Researching… M&A

30/03/2021

Mergers and acquisitions are never very far from the news. But if you need to find out about a transaction in depth, where can you source the details you might not find in the papers?

M&A Specifics

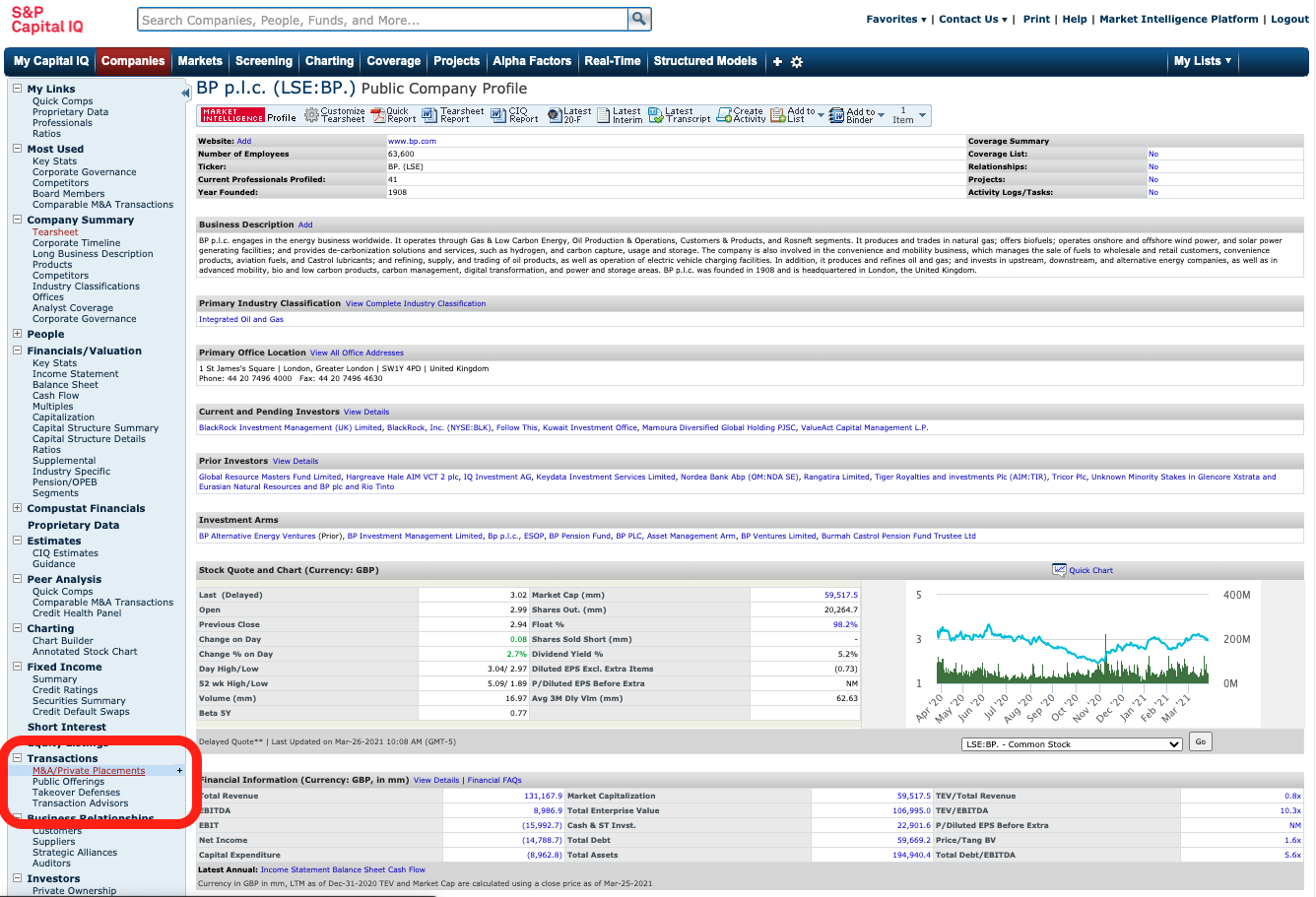

Capital IQ is an ideal starting point for researching M&A, providing access not just to detailed company financials, but also deal specifics for 1000’s of deals globally back to the 1980s. For that reason alone, we would recommend Capital IQ as your starting point for this kind of research.

For deals involving listed companies, the easiest way in is via the ‘Company Overview’ for that firm, pictured below. Choose ‘Transactions’ from the bottom of the left hand menu then ‘M&A/Private Placements’.

To search for deals by criteria, use ‘Screening’ and choose options from ‘M&A transactions’, accessible from the navigation menu at the top of the screen. Select ‘Screening ‘ > ‘Transactions’ > ‘M&A’ from the criteria options to build your search.

Bloomberg also has its own M&A Dashboard where you can search by specifics or simply browse deals by criteria. Access this page using Bloomberg code <MA>. Please contact MIRC for access information.

Background information

Once you have worked your way through the data available in Capital IQ and Bloomberg, SOM Library has a variety of other resources that will also be valuable in your research. These include:

- Background information such as company and industry profiles and reports from sources like FitchConnect, IBISWorld and Factiva.

- Stock market data including share prices and indices are available from both Bloomberg and Workspace. Bloomberg’s charting function is fantastic so please ask if you need help creating any graphs.

- Brokers and analysts’ reports are essential reading from the point where a deal was rumoured until well after the completion date. What else was happening at that time? Was there interest from other companies? Capital IQ is our best source for these. Bloomberg also contains some analysts’ reports. Please contact SOM Library staff for further information.

- The national press will also be a valuable source of information. Check out Factiva for coverage in newspapers worldwide.

- SDC Platinum (available via Workspace) contains the most comprehensive deals dataset available with data back to the 1950s. It is a resource which is more suited to large scale ‘number-crunching’ and therefore more suitable for gathering data for a thesis or research purposes.

As ever, any questions, please pop in or contact us here!

Feature image from Pixabay. Available at: https://cdn.pixabay.com/photo/2015/11/26/07/47/hands-1063442_960_720.jpg.

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...