How to make green investments part of the global sustainability cycle

01/11/2021

We need sustainable investment, not token finance for green projects that leave traditional ways of doing business untouched. Planting more trees, or funding eye-catching blue sky technologies is not the answer.

There is growing commitment to the climate change and sustainability agenda from the finance industry and investors. As there should and would be: without stability and security, no investment is safe. In turn, the new demands from investors drives the shaping of business strategy and priorities.

So the funds and the will to back sustainability are there. But how do we ensure finance streams are going into the ‘right’ projects?

The typical Environmental, Social & Governance (ESG) criteria for investment — now adopted by many asset management firms — encourages generalisation: box ticking of contribution to vague goals rather than specific attempts to deliver impact and change. It would work better, for example, if we think first of all about the specific ‘sustainability challenges’ to solve. Sustainable investment: where money is invested into businesses to solve particular challenges while also constituting business opportunities and providing financial returns. This is where the real potential for creating strong, virtuous circles of investment will be. Not business as usual plus some CSR activity or slightly shifting the allocation of stock portfolios towards a sustainability metric.

Sustainable investment is rooted in balance; making sure the assessment of which challenges are addressed takes into consideration the breadth of factors, environmental, social and economic. It’s not a healthy situation if investors only see funds going into activities without a return. Eventually there will be a creeping cynicism and funds will shift. Sustainability challenges can also be business opportunities — operations like Tesla, Elvis & Kresse, and Beyond Meat, where solving scarcity of materials and climate-related problems have also led to outstanding returns. Another activity might lead to major gains in carbon emissions reduction, but what if the side effects include the slashing of jobs and ruined communities?

As much as new green technologies, then, we need sustainable business models. Part of my research is around understanding the mechanisms involved in sustainability innovation and circular economy. One practical outcome are tools to help companies ‘see’ waste and turn it into value, in other words, identifying new opportunities for creating sustainable value and sustainable business models. Being part of the circular economy means less reliance on scarce resources, new revenue streams, creating new kinds of jobs — and in social terms, the chance to encourage more self-aware, conscious consumerism. Innovations like leasing products, where manufacturers retain ownership, means more of an incentive for businesses to focus on quality and longevity, for there to be more sharing of products and opportunity for returns and repairs, breaking the linear routine of take, make, dispose.

Right-minded investments, rather than funding greenwash, are dependent on reliable forms of measurement. We need a science-based, transparent evaluation system to measure companies’ actual sustainability performance. For investors, companies should formulate sustainable goals (measures of what they want to achieve or what sustainability problems they aim to solve) that take into account the full picture of stakeholder value, social, environmental and economic for the long-term.

First of all, the best approach for making use of the available investment will be to start with a broad brush. Allow for a highly diversified mix of approaches to solving problems of sustainability. Then, when it becomes clearer which of these approaches are working and which aren’t, the funds can become increasingly more targeted. technologies are ignored and their development stunted.

While governments are essential partners for setting overarching goals and contributing a sense of urgency and national mission, where investment programmes are government-led and controlled there is the risk that the direction of funds is guided by political priorities, the breadth of vision narrows and clouds over. Traditionally, government-led spending programmes can become mired in bureaucracy and low efficiency.

Strong incentives or regulations that encourage or force investors to move large amounts of capital into one, very narrow industry, mean danger in terms of creating short-term asset bubbles and a long-term weakening of a sector. It’s a phenomenon which, to some extent, we have already seen happening in the solar cell industry: a sector which profited immensely from the range of government subsidies available in countries across Europe. There was a build-up of overcapacity and a subsequent crash. Plans and policies need to take into account how incentives can benefit a broad range of sub-industries, both helping to solve the climate crisis and also create a business environment where individual contributors have the chance to innovate.

A cycle of sustainable, high-impact investment, then, will not come from the imposition of fixed environmental goals but thoughtful, adaptable enterprise.

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

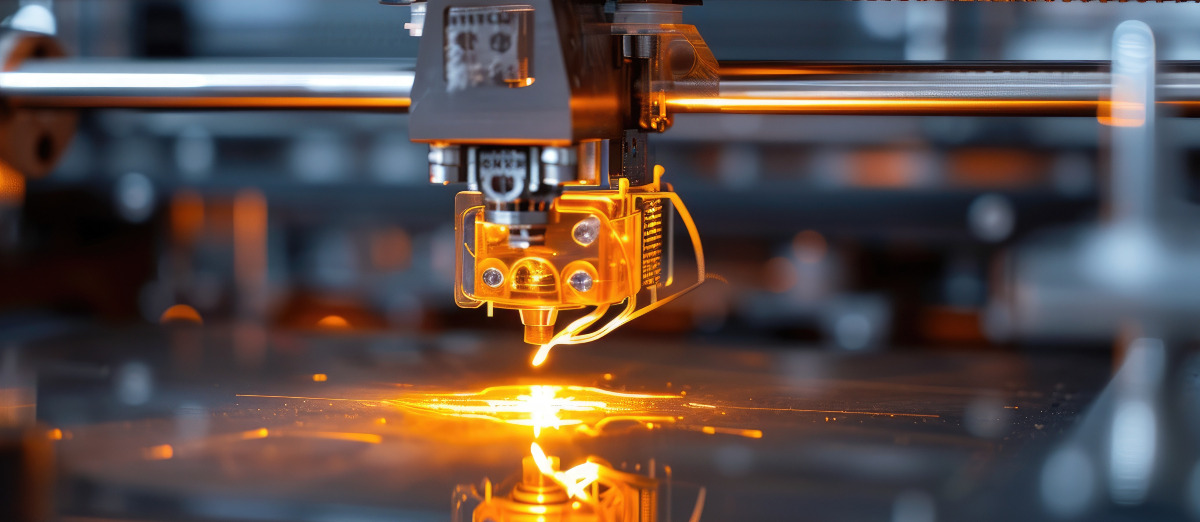

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...