Why Performance Reporting is NOT Performance Management! – Part 2

10/04/2017

“Water, water everywhere, nor any drop to drink!” – goes the Rhyme of the Ancient Mariner as his ship lies lost in the Doldrums upon a wide and vast ocean. I wonder what he would make of the vast oceans of data (or should I say, Data Lakes!) at our disposal these days – perhaps “Data, data everywhere, nor any context to think!”

Last time we introduced the idea that Performance Reporting is not Performance Management and started to examine 3 aspects of this little conundrum:

- How can we better understand what has happened in the past (in order to take more appropriate action going forward)

- What can we say about what is likely to happen going forward (with/without any intervention)

- What are the fundamental differences between Performance Reporting and Performance Management

And, to introduce better understanding, we looked at annual UK GDP figures in their short-term historical context from 1993 – 2011, using extended-SPC techniques (where we are looking for anomalies, tends and patterns), and proposed that this gave far more understanding about how GDP was performing than the typical economic reporting of comparing the latest quarter with some other quarter.

Continuing with better understanding for this post, we said we’d also show how House Prices performed over some of this period – again reinforcing context, and potentially enabling a vestigial cause and effect picture to be developed…

So during the 2001 – 2007 GDP boom, House Prices trended up (@ around circa £20,000 per year – and there is a seasonal pattern, talk to any estate agent about this, which makes the performance corridor wavy with humps in the middle of the year and troughs at the start/end of the year). In Q3 2004, there’s an anomaly in the House Price Chart that corresponds with the anomaly in Jan 2004 of GDP chart. There’s a massive change to the trend at the house-price peak in Q1 2007 where the trend changes to aggressively downwards. This corresponds to the Jan 2007 peak in GDP. In early 2009, house-prices resume an upwards trend around about the same time as GDP resumes its upwards trend.

Ideally, we’d like to see GDP and House Price data on the same timescales (e.g. both quarterly), and both for a longer period (say, 1993 – 2017), but it is not difficult to see how House Prices followed (and possibly drove to some extent through debt-fuelled domestic spend) GDP. Perhaps, if one was attempting to Performance Manage the economy, one would think about managing better how people re-mortgaged their houses based on upwards trending house-prices – or you could consume out of context data from the Land Registry which will inform you:

“As of January 2017 the average house price in the UK is £218,255, and the index stands at 114.47. Property prices have risen by 0.8% compared to the previous month, and risen by 6.2% compared to the previous year”.

If we can agree that looking at data in the form of charts above gives better understanding, next time we will move on to looking at what is going to happen going forwards, and how we might want to Performance Manage rather than just report.

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

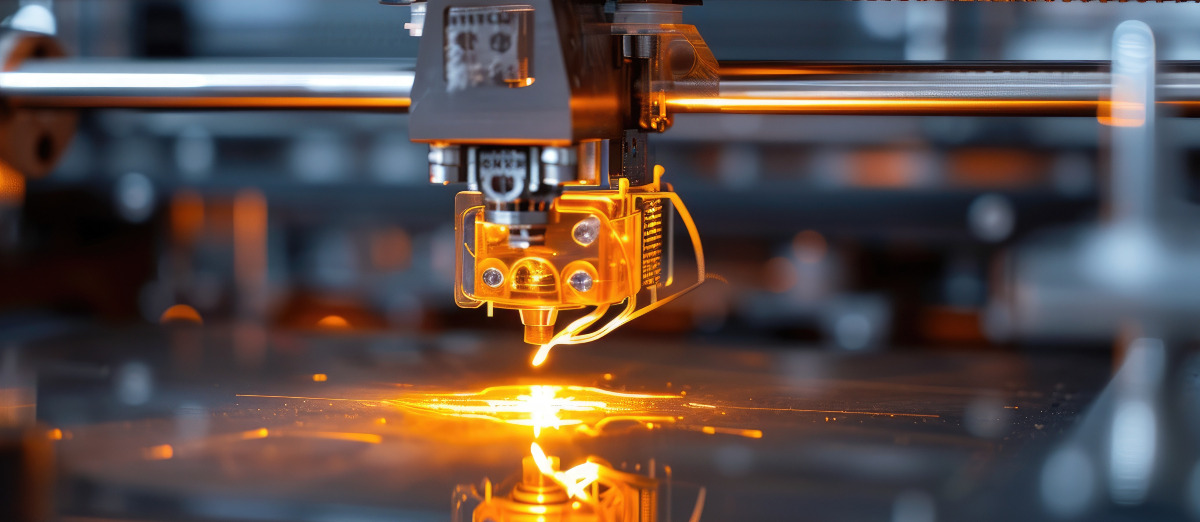

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...