The future of operational performance management

09/01/2017

It always fascinates me on my travels that almost every organisation I come across, be it public or private sector, seems to think that their way of reporting operational (as opposed to financial) performance is peculiar only to them, involves measures that were designed by committee, and requires the use of the latest and greatest in “info-matics” as if there is a competition to cram as many different colours of the spectrum and different types of charts as possible onto one page! Why?

Alongside this, there seems to be some sort of reporting timeline “straitjacket” that dictates that this operational reporting be delivered on a monthly basis. Why?

It may be worth exploring the comparison between operational performance management and financial performance management. So this is a starter for 10!

Financial performance management has been around in more or less its current form since Venetian times – say 500 years. So it’s had some time to evolve and mature a standard way of reporting! And with that, we would be very surprised if a financial performance report did not start with something like a P/L review. A P/L review would contain some well-defined and well-understood measures like revenue, cost and profit (crudely speaking). So we don’t see people getting ridiculously creative in presenting exotic ratios or complex combinations of measures, or visualisation of P/L every which way there is in graphical form.

If we’re being generous, let’s say operational performance measurement has been around since the 1970s – some 50 years or so. So in comparison to financial performance reporting, it’s still very early doors! Suppose we transport ourselves another 20 – 50 years (assume we’re able to move faster than during the last millennium) into the future – can we predict what a standard way of reporting operational performance might look like?

Would it contain just a standard set of measures?

Would it be presented in a standard way?

Would it be presented on a monthly basis?

See our next blog for the answers to these questions.

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

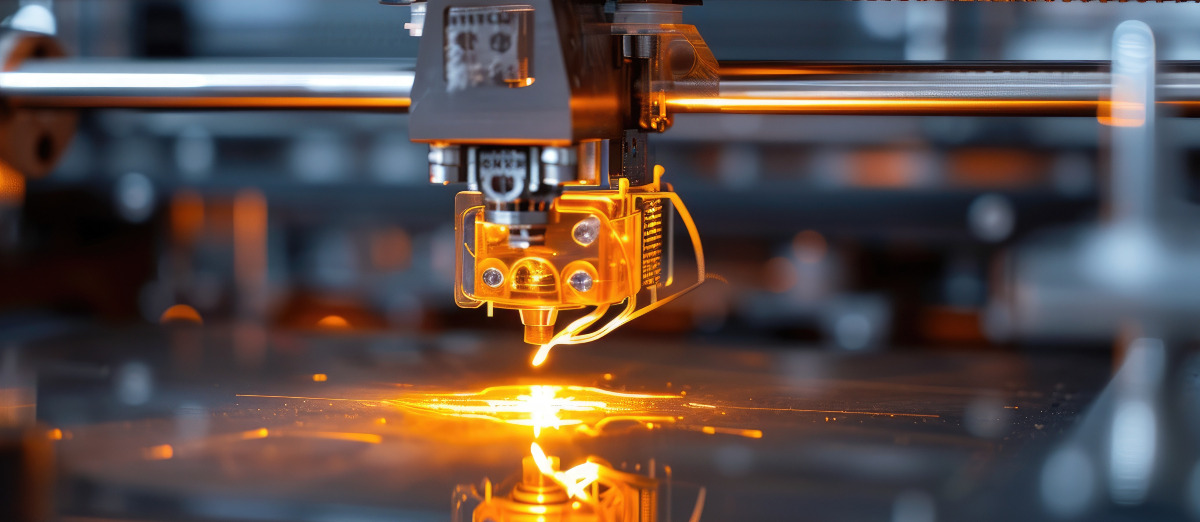

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...