A beginner’s guide to sourcing a company beta

18/04/2023

Beta is the measurement of a company’s common stock price volatility relative to the market. If you’re trying to find a current beta for a company there are a number of places to look. These include:

- Bloomberg

- Fame

- Factiva

- Capital IQ

- Datastream

Please bear in mind that the figures may vary slightly depending on the source although the trend should be the same. The differences will be due to the way in which the betas have been calculated. A methodology should be available within each resource.

If you have any questions about betas or sourcing any other financial ratios, please ask any member of SOM Library staff. Email us on library@cranfield.ac.uk or come in and see us.

- Type beta at the command prompt. Do not hit enter.

- You will see Functions, Securities and Search information displayed.

- To see the full range of information and help about betas on Bloomberg, select ‘Beta: Definition’ from within the Search area (at the bottom of the menus).

Finding the current beta for a listed company

- Enter the name of the company you wish to view followed by beta e.g. BP BETA. Do not hit enter.

- From the bottom of the menus, select ‘Search BP Beta’.

- The adjusted beta of BP will be displayed and links are given to the historical beta and regression analysis.

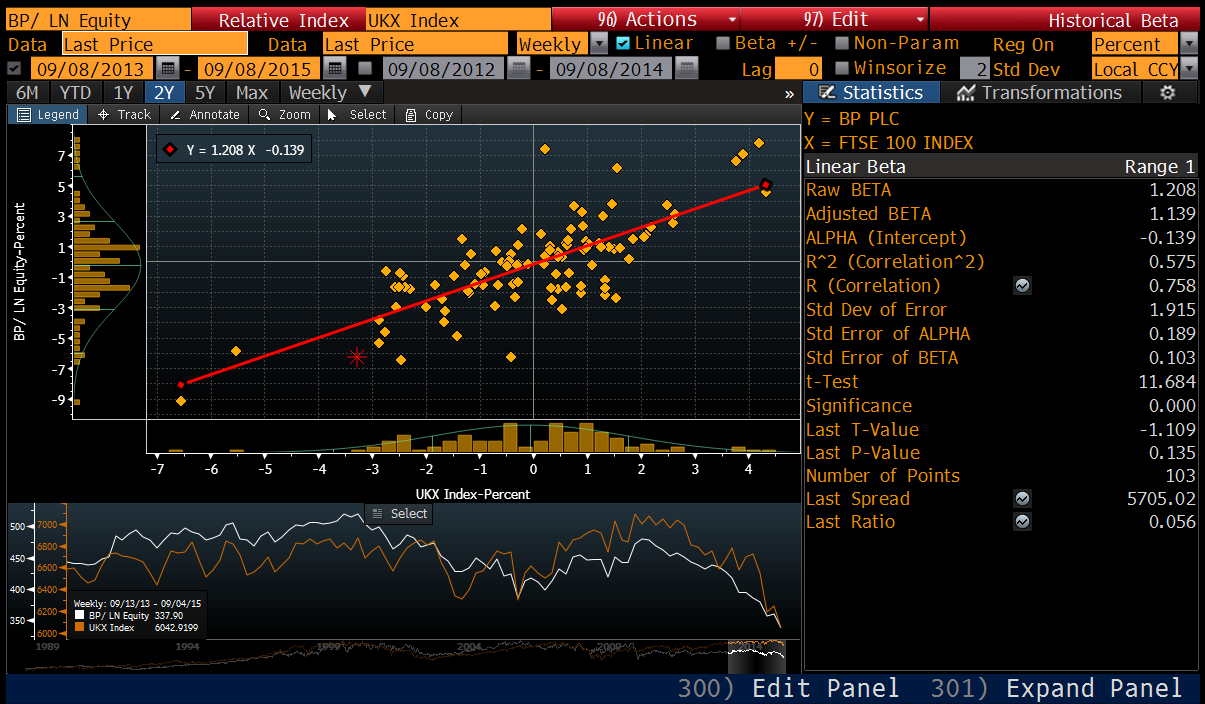

Finding the historical (raw) beta

- From the Current Beta screen, clicking on Historical Beta takes you to a screen displaying a graph and additional data including the raw beta.

- Using the orange boxes on this screen you can change the date range, company, index, lag, etc.

