Private Equity data in Capital IQ

17/08/2023

For those of you interested in private equity, here’s a quick summary of the information available in Capital IQ…

Capital IQ users need to register first for an account. Read about how to do that here.

Viewing details for a named Private Equity/Venture Capital company

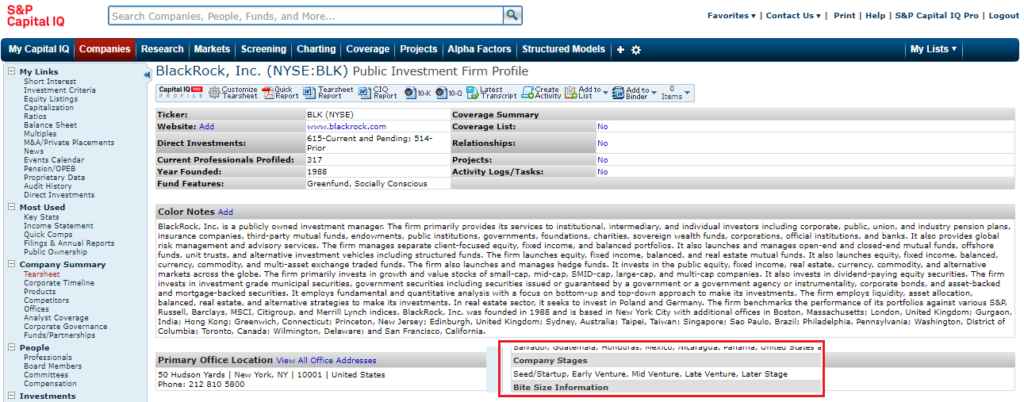

Let’s take BlackRock Inc. as an example. Simply search for the company name in the search box at the top of the screen. The tearsheet is usually displayed as default.

Under the tearsheet’s Company Summary heading you can see that the company is described as a Public Investment firm and that the company stages part of the record show the various stages that it has been through.

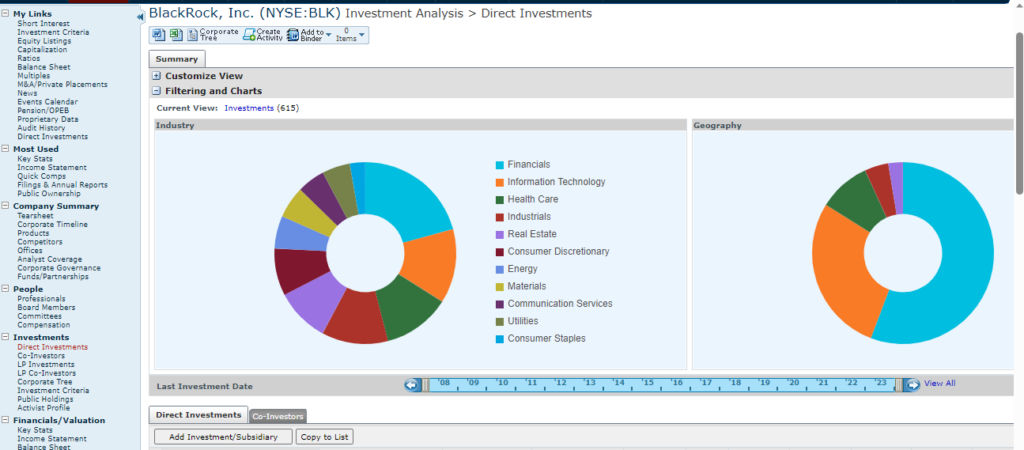

For details of where your private equity company invests, select Investments from the left-hand menu. Direct Investments shows a breakdown by industry and geography. You can also access this from the company tearsheet’s current and pending subsidiaries/investments section.

For information on BlackRock’s funds, select the option for ‘Funds/Partnerships‘ in the Company Summary menu. Funds are categorised by type. Click through on any fund name for more information.

In the left hand menu, towards the bottom, look for the heading for Investors. Here you can view both public and private ownership of your company. Public ownership will show the fund portfolio’s disclosures whilst Private ownership shows the PE/VC investments.

