MSc Management and Entrepreneurship TechCrunch Event

28/05/2021

At the beginning of April 2021 our Management and Entrepreneurship MSc students were invited to attend the TechCrunch Early Stage 2021 – a virtual event which covered a variety of entrepreneurial concepts such as pitch tear down, term sheet construction, product management, first hires, achieving operational excellence and much more. Please see TC Early Stage 2021 – Operations & Fundraising | TechCrunch – for more information and the programme of the event. Please find below the students own summary of the event along with their take-aways.

Lizzy Gu

I was very fortunate to take part in the TechCrunch virtual event as part of the Management and Entrepreneurship MSc programme. I was surprised by the breadth and depth of the startup disciplines covered by this event ranging from marketplace positioning and product management, to pitch deck presentations, fundraising, go-to market strategies and much more. This virtual event covered everything I needed to learn to enable me to develop my own business plan.

Before attending this event I was not confident my business idea and product would be accepted by the market. I found the session ‘Finding your product market fit’ really helpful because it taught me how to write a good business plan and showed me that in order to find a niche I needed to focus on the solution which didn’t currently exist in the market and build on these market needs. It also developed my awareness to recognize market trends and to take on feedback from big customers to help develop my ideas and to help me know how to price my product or service to position it correctly in the market.

I learnt that once I start my business I should be continuously reevaluating and updating products to keep them current.

The session ‘How to get an investors attention’ was focused towards company founders who are trying to fundraise. In this session I learnt that projects which have a bigger impact would be the most attractive to investors so a clear and well structured pitch deck is critical to securing an investor. The pitch deck should cover margins, and a reactive acquisition plan (for example how to acquire customers during the Covid-19 pandemic), marketing strategies, staffing requirements and more.

These high quality sessions inspired me to constantly reassess my business idea and to keep developing and researching in order to improve over time.

Even though I am not an early stage founder at present I was inspired by the enthusiasm conveyed by the investors, founders, speaker and participants in the TechCrunch event. It has inspired me to become an entrepreneur in the future.

Rohit Malhotra

Techcrunch 2021 was an interesting online virtual event on how to raise funding and nail your pitches when pitching to investors. The sessions went into detail and delivered tangible advice on how to look at products, market fit and nail your pitch meeting well.

The session “Power of product-led growth” with Tope Awotona, founder of Calendly, I found particularly fascinating as this is a tool which I currently regularly use. Tope talked about how he had bootstrapped the company and found the initial users from higher education. There were no salespeople in the company, so the company was capital efficient and relied on the virality of the product to enable distribution which allowed Calendly to be successful.

Another insightful session was with Melissa Bradley on “how to nail your virtual sales pitch”. She mentioned that instead of pitching about your product, look at it as a conversation about your product and spending 2/3rds of your time on fielding the questions from VCs, rather than making it only a presentation.

I also enjoyed the session with Bucky Moore from Kleiner Perkins where he mentioned about storytelling. Pitching about your startup is important and you need to explain why you need to raise an investment now for your startup. If the founder has a unique perspective about the market, then it will excite the investor on why they should invest in the market right now.

All the sessions were insightful and interesting, and I would like to thank Cranfield School of Management for the opportunity to get the students access to TechCrunch 2021 event.

Petar Dimov

One of the most crucial decisions a founding team can make is to consider when to sell a company to a strategic buyer. During the session ‘An M&A Playbook for startup Founders: Lessons from Google and Microsoft’ with Sean Dempsey (founding partner of Merus Capital and former Corporate Development Director for Google and Microsoft) and Dave Sobota (VP of Corporate Development at Instacart and former M&A leader at Google) I learnt the answers to the following question – What drives a company’s valuation?

1. Quantitative factors – An acquirer will look at your Discounted Cash Flow (DCF), revenue multiple, EBITDA multiple or other traditional valuation metrics.

2. Qualitative factors – These factors are more difficult to incorporate into an Excel spreadsheet, but they are critical for determining value. Some of the qualitative factors can include the strength of your leadership team, the time-to-market advantage you will give the acquirer by having them buy you versus developing something similar in-house. For example, if you have really hard to develop technology or a significant consumer base that an acquirer simply cannot replicate. Another qualitative aspect is the uniqueness of your company – Are you the only player in this space, or are there many competitors?

3. Synergies – The formula for synergies is when one plus one does not equal two, but it equals something bigger. This bigger number is due to the synergies. There are two types of synergies – revenue synergies and cost synergies.

- Cost synergies are where the two companies can combine and reduce costs, such as eliminating redundant functions that are no longer needed.

- Revenue synergies are the main synergies in strategic M&A. One great example of revenue synergies is when Cisco or Oracle purchases a company and then leverage their strong sales channel to rapidly accelerate sales and revenue of the acquired business.

As a founder, you can become so focused on growing the venture, and sometimes it can be hard to change the focus and put yourself into the shoes of an acquirer and how they will look at you. It is crucial to be able to understand the way an acquirer looks at the value they might get from buying you. When the time comes, tell the story in such a way that the acquirer sees the maximum value they will obtain, which in turn, will help you boost the sale price you will receive.

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

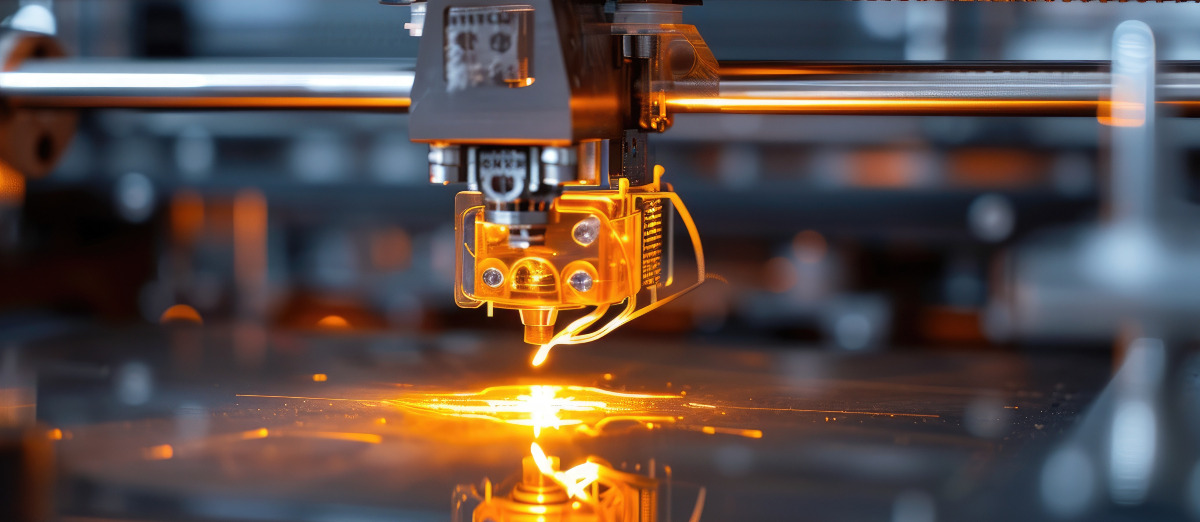

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...