Sourcing company Betas in LSEG Workspace and Datastream

12/06/2025

Following our introductory post on sourcing Betas, this post will go into a little more depth for those who may be seeking more complex data. Betas are accessible in LSEG’s Workspace service, through Workspace itself, also in the Datastream Excel add-in. This provides a flexible solution allowing you to gather Betas for more than one equity/company at a time utilising the features to create lists on Datastream. Read on to find out how to source Betas in each platform.

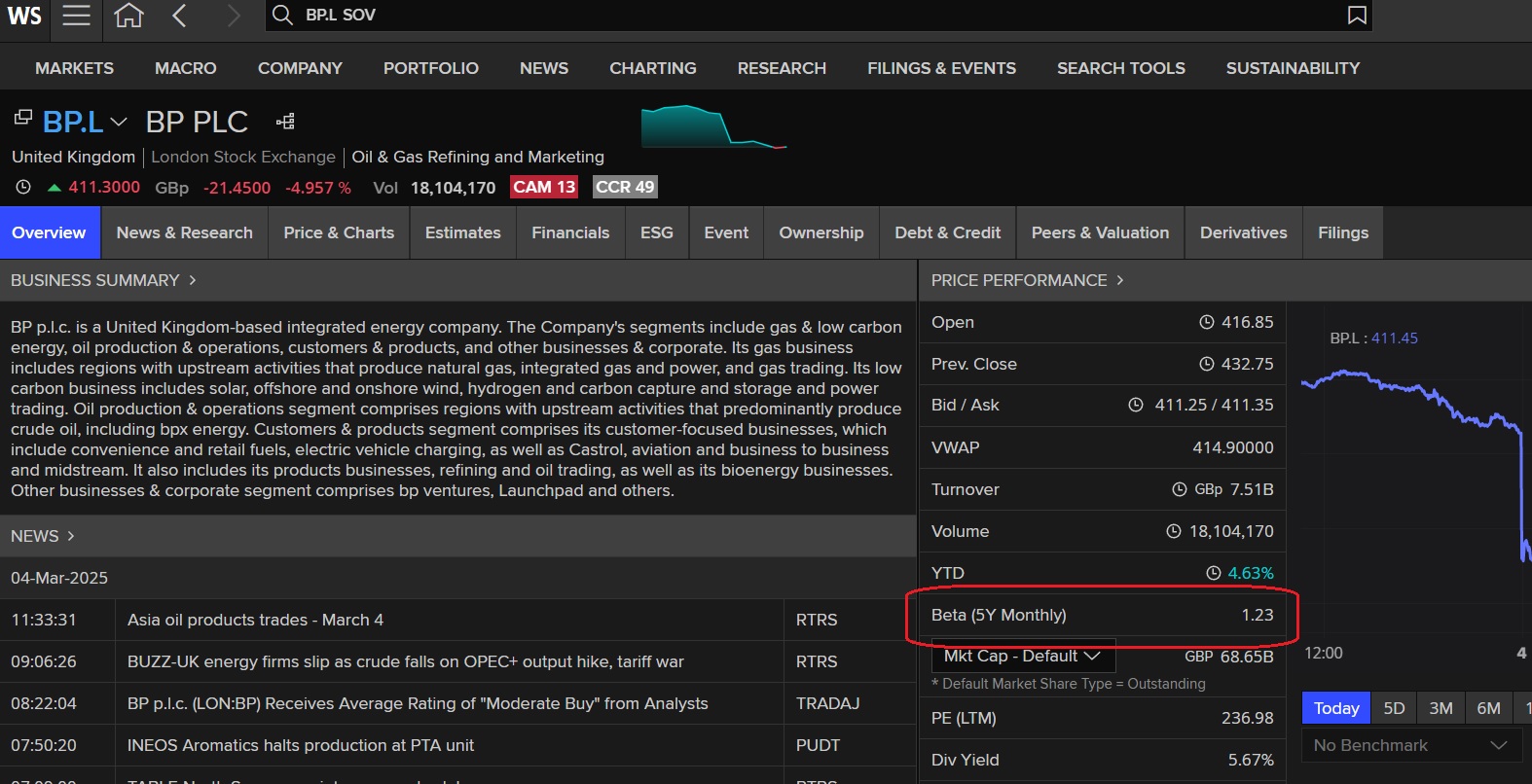

Betas in Workspace:

To source a company Beta on the Workspace platform, check out the Price Performance section of the company profile document. You will find 5 year monthly Beta for your equity (in this case, BP plc) listed next to the share price diagram. If you are using Workspace via the Excel add-in however, use the Excel function =TR(“BP.L@RIC”,”TR.BetaFiveYear”) to source your Beta.

Betas in Datastream

Betas are also accessible in Datastream, which is available via the Workspace Excel add-in. Datastream provides current Betas and pre-formatted expressions to calculate historical Betas for quoted companies around the world. Data is not held historically although it is possible to use formulae to calculate historic Betas, so Datastream provides the option either to use a predefined formula for the calculation of the Beta or use the Expression Picker to calculate your Beta hence making it more flexible option if you wish to do your own calculations. In order for Datastream to display Beta calculations, at least 2½ years of data are required.

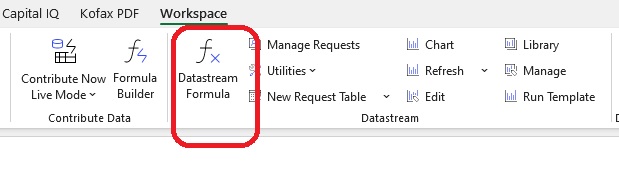

First access the Datastream formula function within Excel.

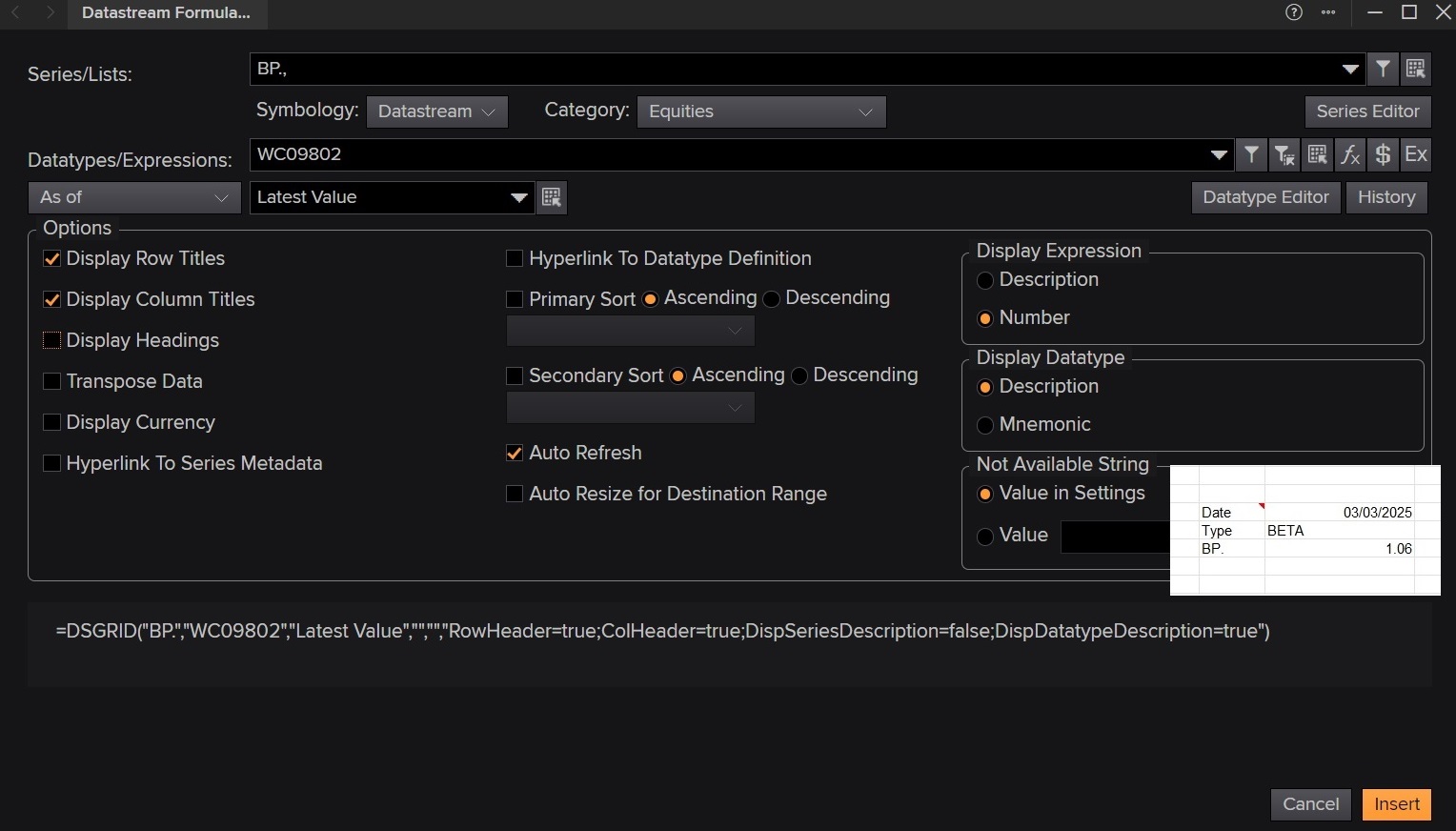

Current Betas in Datastream

- From the Workspace Excel menu options choose Datastream Formula (as shown above). A search form will appear.

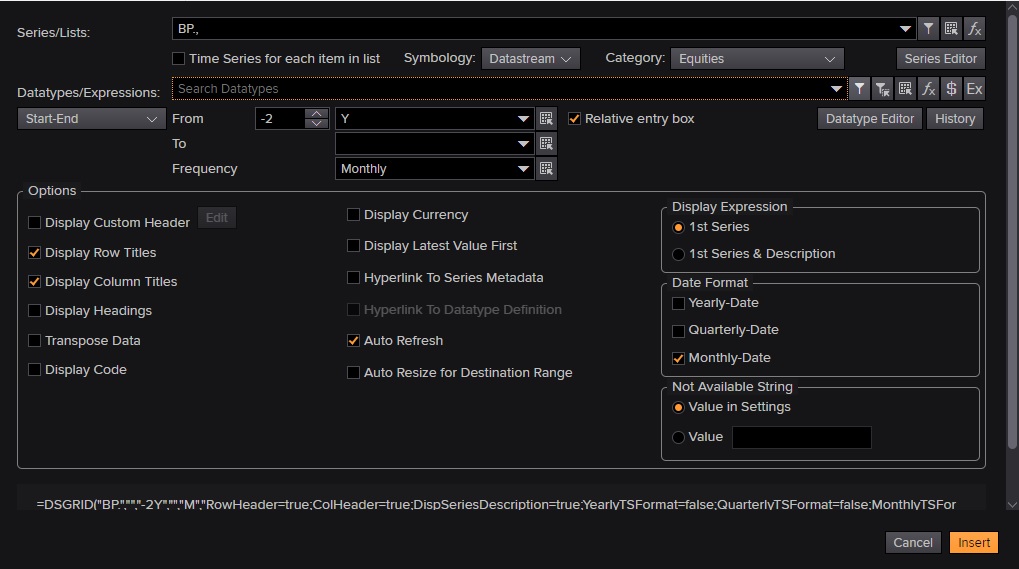

- Datastream screen

- Click on the funnel icon beside the Series/Lists search box. This will take you into the Datastream Navigator where you can search for the company you want.