Identifying Private Equity/Venture Capital companies

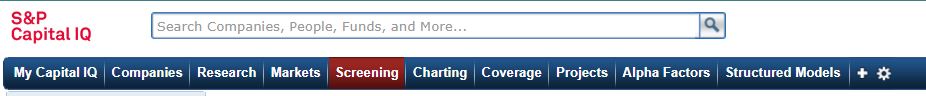

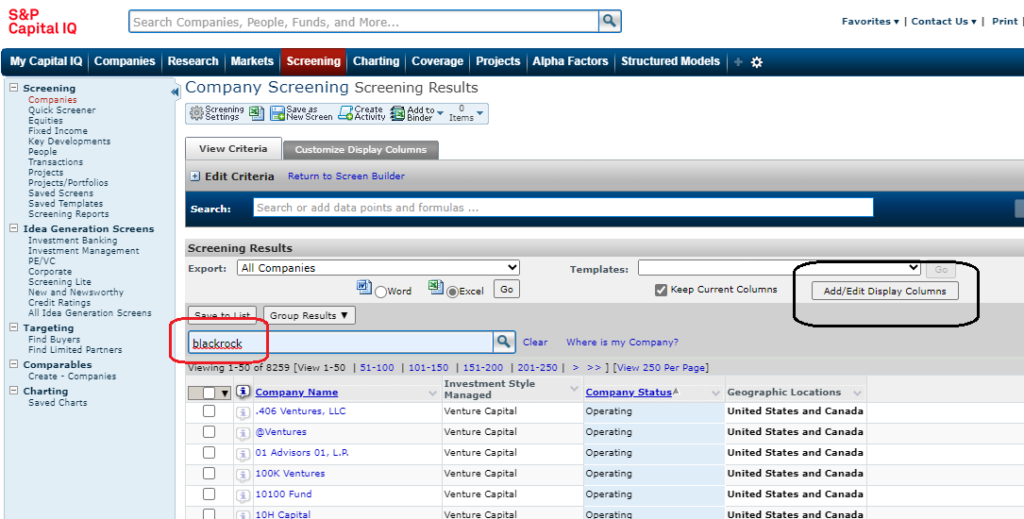

First select the Screening tab at the top of your screen.

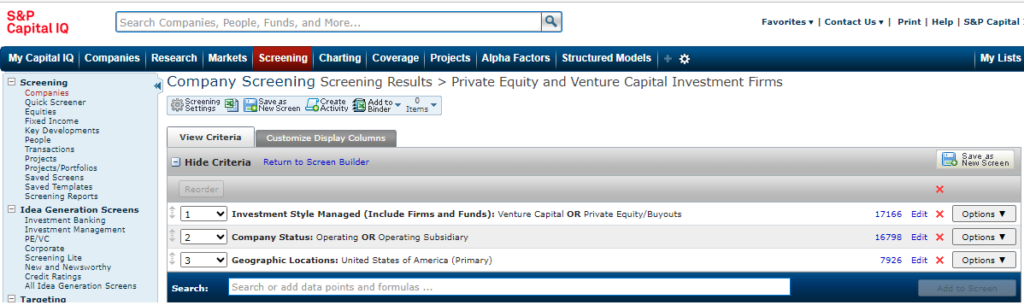

From the Criteria options displayed in the Screening criteria menu (see below), find the ‘Investment/Advisory Firms’ section and select ‘Investment style managed’ then select Venture Capital and Private Equity. Click on ‘Add Criteria’ to add your selections into your search.

- Then select from company status – operating or operating subsidiary

- Select a geographic location from Company Details, in my example United States of America.

When you are ready, click ‘View Results’. Results will show lists of PE/VC companies with company name, investment style, location etc. You can search within the results to locate a specific company name or you can add extra columns of data to your results. Results can be exported to Excel.

Any questions at all on any part of your PE/VC research, please contact us or visit us in the Library.

Feature image from Pixabay. Available at: https://pixabay.com/photos/savings-budget-investment-money-2789112/

Categories & Tags:

Leave a comment on this post:

You might also like…

Introducing… Bloomberg Trade Flows

Are you interested in world trade flows? Would it be useful to know which nations are your country's major trading partners? If so, the Bloomberg terminal has a rather nifty function where you can view ...

Cranfield alumni voyage to the International Space Station

Seeing our alumni reach the International Space Station (ISS) has a ripple effect that extends far beyond the space sector. For school students questioning whether science is “for them”, for undergraduates weighing their next ...

From classroom to cockpit: What’s next after Cranfield

The Air Transport Management MSc isn’t just about learning theory — it’s about preparing for a career in the aviation industry. Adit shares his dream job, insights from classmates, and advice for prospective students. ...

Setting up a shared group folder in a reference manager

Many of our students are now busy working on their group projects. One easy way to share references amongst a group is to set up group folders in a reference manager like Mendeley or Zotero. ...

Company codes – CUSIP, SEDOL, ISIN…. What do they mean and how can you use them in our Library resources?

As you use our many finance resources, you will probably notice unique company identifiers which may be codes or symbols. It is worth spending some time getting to know what these are and which resources ...

Supporting careers in defence through specialist education

As a materials engineer by background, I have always been drawn to fields where technical expertise directly shapes real‑world outcomes. Few sectors exemplify this better than defence. Engineering careers in defence sit at the ...

Comments are closed.