Where can I find… Company financial ratios?

07/02/2022

Financial ratios are often used to measure the performance of a company. These can be found ‘ready-made’ in several of our finance resources.

Company ratios can be categorised into different types:

- Profitability ratios – e.g. profit margin or return on capital employed. These analyse profitability.

- Liquidity ratios – e.g. cash ratio. These indicate how quickly a company’s assets can be converted into cash in order to pay creditors.

- Solvency (or debt) ratios – e.g. debt equity ratio. These show how well a company can deal with its long term financial obligations.

- Valuation ratios – e.g. price earnings ratio. These are used to measure the attractiveness of an investment in a company.

Analysis of financial ratios can be used to show how well a company is doing relative to its competitors. In this post, we are highlighting resources where the ratios come pre-calculated. Bear in mind however that ratios are calculated using standard formulae from data in the company’s financial statements – and if you are doing some in-depth analysis, you will be expected to do such calculations yourself.

If you need quick ratios, the best resources to look at are:

- Capital IQ

- Fame

- Bloomberg.

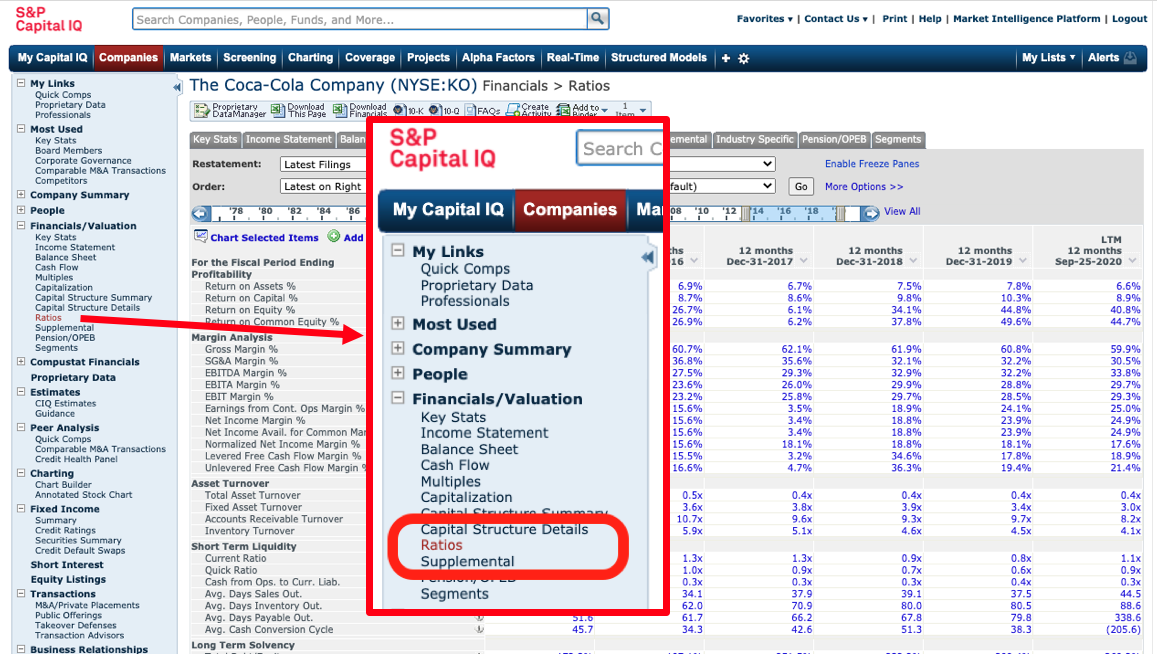

On Capital IQ, ratios can be found with the Financials menu. Simply type a company name into the search box, load up the company profile and look to the left hand menu. You will find the Ratios option under the Financials/Valuations heading. Both current and historical rations are available.

Use the menu situated directly above the data table to download to Excel.

