A beginner’s guide to sourcing a company beta

04/04/2025

Beta is the measurement of a company’s common stock price volatility relative to the market. If you’re trying to find a current beta for a company there are a number of places to look. These include:

- Bloomberg

- Fame

- Factiva

- Capital IQ

- Datastream / LSEG Workspace

Please bear in mind that a company’s beta figures may vary slightly depending on the source although the trend should be the same. The differences will be due to the way in which the betas have been calculated. A methodology should be available within each resource.

If you have any questions about betas or sourcing any other financial ratios, please ask a librarian. Email us on library@cranfield.ac.uk or come in and see us.

Bloomberg

Finding the current beta for a listed company

A company’s current beta is available from within a listed company’s Security Description <DES>. It uses the main index of which the company is a member for its calculation. For BP, this is the FTSE 100 (Bloomberg code: UKX).

Current Beta in Bloomberg’s Company Description

Finding the historical (raw) beta

- From the company’s Security Description (or any other) page, type beta <GO> into the command line.

- This will take you to the Historical Beta, a screen displaying a graph and additional data including the raw beta.

- Using the orange boxes on this screen you can change the date range, company, index, lag, etc.

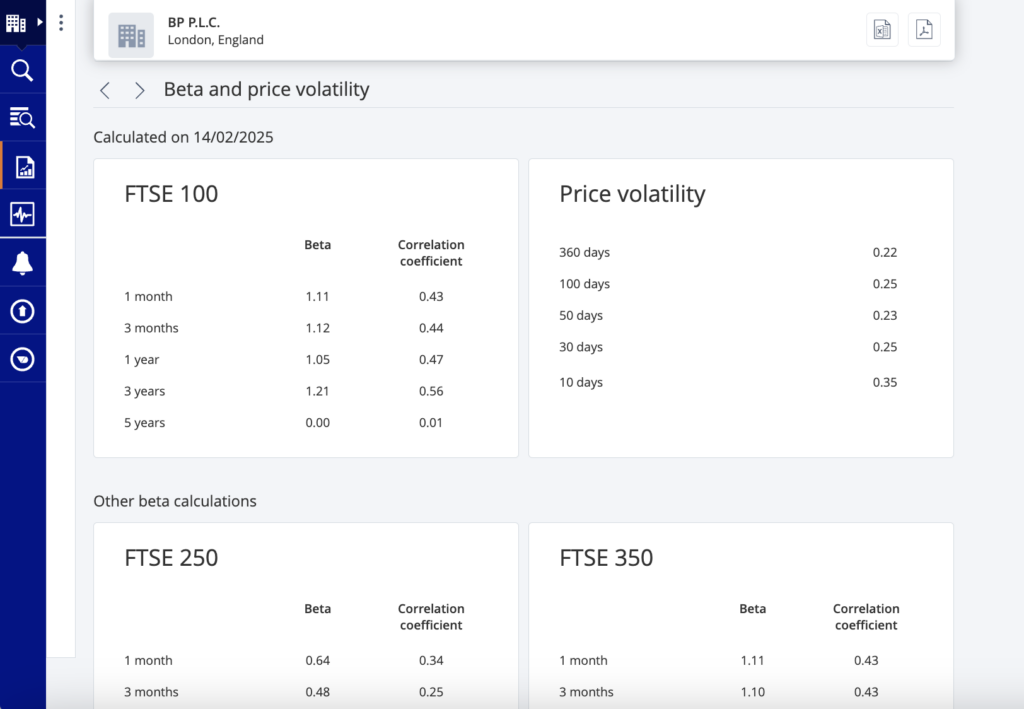

Fame

FAME provides company betas for UK and Irish companies only. Betas are calculated with reference to five key UK indices: FTSE 100, FTSE 250, FTSE 350, FTSE AIM 100 and FTSE All-Share. To find the figures:

- Enter the company name in the search box and select from the dropdown options to open the company profile.

- Open the Table of Contents by clicking on the dots icon on the left.

- From the Table of Contents, open the ‘Stock’ menu and

select the option for ‘Beta and price volatility’.

Betas in Fame

The beta screen will offer you figures for 1 month, 3 months and 1, 3 and 5 years for each of the indices available.