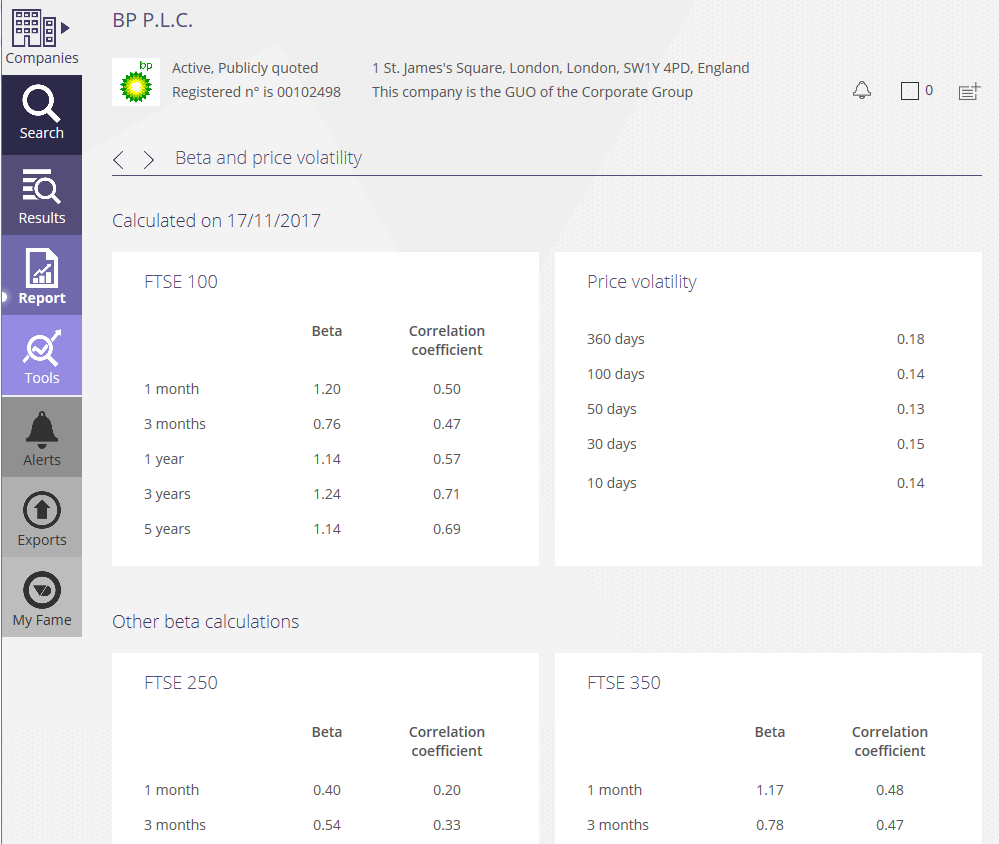

Fame

FAME provides company betas for UK and Irish companies only. Betas are calculated with reference to five key UK indices: FTSE 100, FTSE 250, FTSE 350, FTSE AIM 100 and FTSE All-Share. To find the figures:

- Enter the company name in the search box and select from the dropdown options to open the company profile.

- Open the Table of Contents by clicking on the dots icon on the right.

- From the Table of Contents, open the ‘Stock’ menu and

select the option for ‘Beta and price volatility’.

The beta screen will offer you figures for 1 month, 3 months and 1, 3 and 5 years for each of the indices available.

This section can then be exported into PDF or Excel using the on-screen options.

