From growth to supergrowth – Cranfield Venture Day 2016

12/05/2016

All economies need businesses to grow so that employment is created and wealth is generated for the owners and for society. This does place a big onus on entrepreneurial firms and on government policies to make sure that the infrastructure and conditions are right, whether this is at the micro level of the firm or the macro level of society.

From our experience and from text books we can see there are broadly three identifiable phases of business growth. The early stages when products and markets are being defined and teams are coming together. As the firm gains critical mass at this stage and the resources to grow, we see a second phase, which (while it may be bumpy) nevertheless sees a period of growth in terms of sales, profits and perhaps employees. This leads to gaining a clear market presence, perhaps a visible brand and an experienced team of senior people who work with systems and procedures to ensure operational efficiency. The second phase is perhaps the danger phase as it comes to a transition point of maturity. Because it may be at this point that the third phase of growth is experienced. It is mature, slow, probably generating a good amount of cash and this could lead senior teams to a state of complacency.

In the third phase of growth – where the growth is about cash and bottom line profits – and not so much about innovation, new products or new markets – what we begin to see is the gradual extinguishing of the “mojo” of the founding team. So we get to a point where companies have established themselves and had a period of rapid growth and this is now followed by a slowing down.

In the words of Charles Handy – it is before we get to his point that we want to start the new growth curves. We need to jump to a new S curve based on innovations, new products/services or new markets. It is this mentality that helps to achieve a transition from growth to supergrowth.

But what does this actually mean? What is supergrowth?

For existing companies we would argue that supergrowth is possibly doubling the rate of growth that was experienced during a strong growth phase. It can be achieved by entering new markets, changing business models, altering the product/service mix.

New companies that are being founded on the back of IT and internet trends will probably experience supergrowth rates right from very early stages and because of the kinds of firms they are and how they are funded they may well be short-lived. The question for us then is about how sustainable and enduring supergrowth is. One such company is the Reliance group in India. This has been growing at 20% per annum for 40 years. It has gone through all manner of Government policies and it was the business minds of the entrepreneurial family business that navigated the varying conditions by continually entering very big markets with a lot of determination.

An example of a supernova is perhaps Rovio – creators of Angry Birds – which seemed to come out of nowhere. The founding team experimented with over 50 games before Angry Birds created the mountain of cash. Now the question is about what next? Coolmilk – provider of milk to schools – became a national company after a reboot of its business model from supplying milk locally to becoming an enabler for other dairies to provide milk and taking away the burden of paper work for schools. Wizzair, barely 10 years old and turning over a billion Euros per annum, has focused on very clear market segments – it has worked in unaddressed markets and is one of the few low cost airlines that is making money.

What connects all these companies are the mindsets of the founders with a clear ability to make things happen while holding on to the “tail of the tiger”.

Startup to scaleup has become a rallying cry of government policy and is being supported by the Scaleup Institute. This is excellent for new ventures as they are supported. We also need to find ways to get existing businesses, owned by families and investors, to look at how they can get past their glass ceilings and turn their growth into supergrowth.

These topics will be explored through the voices of entrepreneurs, CEOs and experts at Cranfield Venture Day 2016. It will attract the kind of people new and existing business, their CEOs and their senior teams will want to attend to explore the topic.

Our intention at The Bettany Centre for Entrepreneurship is to run with this theme for two years and help connect people who are interested in this question with each other.

For more information on Venture Day 2016 please visit www.ventureday.co.uk

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

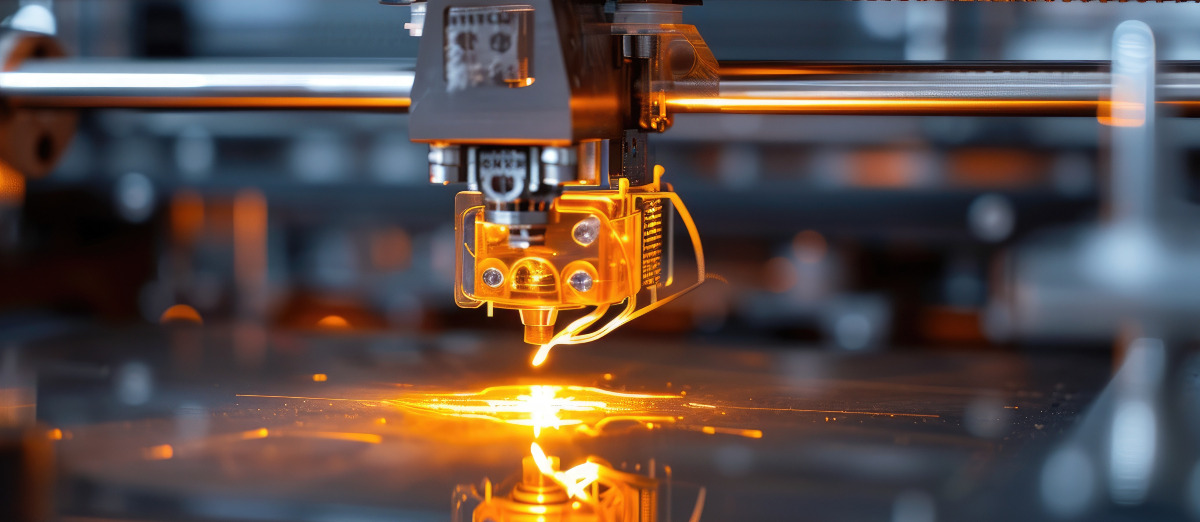

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...