This section can then be exported into PDF or Excel using the on-screen options.

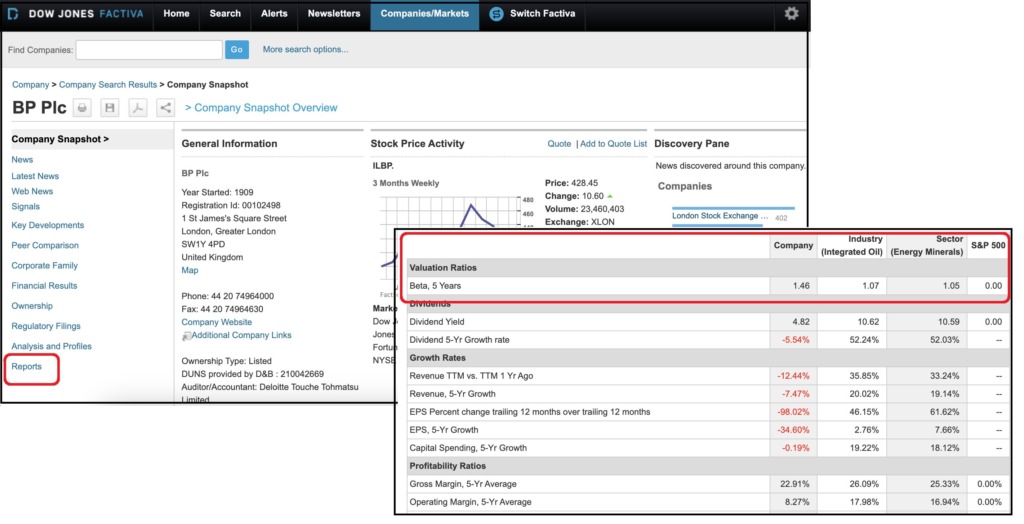

Factiva

Factiva is primarily a source of worldwide news but also includes a section on Companies/Markets which provides financial information for public companies globally and some private companies. Using this part of Factiva you can find both company and industry betas.

To find the company and industry beta for any company:

- Hover over Companies/Markets on the menu bar and then select ‘Company’.

- Type your company name in the search box and select from the options

- From the Overview page, select ‘Reports’ from the left hand menu and then choose ‘Ratio Comparison Report’.

- Factiva includes beta values for the company, industry and sector.

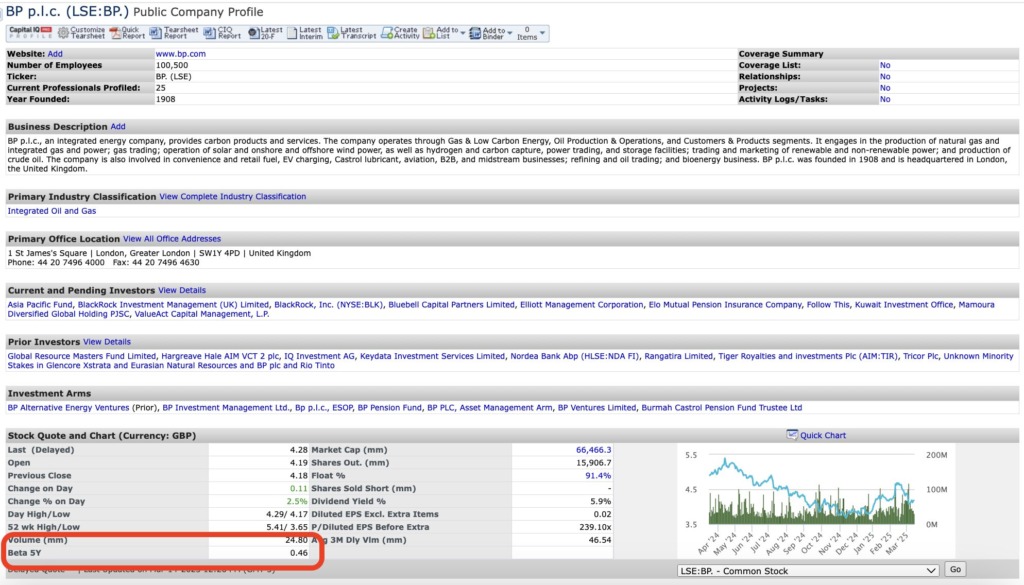

Capital IQ

The 5 Year beta is displayed towards the bottom of the company tearsheet, so first enter the name of the company, e.g. BP plc, in the search box then take a look at the ‘Stock quote and chart’ section of the screen. The tearsheet can be exported as a quick report or customised.

