Where can I find credit ratings for companies?

16/06/2021

A credit rating (or score) is a measure of a company or corporation’s ability to meet their financial commitments based on their previous dealings. It can also be viewed as a measure of a company’s credit worthiness when issuing bonds. Scores will be calculated by reference to various items, for example cash flow, profits, equity and financial ratios.

Credit ratings are issued by three main agencies:

- Standard & Poor’s

- Fitch

- Moody’s.

The rating system and calculations vary between each however generally they range from AAA+ [Good] to CCC [Poor].

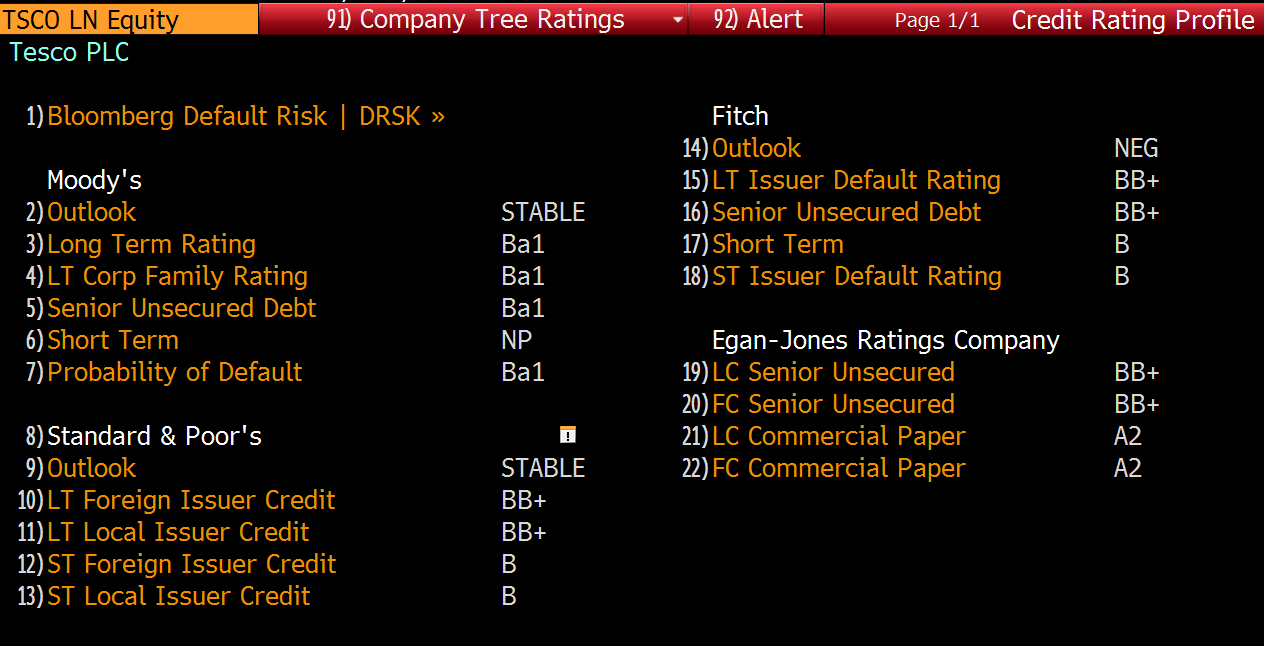

On Bloomberg you can get to a company (equity) credit rating by entering the code CRPR which will give you the credit rating profile. An example is shown below.

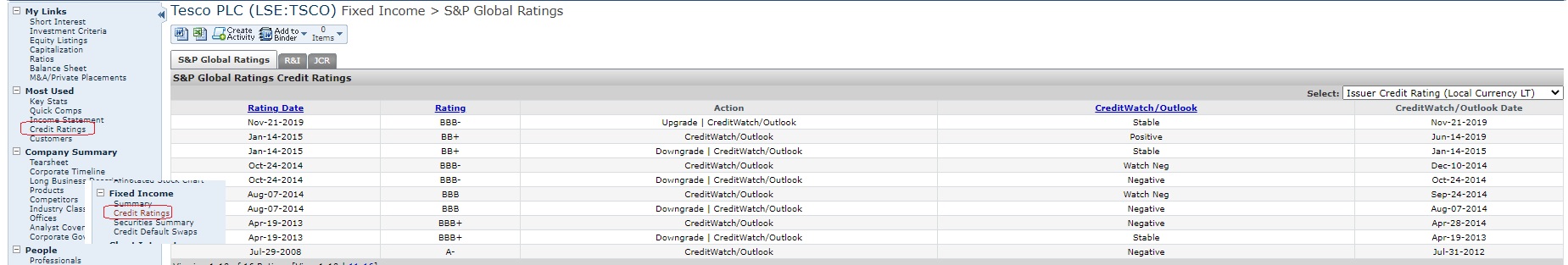

You will also find S&P Credit ratings on the Capital IQ platform. Simply select credit ratings from either the Most Used or Fixed Income menu that can be found at the right hand side of the company profile. Remember to create an account if you wish to use Capital IQ our blog post explains how to register for one.