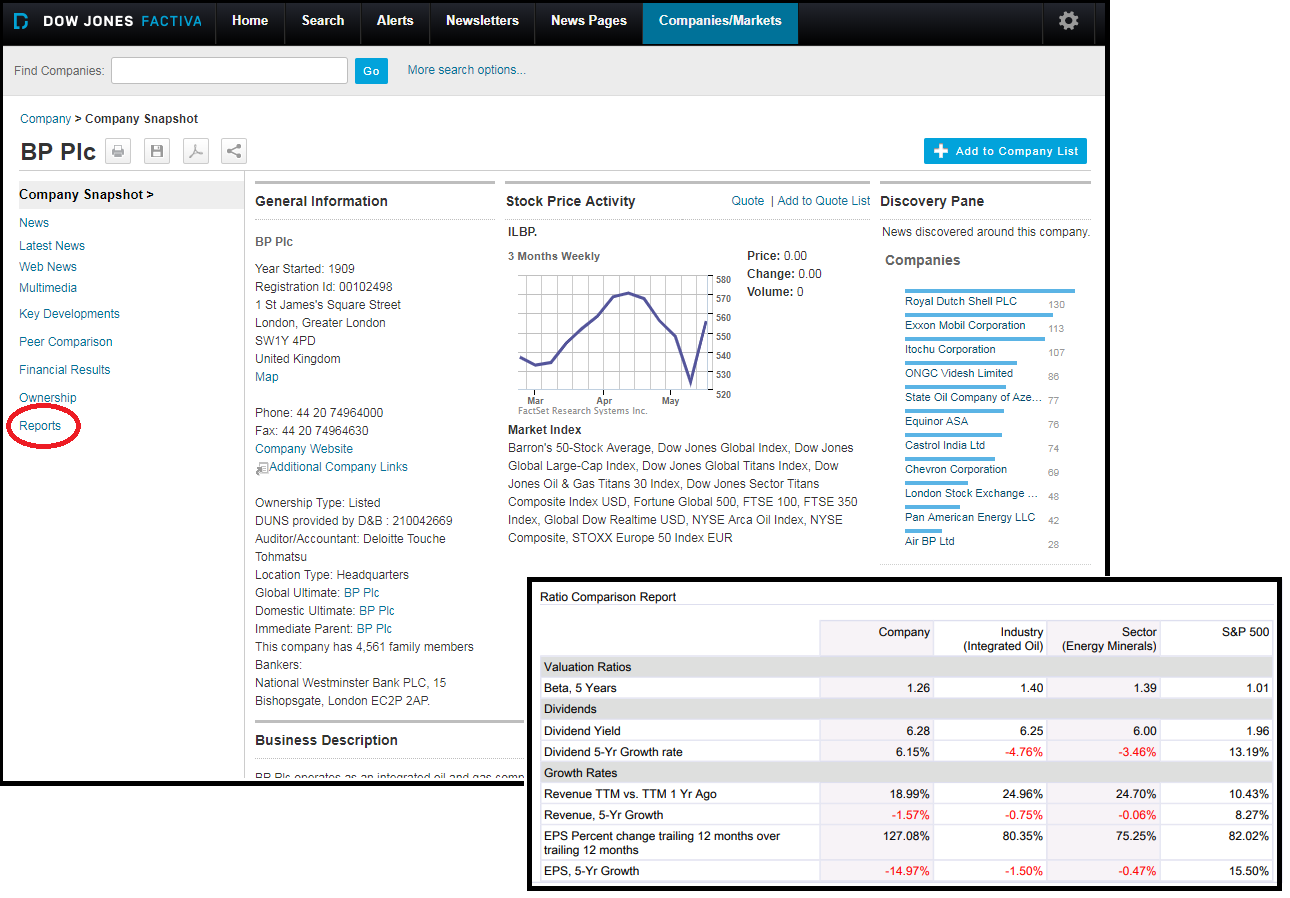

Factiva

Factiva is primarily a source of worldwide news but also includes a section on Companies/Markets which provides financial information for public companies globally and some private companies. Using this part of Factiva you can find both company and industry betas.

To find the company and industry beta for any company:

- Hover over Companies/Markets on the menu bar and then select ‘Company’.

- Type your company name in the search box and select from the options

- From the Overview page, select ‘Reports’ from the left hand menu and then choose ‘Ratio Comparison Report’.

