Bridging digital inequality

28/02/2022

Introduction

On a wintry Sunday evening this January, I decided to make a short cavalier workout video at the gym aimed at inspiring my nearest and dearest to steadily enhance their fitness regime. But surely it would be impossible to simultaneously workout and make the short video, or so I thought, and so I sought the help of a gentleman (in his early 20’s and from a top digitally competitive country) with whom I was acquainted, to assist me with the recording.

He smiled broadly and in two minutes showed me how to remotely control the iPhone camera using the watch to achieve my blithe endeavour. I was possibly on my sixth iPhone and third apple watch! How could I not know this? Minutes later as I walked out of the gym partially musing over this, it came to me as epiphany would: digital inequality!

Imperial College London and the Good Things Foundation UK reported that in 2021, seven million UK residents lacked internet access at home. Globally, the situation is direr. Internet World Stats revealed that Africa has the lowest internet penetration rate of 39.3% second only to Asia at 53.6%.

Some telecom players in Africa have taken the commendable step of slashing data prices to narrow the digital divide. For the financial services sector, driving ESG investing and supporting green businesses are all well and fine, but more can be done to bring sustainability right up to the hearts of billions of customers through digital banking channels (mobile apps and online banking) and afford them the opportunity to acquire bite size learning about sustainability, its localised challenges and to contribute to the solutions. How so?

More from the Financial Services sector

Take HSBC for example. It has presence in over 60 countries which equals about 33% presence global reach. What if through cross-sectoral collaboration along with multilateral organisations such as the UNEP, it categorises, regionalises and updates sustainability challenges for willing local customers to provide limited responses, under its ‘Products and Services’ interface on its digital channels; and then markets this product for what it is, a service to the environment and an individual invitation to its customers to have and share in future-proofing our planet? What if this is adopted by other sector players? One can only imagine its effect globally, more so in developing economies where the hurdles to achieve sustainable living are as many as they are diverse and the means and channels to proffer solutions or even useful ideas are limited.

One upside of the COVID-19 pandemic is that it increased the use of digital channels and banking apps amongst hitherto sceptical customers. Last year, Forbes reported that 76% of Americans used their primary bank’s mobile app for everyday banking tasks; and from the writer’s interaction and experience there was an increase in parts of Africa and Asia. Interestingly, a good number of these ‘converts’ are older persons who are often in tune with unique ideas and solutions for tackling localised sustainability challenges but lack a formal and sober channel to share and engage these ideas. Therein, lies the opportunity. In fact, it is a win-win as employees in this sector will have to learn and champion sustainability if they are to sell the product and satisfactorily respond to customers queries.

Creating a sustainable planet and future is a task for all

Frankly, the sustainable solutions to global challenges, cannot exclusively come from the West, Management schools and Green Giant organisations. We must equally give the same opportunity to developing countries to have a go, well beyond just mechanisms such as carbon offsetting; for developing economies do not mean developing minds. Lest we forget, Mathematics had its origin in Egypt, Africa; Yoga a multi-billion-dollar health industry, in India; and a scientist from Mexico, in Latin America was crucial to the invention of the contraceptive pill. This point was not lost on the United Nations, when it created the extant SDG goals and declared them universal and applicable to all countries irrespective of their socio-economic stratum.

This intendment of this article is not to set out the process flow for this idea but rather to open it up for further analysis, discussions and interrogations at workspaces and warehouses, from bedrooms to board rooms and of course, in gyms and government regulatory agencies.

Conclusion

By way of peroration, to the Greek physician, Hippocrates these words were attributed: “For extreme diseases, extreme methods…are most suitable”. Ours are extreme times and all rational ideas to drive sustainability should be welcomed and debated, even seemingly incremental ones. The race to save our planet is on, failing which the consequences will be catastrophic for the globe and yes, every inch more severe than been unable to record a gratuitous workout skit on an iPhone.

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

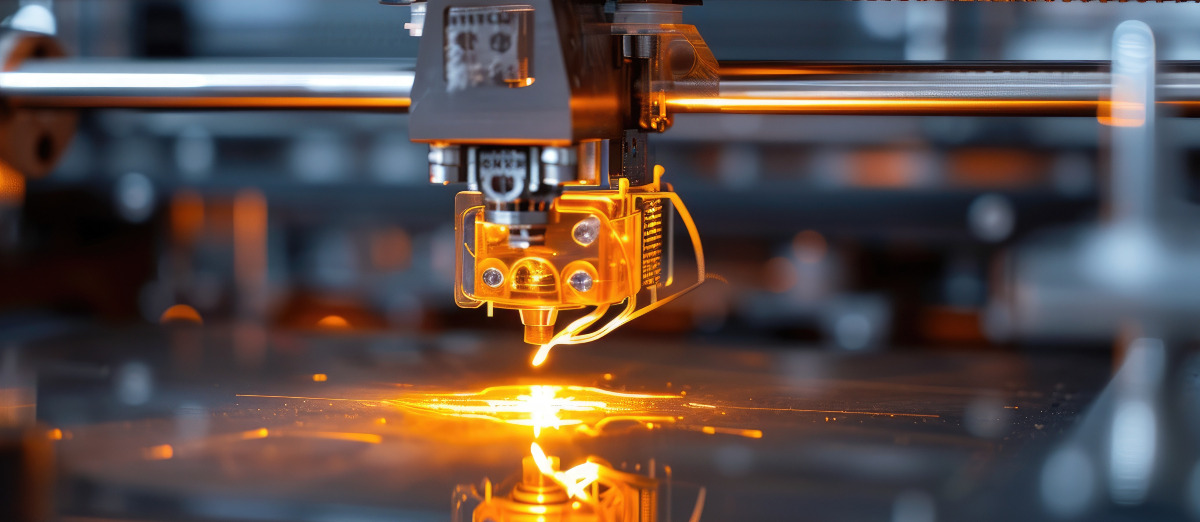

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...