- Type the name of the company in the search box, e.g. BP, and select the correct company from the options displayed. To select, place a tick in the box next to the name and then click on ‘Use’ at the top of the column to import it into the search form.

- Then go to the ‘Datatype/Expressions’ line. Hover over the options to the right of the search box and choose Datatypes or Datatypes associated with series, type in “Beta”

- Click on ‘Search’ and from the options displayed select ‘Beta (WS) – WC09802’. (To get the datatype definition click on the datatype heading and see the description provided).

- Change from ‘start/date’ to ‘As of’ and just leave at Latest Value.

- Click on the orange insert box at the bottom right hand box of search form the latest beta value will be displayed in excel. As shown in insert.

Current Beta in Datastream also showing search form

Historical Betas in Datastream

- As above, select the Datastream Formula screen

- Click on the upside down funnel ‘Find Series’ button and follow the steps above to find the company you need.

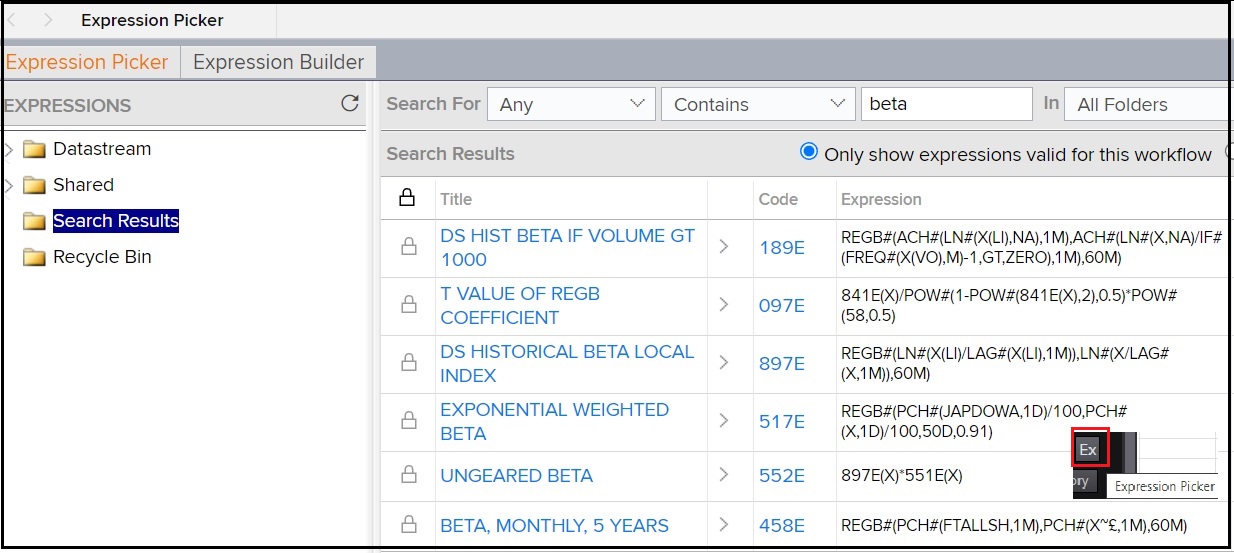

- Then click on the ‘Expression Builder’ icon letter E– available to the right of the search datatypes search box. You will be taken to the Expressions page.

- Make sure that Expression Picker tab is selected.

- In the Search For boxes choose ‘Any’ and then enter beta. Click on Search and a list of relevant expressions will be displayed.

