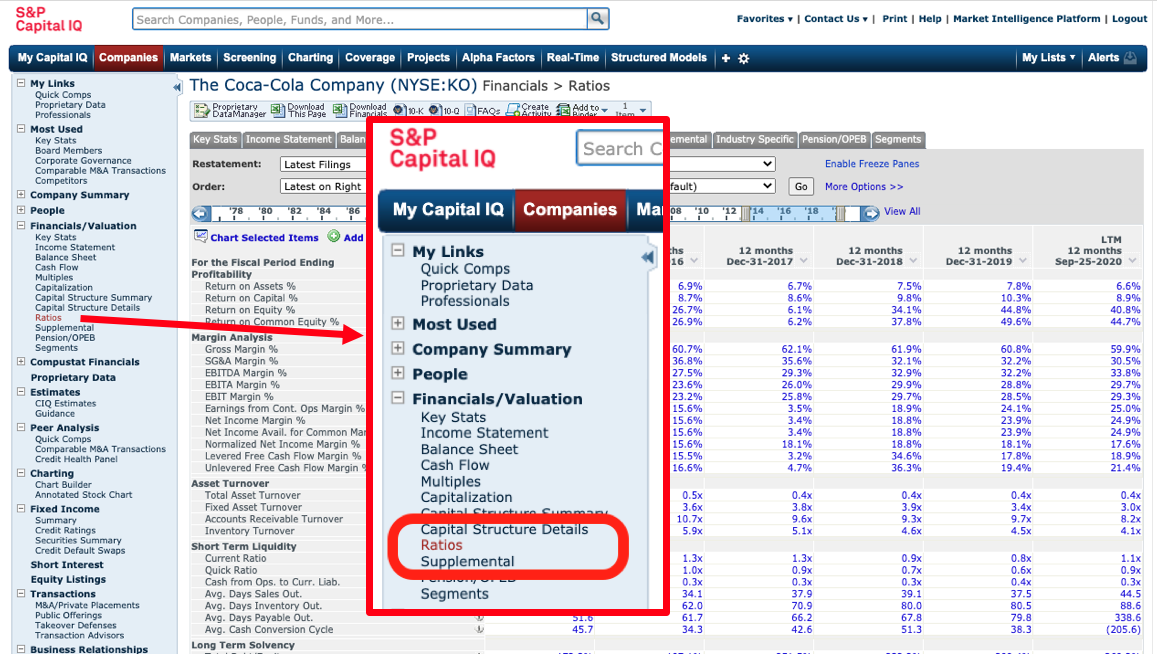

On Capital IQ, ratios can be found with the Financials menu. Simply type a company name into the search box, load up the company profile and look to the left hand menu. You will find the Ratios option under the Financials/Valuations heading. Both current and historical rations are available.

Use the menu situated directly above the data table to download to Excel.

