Why Performance Reporting is NOT Performance Management!

03/04/2017

“Mirror, mirror on the wall whose presentation is the fairest of them all?”

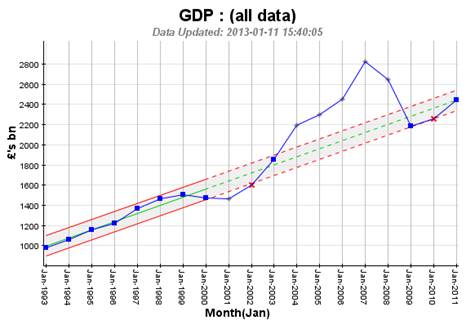

“GDP last quarter is higher than the previous quarter, and the same quarter last year”, says Kamal Ahmed of the BBC News. So far his reporting is correct. “Therefore it’s improving!”, and that’s where his performance management is wrong! The accurate thing that he can say looking at GDP data like this is “Therefore it’s different!”

There’s a massive chasm between reporting what has happened in the past and claiming it tells us about performance management – i.e. about what is likely to happen going forward. Let’s look at 3 aspects of this little conundrum:

- How can we better understand what has happened in the past (in order to take more appropriate action going forward)

- What can we say about what is likely to happen going forward (with/without any intervention)

- What are the fundamental differences between Performance Reporting and Performance Management

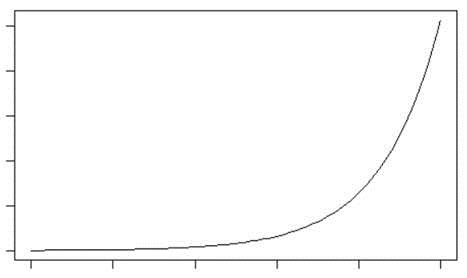

Let’s go back to Kamel Ahmed, and to keep things less controversial for this piece, we’ll look at GDP for the UK (figures from the World Bank – and let’s not get into which sources of figures best suit what position we want to take, or who can present the fairest of them all) on an annual basis up to and including 2011. The first thing you’ll notice is (refer back to previous posts on this matter) we are not showing % increases. The misleading reporting we hear and see around the %GDP increase this period (month, quarter, year) is x% better than last period – as if there is some God-given right that %GDP should always be increasing (we are living in a finite world!). If this was indeed the case, then we would be see raw GDP increase exponentially! That looks something like this:

This would mean infinite raw GDP sometime soon. “Unrealistic!” you might say!

So what does raw GDP actually look like:

Interesting! I only have the figures back to 1993, but you have to start somewhere! We are showing the annual figures within trended (Extended-SPC, see previous posts) guidelines – and it is the pattern and trend we should look at as much as the actual individual annual results. We can see up until the credit boom in the early 2000s GDP was trending upwards at about £100bn per year (not unhealthy!). Then GDP dipped around the bursting of the “dotcom bubble”, around 2000 – 2002, and then went nuts with the credit fuelled economy. Then there was a correction (some say disaster, but, as I say, we are living in a finite world!) around 2007/2008. And guess what, the following 3 years where everyone thought we were in “plateau-land” (percentages!) GDP returned to the previous upward trend established in the earlier part of the chart.

Is this a better way of looking at Performance in order to understand it? I’ll leave that with the reader …. and next time we’ll have a look at house prices in the same way, and see if we can see a pattern. After that? We’ll attempt to answer the final two questions posed above…

David Anker

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...