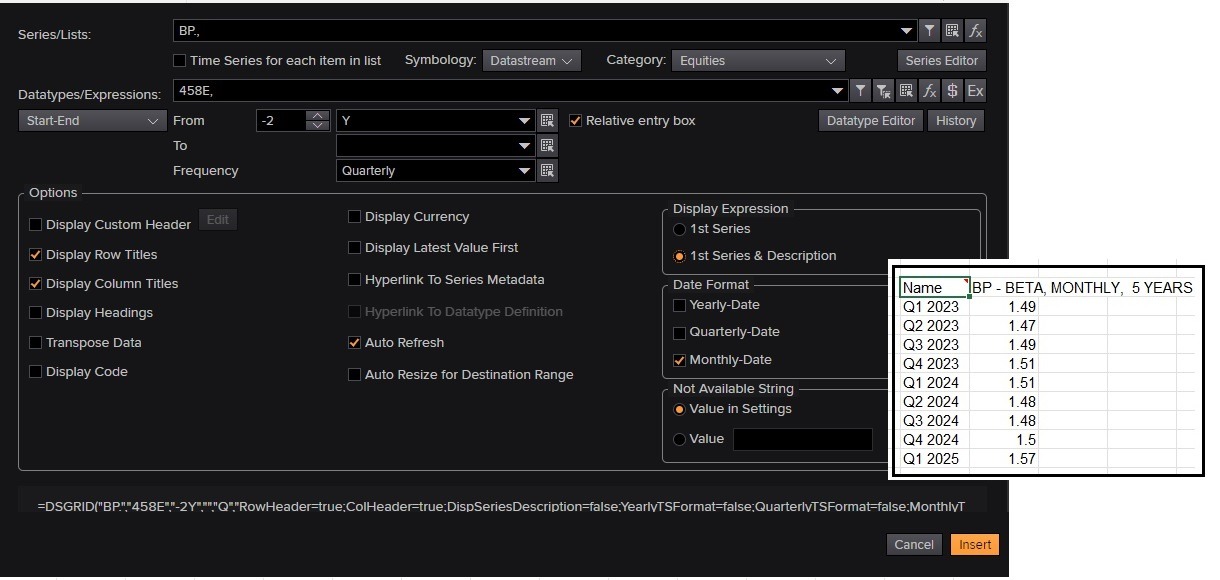

- Select BETA, MONTHLY, 5 YEARS by clicking on the code ‘458E’

- Enter your time period, e.g. -2Y, and frequency e.g. Quarterly.

- Click on ‘Submit’ and your values will be displayed.

- Results can be transferred to Excel.

Historical beta on Datastream

Datastream is available on the Workspace Excel add-in which can be downloaded to your laptop.

If all of this sounds a little complicated and scary, why not read our Beginner’s guide to sourcing a company Beta too.

If you have any questions on Workspace or Datastream or sourcing financial data, please contact our Business Librarians for more information.

Feature image from Pixabay. Available at: https://pixabay.com/photos/business-stock-finance-market-1730089/

Categories & Tags:

Leave a comment on this post:

You might also like…

My journey to Cranfield as an FIA Motorsport Engineering Scholar

"You don’t need to fit a stereotype to succeed in engineering or motorsport. You need curiosity. Resilience. And the confidence to take up space." In this blog, Sanya Jain, current MSc student and FIA ...

‘Getting started with Bloomberg’ training – discover the power of Bloomberg terminals

Perhaps you've heard people talking about Bloomberg or heard it mentioned in the news and are wondering what all the fuss is about? Why not come along and find out at our Getting started with ...

Commonwealth Scholarships play a critical role in developing sustainability and leadership in Africa

Q&A with Evah Mosetlhane, Sustainability MSc, Commonwealth Distance Learning Scholar What inspired you to pursue the Sustainability MSc at Cranfield? I was inspired to pursue the Sustainability MSc at Cranfield because of the university’s ...

How do I reference a thesis… in the NLM style?

You may be including theses within your research. When you do so you need to treat them in the same way as content taken from any other source, by providing both a citation and a ...

Introducing… Bloomberg Trade Flows

Are you interested in world trade flows? Would it be useful to know which nations are your country's major trading partners? If so, the Bloomberg terminal has a rather nifty function where you can view ...

Cranfield alumni voyage to the International Space Station

Seeing our alumni reach the International Space Station (ISS) has a ripple effect that extends far beyond the space sector. For school students questioning whether science is “for them”, for undergraduates weighing their next ...