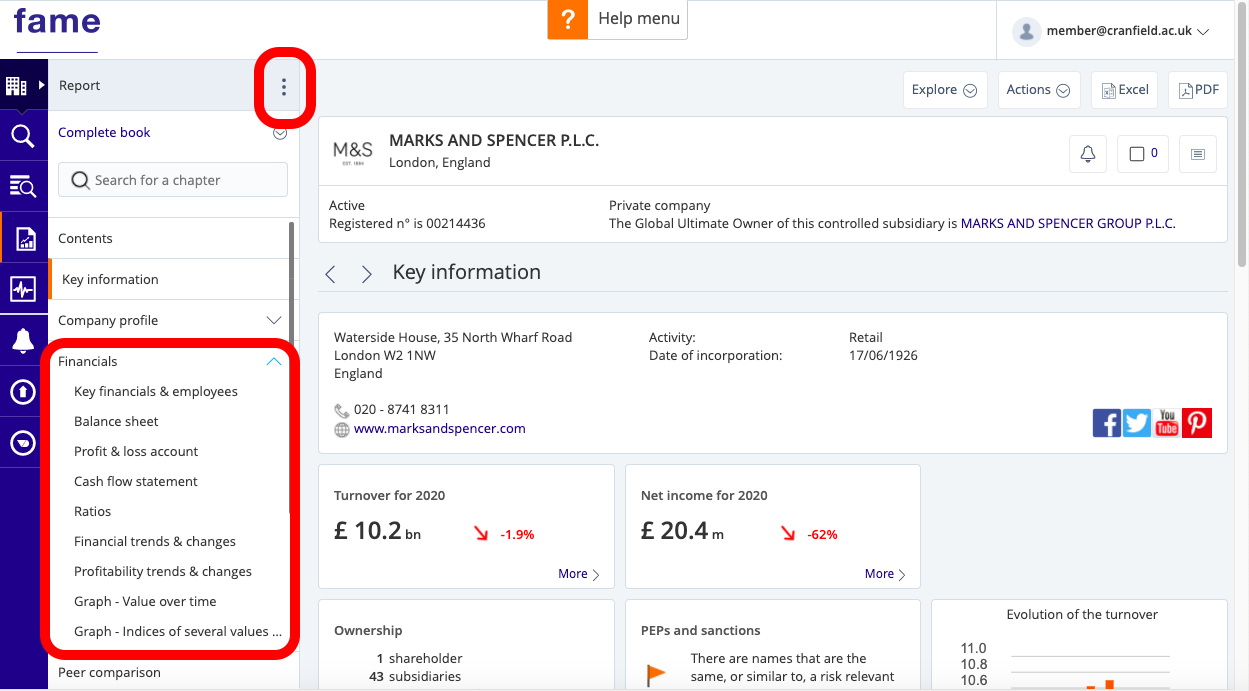

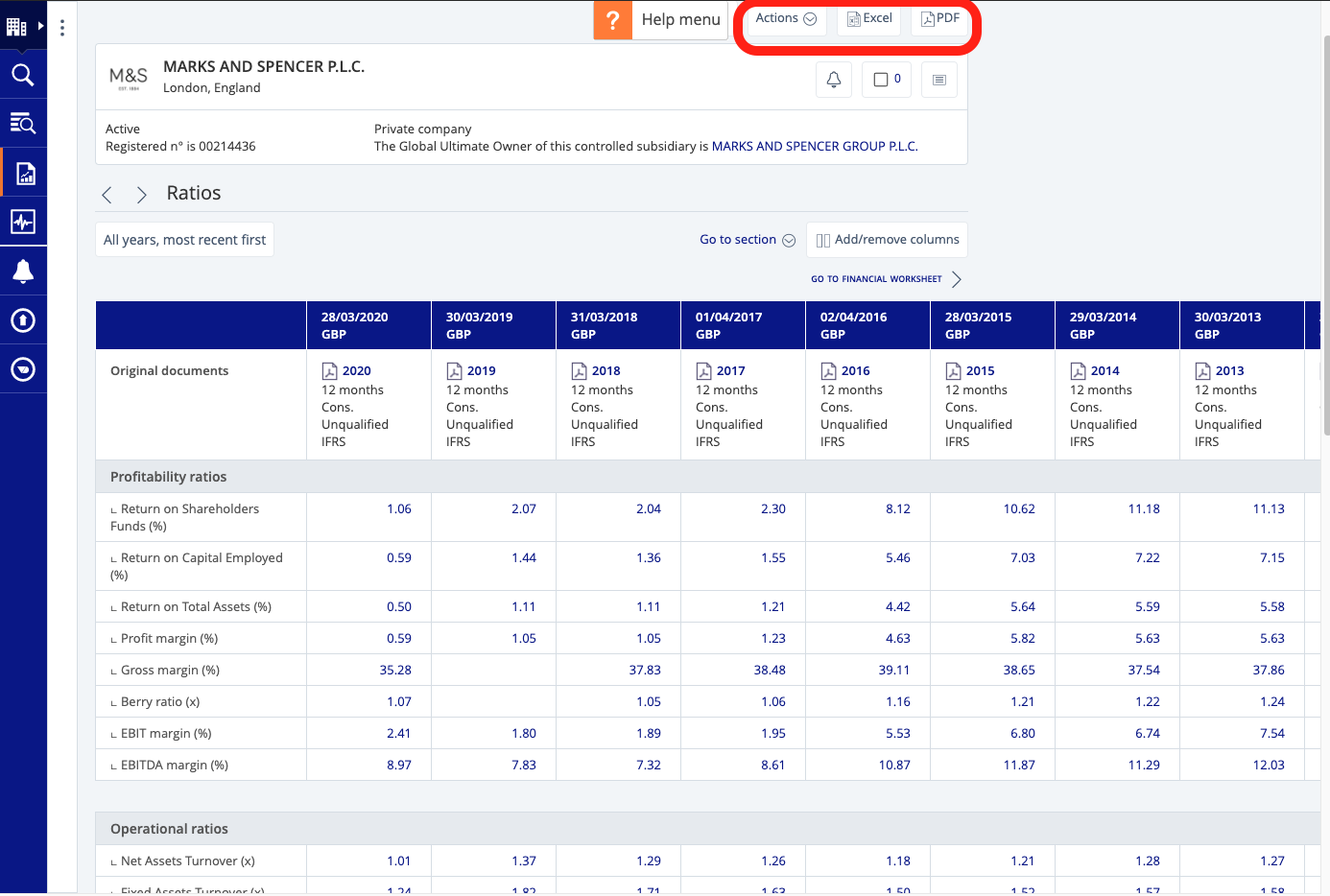

On Fame, ten years of financial ratios are available. To view the ratios section, use the dots icon on the left-hand side to open up the table of contents. From here, select ‘Financials’ > ‘Ratios’.

To export, click on the Excel or PDF icon at the top.

On Bloomberg, a summary can be found in the Company Description <DES> or a more detailed list on the Ratios tab within a company’s Financial Analysis <FA>. To export, first ensure your Office Add-ins are enabled then select ‘Output’ > ‘Excel’> ‘Current Template’ from the red menu bar.

If you have any questions about where to find particular ratios or any other financial data you require, please do not hesitate to contact MIRC.

Feature image from Pixabay. Available at: https://pixabay.com/photos/savings-budget-investment-money-2789112/

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...