Capital IQ

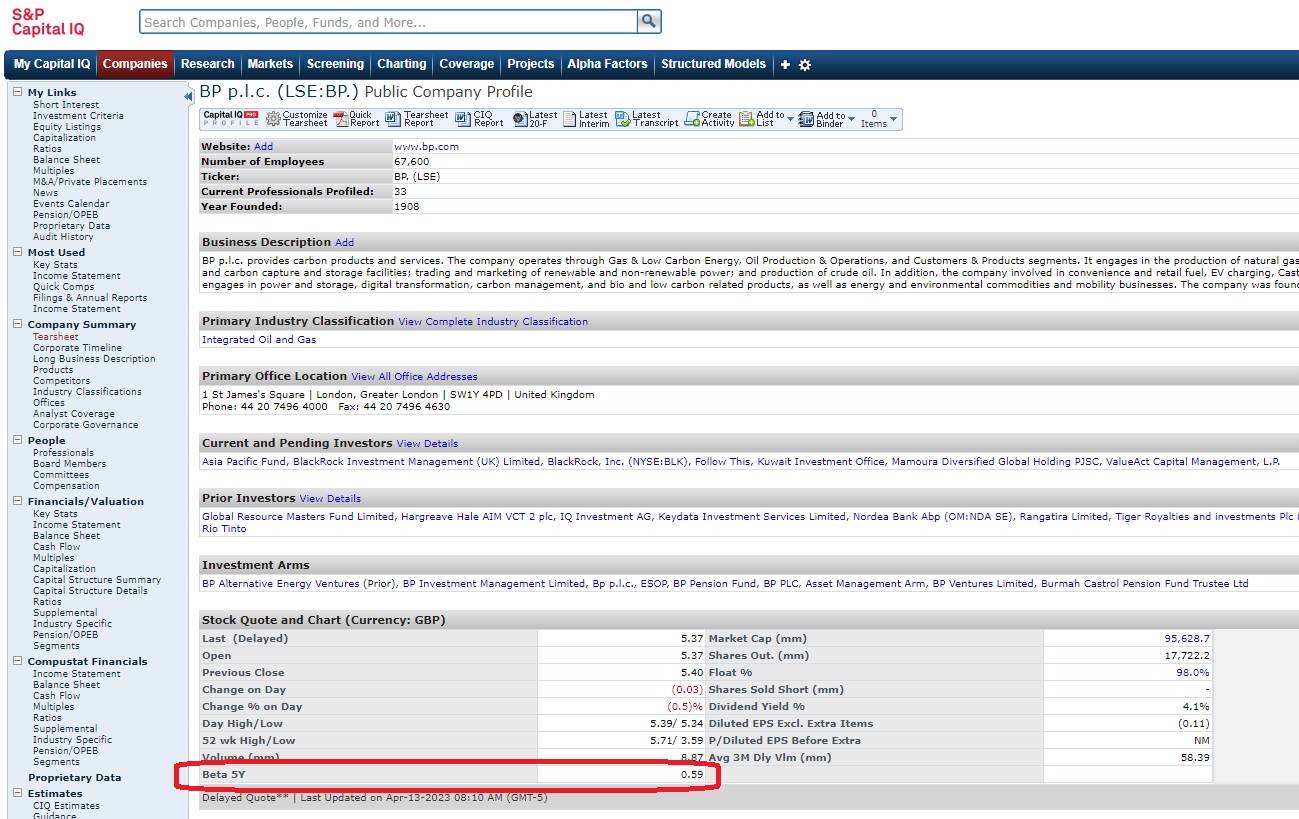

The 5 Year beta is displayed in the company tearsheet so first enter the name of the company e.g. BP plc in the search box then take a look at the Stock quote and chart section of the screen. The tearsheet can be exported as a quick report or customised.

Betas in Capital IQ

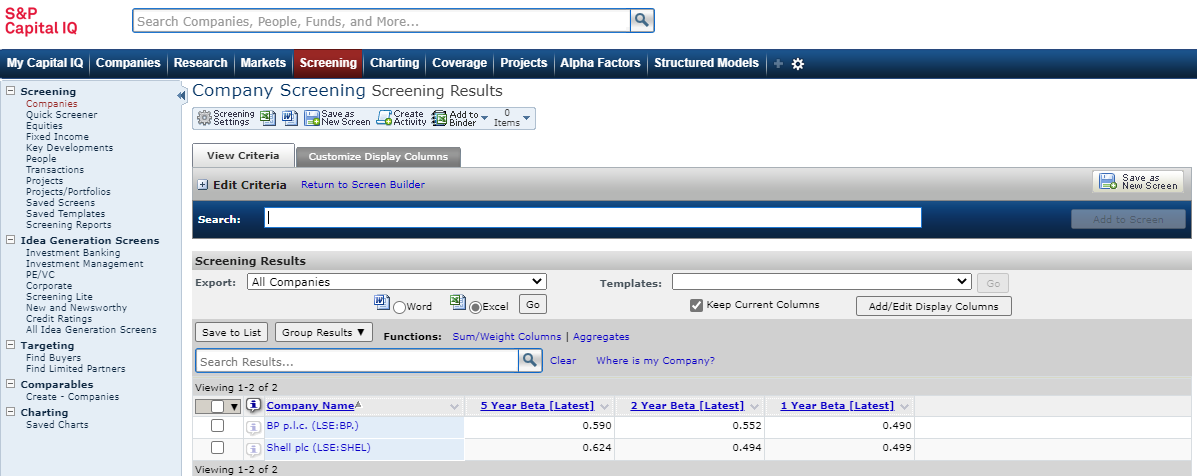

To find the 1Year and 2Year Betas you can use the screening tool within Capital IQ :

- Hover over the Screening option on the navy blue navigation panel and select ‘Companies’.

- Under the List Management box, click ‘Add Companies’. You can search for a company and select it by double-clicking the result then clicking ‘Add Criteria’ on the right.

- Under the Financial Information box, select Financial Statements. Scroll down to Market Data -> Stock Price/Volume then select the relevant beta metric and ‘Add Criteria’.

- Once done, you can click ‘View Results’.

1year, 2year & 5year beta from Capital IQ

Datastream

Datastream provides current betas and pre-formatted expressions to calculate historical betas for quoted companies around the world. In order for Datastream to display Beta calculations, at least 2½ years of data are required. Data is not held historically although it is possible to use formulae to calculate historic Betas.

See also our post on Company Betas in Datastream for more information – not for the faint hearted!

Any questions about any of the above resources – or using them to source financial data, please do not hesitate to contact the SOM Library.

Feature image from AhmadArdity on Pixabay. Available at: https://pixabay.com/photos/business-stock-finance-market-1730089/

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...