Brexit and Business Finance

12/07/2016

The UK referendum produced a vote to leave the EU, and so leave we will. However, it is notable that neither the Government nor the Leave groups went into the referendum with any sort of plan for how an exit could be done. Hence we are living through a time of great turbulence. Regardless of how things develop over the next months and years, your business does need a plan for how to survive it. Here are some things to consider:

Think about the opportunities

Let’s start on a positive note: there will for some businesses be opportunities. As the £ sinks, our exports become more attractively-priced, so is this a good time for your business to up its game in exporting? Likewise, imports will become more expensive: does this give you an advantage in the home market? Some industries will probably benefit from Brexit, and it’s worth considering that yours might be one.

Think about the threats

The threats are many and varied, but rather than hiding under the bed and refusing to face them, all organisations need to acknowledge them and prepare to deal with them. Here are just a few things for your list:

- Imports will become more expensive –how does this affect your cost base?

- Are you dependent on EU nationals in your workforce or customer base?

- Will leaving the EU affect your ability to sell into EU countries?

- How will leaving the EU affect your supply chain (inventory levels, credit terms, etc)?

- Regulations will change – how is this likely to affect your business?

- Do you need more funding in the short- or medium-term, and will existing lines of funding still be available to you?

- How is tax regulation (direct and indirect) likely to change, and how will that affect your business?

- The UK never adopted the € so Brexit does not affect anyone’s core currency. But the new volatility in the currency markets is going to hit businesses, and you need to decide how you are going to deal with it.

For each of these you need to consider what is the potential range of impacts, and what you can do to mitigate them. Which brings me to another point.

You need a forecast

In my view, every business should already be producing a forecast, particularly of what its cash flows will be over the coming period. For some industries, a rolling 13-week forecast is useful; in others we might be looking at a much longer business cycle, and forecast out over a longer period of time.

To be of most use, your forecast should include an income statement (profit and loss account) and a balance sheet, which link to produce your cash flow forecast – the key document. Document your assumptions for these very clearly, so that everyone who uses it understands the basis of preparation – and get input from others – ask them to critique these assumptions, as they will have insights you might lack.

And you need sensitivity analysis and scenarios

Yes, you definitely need that forecast. And, it will be wrong. It has to be wrong – it’s a forecast, and we don’t know what is going to happen in the future. So, having produced a basic suite of forecasts, start looking at potential scenarios for Brexit, and prepare sensitivity analysis that indicates what might happen in each instance. That will give you an idea of your financing need and inform your action plan. The scenarios won’t pan out the way you think, but having thought about them will give you a great advantage in facing what does come along.

Dr Ruth Bender is Associate Professor of Corporate Financial Strategy, Course Director for Finance for the Boardroom, and also teaches on Finance & Accounting for Managers.

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

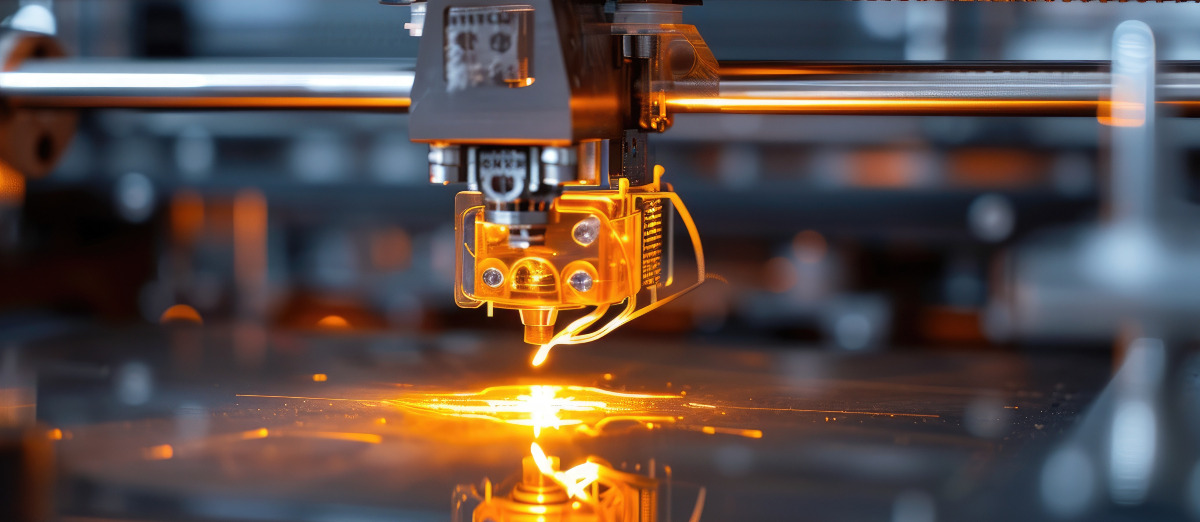

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...