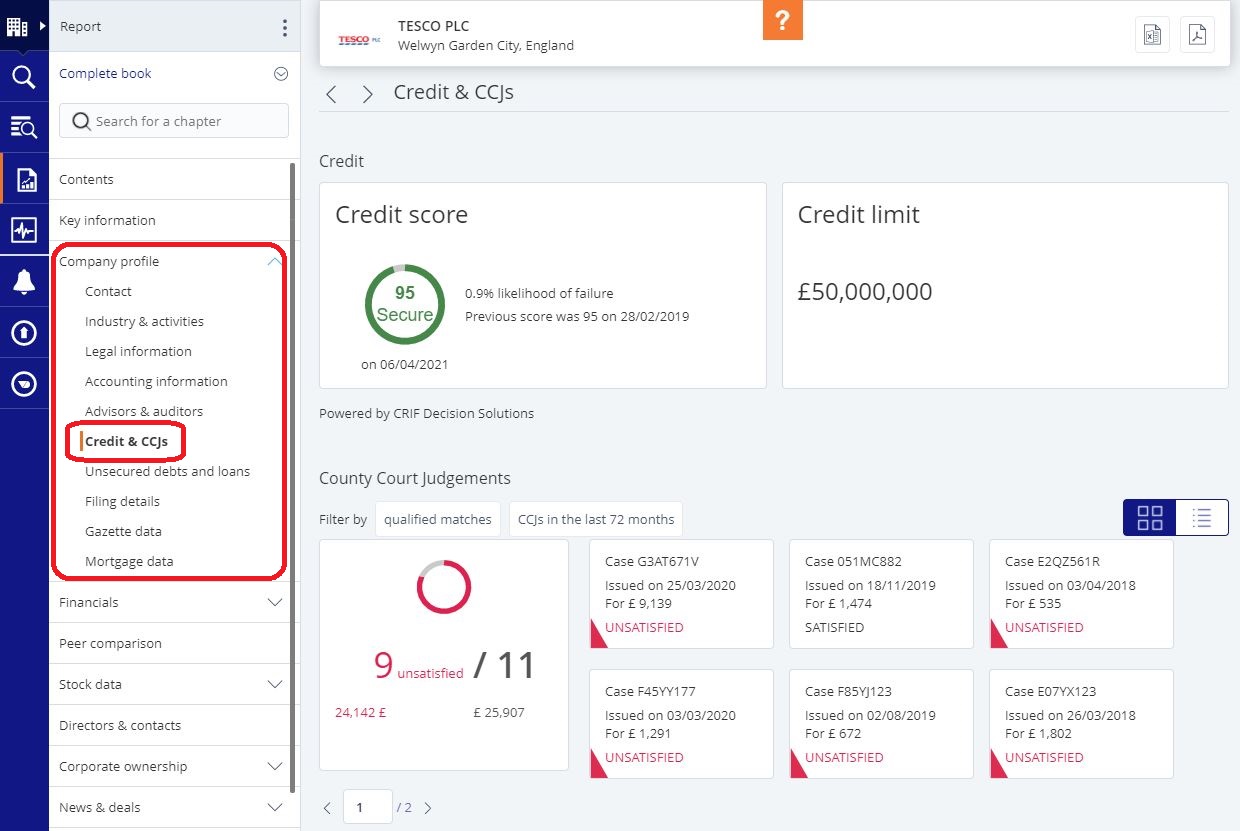

Fame has a new credit rating system for UK and Irish companies, developed by the company CRIF Decision Solutions in collaboration with Jordan’s, which provides a number that predicts whether a company will become insolvent. To view the credit rating for a company, open the Company profile section of the left-hand report menu and select ‘Credit & CCJs’.

Any questions, contact MIRC.

Feature image from Pixabay. Available at: https://pixabay.com/photos/savings-budget-investment-money-2789112/

Categories & Tags:

Leave a comment on this post:

You might also like…

Come to a virtual study session in May

What are virtual study sessions? These are online study sessions facilitated by Library staff, where you can study independently alongside other students via Teams. They are a great way for you to dedicate specific time ...

Getting started on your School of Management thesis

Writing a thesis, business plan, internship project or company project can be a daunting task, and you might have some uncertainty or questions around how to get started. This post will share some ideas and ...

Sustainability by royal request: Managing an event fit for a King

The Coronation of King Charles III on May 6th 2023, was watched by millions of people around the world with tens of thousands of people travelling to Central London to witness the pageantry firsthand. ...

Getting started on your Master’s thesis

Please note: This post is intended to provide advice to all students undertaking a thesis in the Schools of Aerospace, Transport and Manufacturing; Water, Energy and Environment, and Defence and Security. There is separate advice ...

Finding your tribe: “Joining the sustainability community was the best decision”

For students on Cranfield’s Sustainability Business Specialist Apprenticeship, community and camaraderie is a vital component for success. Designed in consultation with industry, the part-time Level 7 apprenticeship aims to deepen participants’ knowledge of the ...

“My sustainability studies gave me the confidence to take on Amazon”

Not everyone would have the confidence to challenge a big global power like Amazon but, for Colin Featherstone, Senior Technology Manager and Tech Sustainability Lead at Morrisons, his Cranfield studies equipped him with the ...