Beta in the Capital IQ Tearsheet

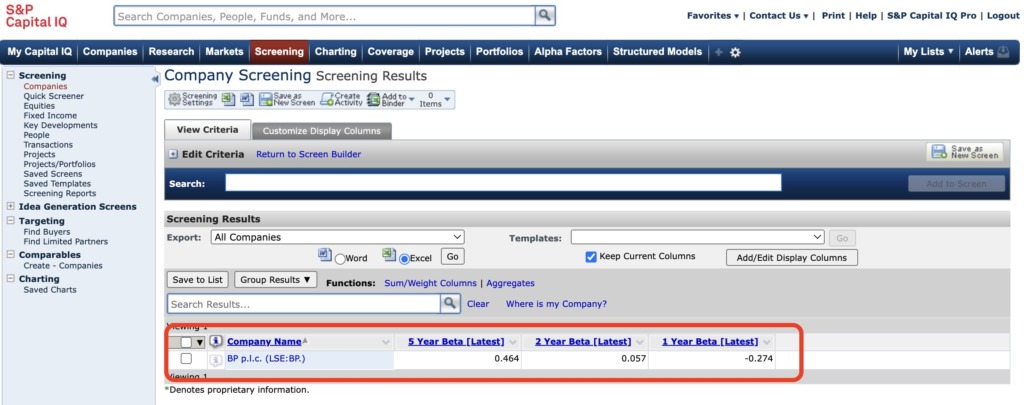

To find the 1Year and 2Year Betas you can use the screening tool within Capital IQ :

- Hover over the Screening option on the navy blue navigation panel and select ‘Companies’.

- Under the List Management box, click ‘Add Companies’. You can search for a company and select it by double-clicking the result then clicking ‘Add Criteria’ on the right.

- Under the Financial Information box, select Financial Statements. Scroll down to Market Data -> Stock Price/Volume then select the relevant beta metric and ‘Add Criteria’.

- Once done, you can click ‘View Results’.

Betas in Capital IQ

Beta can also be accessed via Datastream in LSEG Workspace. More information is available in a forthcoming dedicated post.

Any questions about any of the above resources – or using them to source financial data, please do not hesitate to contact the Library.

Feature image from AhmadArdity on Pixabay. Available at: https://pixabay.com/photos/business-stock-finance-market-1730089/

Categories & Tags:

Leave a comment on this post:

You might also like…

Commonwealth Scholarships play a critical role in developing sustainability and leadership in Africa

Q&A with Evah Mosetlhane, Sustainability MSc, Commonwealth Distance Learning Scholar What inspired you to pursue the Sustainability MSc at Cranfield? I was inspired to pursue the Sustainability MSc at Cranfield because of the university’s ...

How do I reference a thesis… in the NLM style?

You may be including theses within your research. When you do so you need to treat them in the same way as content taken from any other source, by providing both a citation and a ...

Introducing… Bloomberg Trade Flows

Are you interested in world trade flows? Would it be useful to know which nations are your country's major trading partners? If so, the Bloomberg terminal has a rather nifty function where you can view ...

Cranfield alumni voyage to the International Space Station

Seeing our alumni reach the International Space Station (ISS) has a ripple effect that extends far beyond the space sector. For school students questioning whether science is “for them”, for undergraduates weighing their next ...

From classroom to cockpit: What’s next after Cranfield

The Air Transport Management MSc isn’t just about learning theory — it’s about preparing for a career in the aviation industry. Adit shares his dream job, insights from classmates, and advice for prospective students. ...

Setting up a shared group folder in a reference manager

Many of our students are now busy working on their group projects. One easy way to share references amongst a group is to set up group folders in a reference manager like Mendeley or Zotero. ...