The Bigger Bang

22/05/2015

The news in today’s newspapers about the fines being handed out to the banks again takes me back to the “big bang”; the change that happened in the City of London in the late 1980s.

Before that date, the city was seen by many as a gentleman’s club. That wasn’t a bad description. But in that pre-big bang state, those in the city had real skin in the game in that they owned (or part owned) the institutions whose money they were gambling. They weren’t just hoping for success, they were concerned about failure and the impact that would have on their wealth and reputation.

It was at that time my wife’s colleague at City University and friend George Webb wrote the book “The Bigger Bang”, and how prophetic that phrase seems to be now!

Now we pay people to gamble other people’s money. And guess what they do? Yes they gamble other people’s money, our money. But such people are incentivised to share in the success but have no stake in the failure. These are the perverse incentives that seem to inhabit our financial world.

I remember as a young manager joining the Unilever share option scheme. It seemed odd at the time. I could invest my money in the shares if the company’s share price went up, but I could take the money out if it didn’t. Almost a one way bet and that is the way we appear to incentivise many executives. But I would prefer to buy shares in a company such as Berkshire Hathaway where those running the business such as Warren Buffett could lose as well as make money.

The consultants Stern Stewart developed their approach to increasing Economic Value Added in the 1990s but even they realised bonuses needed to be pooled so that profits one year were not all paid out, but partly held against future negative consequences over the next two years.

But in today’s markets, we are paying out more in bonuses to employees than the financial institutions are paying out in dividends to shareholders. And we tolerate it! It is high time we got back to basics. That doesn’t mean we don’t incentivise people but that we actually take the time to create an incentive system that encourages people to take appropriate risks whilst managing our money.

Mike Bourne.

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

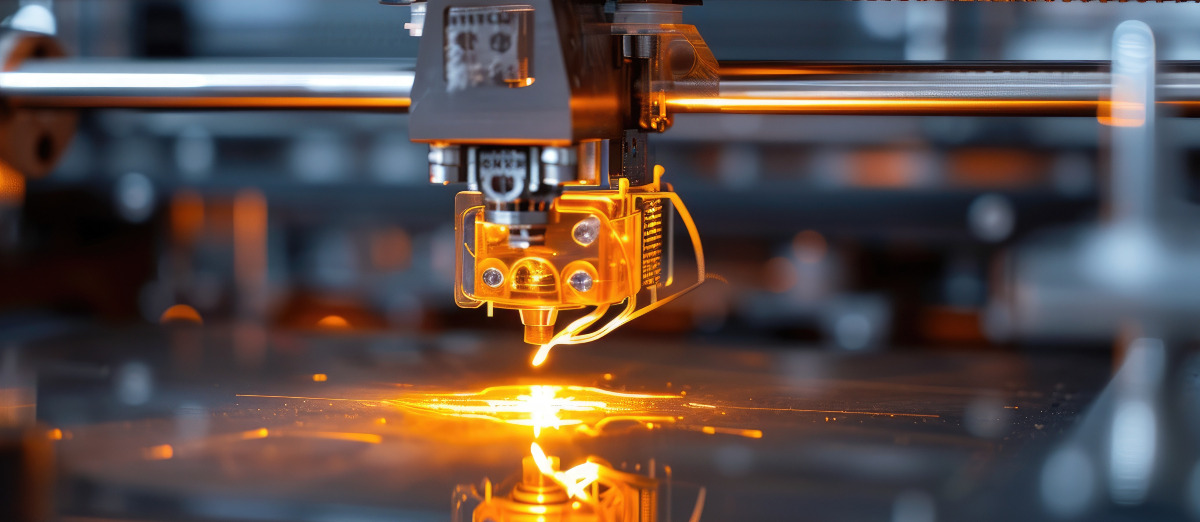

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...