Guest Entrepreneurship Speaker Series Autumn 2021

26/11/2021

Vincent Choi Cranfield MBA 2011: Insights from the Frontline

On Thursday 11 November we were delighted to host Cranfield MBA Vincent Choi to kick off our Autumn 2021 Guest Speaker series. After so many months of Zoom presentations, it was fantastic to have Vincent join us in person, fresh off the plane from Singapore. Vincent had taken time out of his busy role as co-founder and CEO of Pomelo Pay to share some of what he has learned from his entrepreneurial journey – specifically to give tips and demolish myths about what it takes to build a high-growth business funded by venture capital.

Vincent began his career as a Chartered Accountant, working for Deloitte and Macquarie Bank before taking a year out to study at Cranfield. He had no background in family business or entrepreneurship, but the MBA proved a turning-point in his life, boosting his confidence that he could carve out a career as a business founder. His business, Pomelo Pay, is a mobile payments company that helps merchants process transactions without the need to invest in additional hardware. Vincent and his co-founders did not start Pomelo straight away after he finished at Cranfield. Initially, they provided software solutions to other companies operating in fintech, before concluding that they had the skills and experience to do something similar on their own account. And so, in 2017, Pomelo was born in London and has grown from three founders to 60 staff operating in eleven countries.

Tips for fellow-founders

From his hard-won experience, Vincent shared the following tips:

#1: Build the team. It’s rare for a single founder to have all the skills and competencies required to make the dream a reality. Assembling the right talent may take time, but there are no short-cuts.

#2: Create a Shareholders’ Agreement that’s fit for purpose, using the best legal expertise available. It’s important to understand the difference between a fair and equitable split of shareholding at the outset, and the requirement for those shares to vest over time as the venture progresses. The right structure avoids a messy situation, such as a founding shareholder who leaves the business after six months keeping a large percentage holding, which can deter future investors from putting their money in.

#3: You may have every confidence in your business, but don’t over-sell the business to investors. If you can’t keep your promises, these may well come back to haunt you.

#4: Take care to build your board[s] of directors, and use them well. When you are deeply immersed in your business, they will see the wood for the trees. Vincent said that he regretted not paying more attention to creating an Advisory Board. There are experienced people out there who will be keen to help you succeed.

#5: Securing money is great, but it doesn’t solve every problem.

#6: Your business cannot do everything. It’s important to rule certain things out early on, so you can focus on the opportunity.

Myth-busting

In the second half of his presentation, Vincent addressed some of the myths around start-ups and VC investment:

Myth #1: Processes are only for corporates. Vincent argued that processes and systems should be embedded early in a company’s life, so that activities such as sales are not continually reinvented.

Myth #2: VCs care only about sales and profit. He shared with us the highly insightful “ladder of proof”, which charts the sequence of evidence that makes a compelling and investible proposition. The bottom rungs of the ladder are the foundations of a sustainable business, such as a credible team and an addressable opportunity. Further up the ladder are the rungs of capabilities and partner relationships that make the business viable, and at the top are the revenues which are the outcome of everything that has come before.

Myth #3: You have to grow locally, before you can cross borders. Pomelo was born global. It is headquartered in London, where it raises money, but its key markets extend across south and east Asia, from the Maldives to the Philippines. A good idea has legs of its own.

Vincent’s insights derive from several rounds of angel and VC funding. In the most recent raise, Pomelo secured $10 mn and is on course to expand operations to over 20 countries next year. In 2023, Vincent and his team aim to be present in 34 countries, with the goal of processing in excess of $10bn of payments across both European and emerging markets.

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

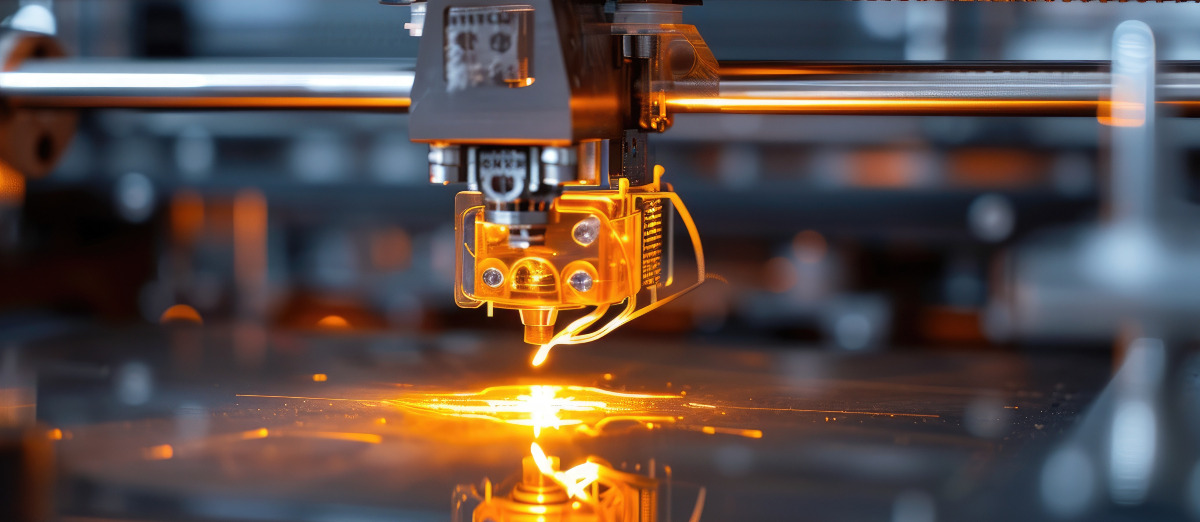

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...