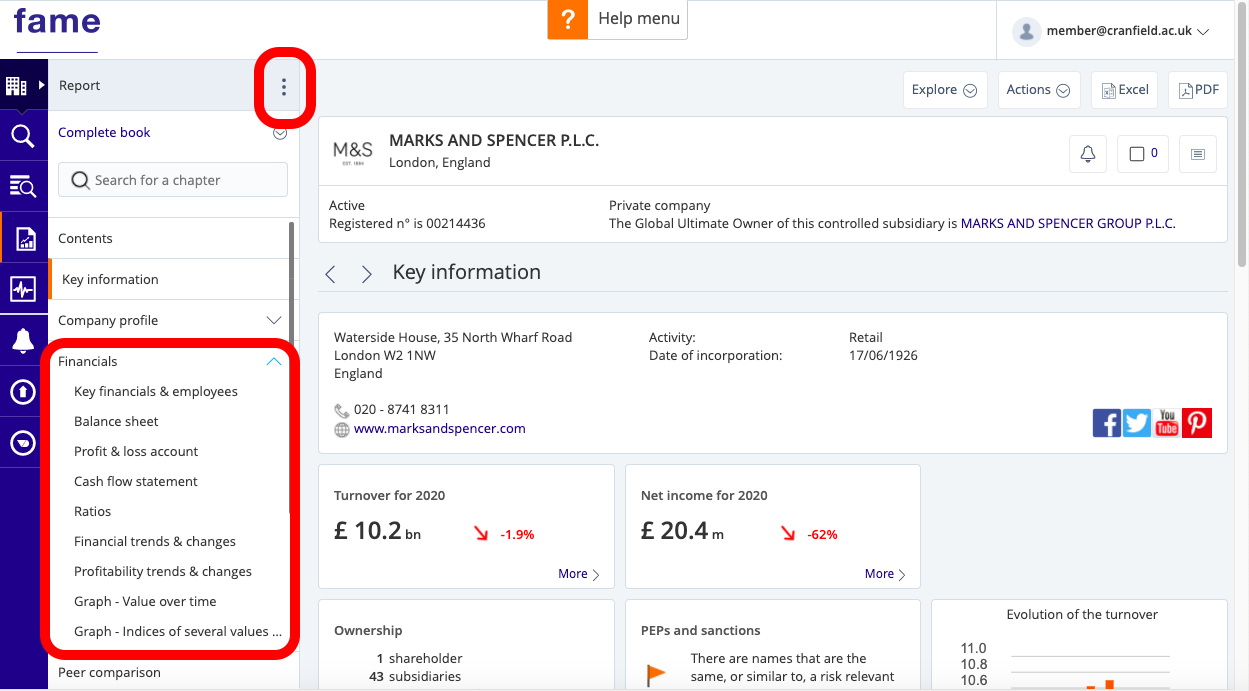

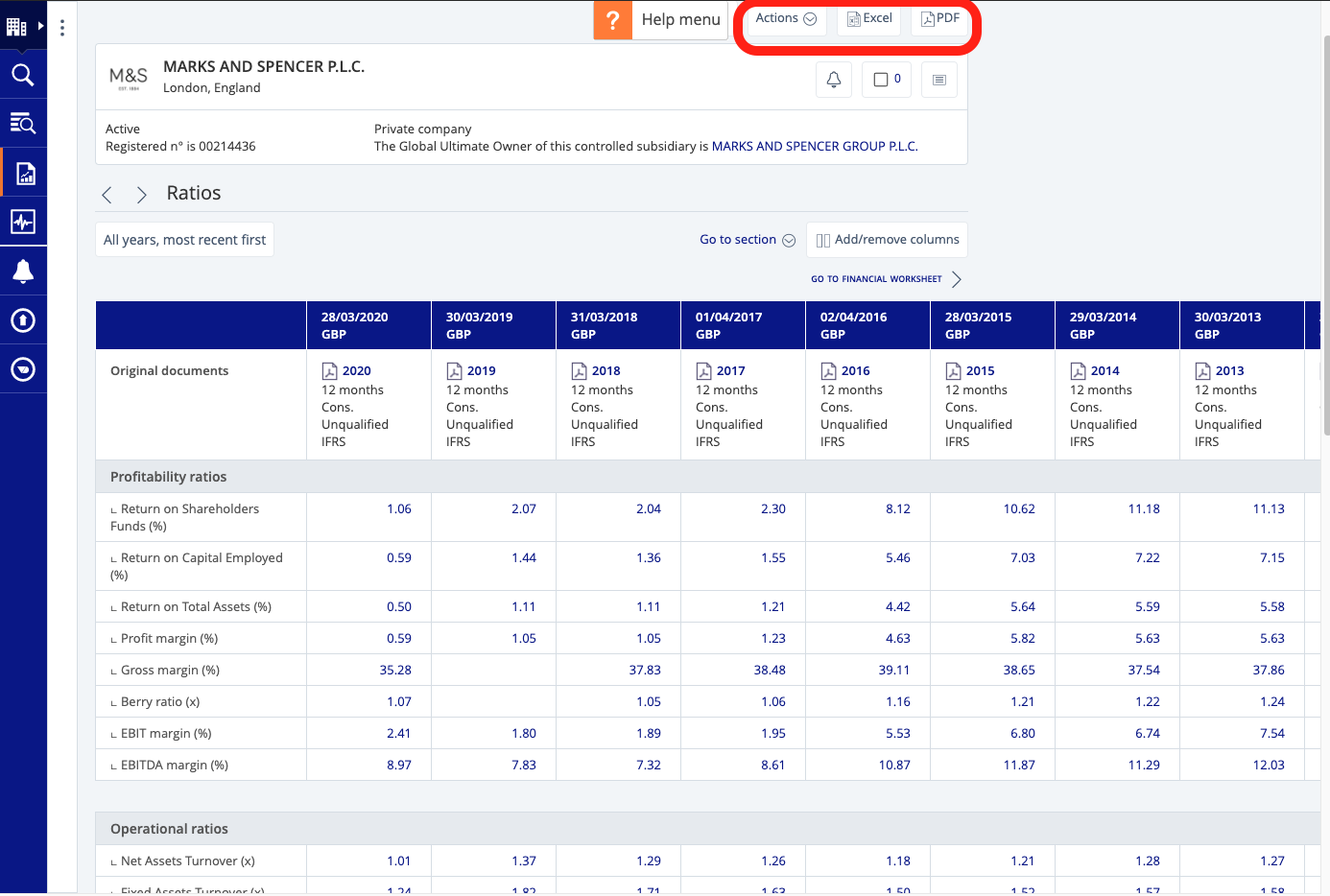

On Fame, ten years of financial ratios are available. To view the ratios section, use the dots icon on the left-hand side to open up the table of contents. From here, select ‘Financials’ > ‘Ratios’.

To export, click on the Excel or PDF icon at the top.

On Bloomberg, a summary can be found in the Company Description <DES> or a more detailed list on the Ratios tab within a company’s Financial Analysis <FA>. To export, first ensure your Office Add-ins are enabled then select ‘Output’ > ‘Excel’> ‘Current Template’ from the red menu bar.

If you have any questions about where to find particular ratios or any other financial data you require, please do not hesitate to contact the Library.

Feature image from Pixabay. Available at: https://pixabay.com/photos/savings-budget-investment-money-2789112/

Categories & Tags:

Leave a comment on this post:

You might also like…

Commonwealth Scholarships play a critical role in developing sustainability and leadership in Africa

Q&A with Evah Mosetlhane, Sustainability MSc, Commonwealth Distance Learning Scholar What inspired you to pursue the Sustainability MSc at Cranfield? I was inspired to pursue the Sustainability MSc at Cranfield because of the university’s ...

How do I reference a thesis… in the NLM style?

You may be including theses within your research. When you do so you need to treat them in the same way as content taken from any other source, by providing both a citation and a ...

Introducing… Bloomberg Trade Flows

Are you interested in world trade flows? Would it be useful to know which nations are your country's major trading partners? If so, the Bloomberg terminal has a rather nifty function where you can view ...

Cranfield alumni voyage to the International Space Station

Seeing our alumni reach the International Space Station (ISS) has a ripple effect that extends far beyond the space sector. For school students questioning whether science is “for them”, for undergraduates weighing their next ...

From classroom to cockpit: What’s next after Cranfield

The Air Transport Management MSc isn’t just about learning theory — it’s about preparing for a career in the aviation industry. Adit shares his dream job, insights from classmates, and advice for prospective students. ...

Setting up a shared group folder in a reference manager

Many of our students are now busy working on their group projects. One easy way to share references amongst a group is to set up group folders in a reference manager like Mendeley or Zotero. ...