Private Equity data in Capital IQ

17/08/2023

For those of you interested in private equity, here’s a quick summary of the information available in Capital IQ…

Capital IQ users need to register first for an account. Read about how to do that here.

Viewing details for a named Private Equity/Venture Capital company

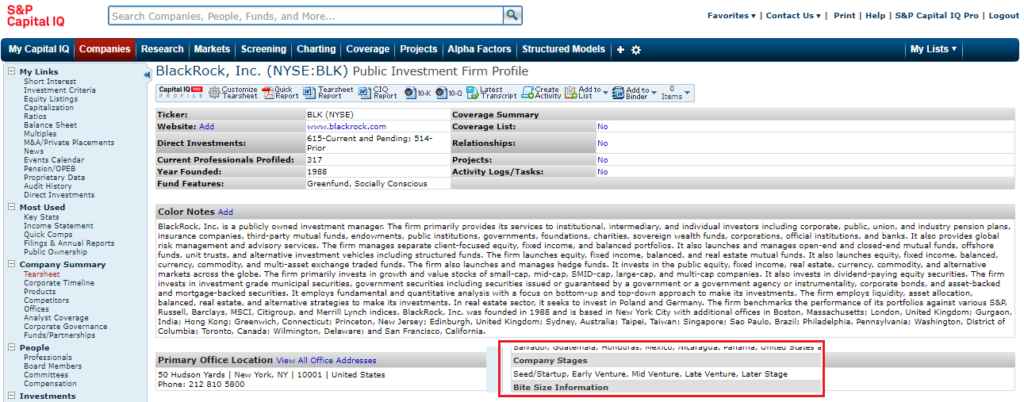

Let’s take BlackRock Inc. as an example. Simply search for the company name in the search box at the top of the screen. The tearsheet is usually displayed as default.

Under the tearsheet’s Company Summary heading you can see that the company is described as a Public Investment firm and that the company stages part of the record show the various stages that it has been through.

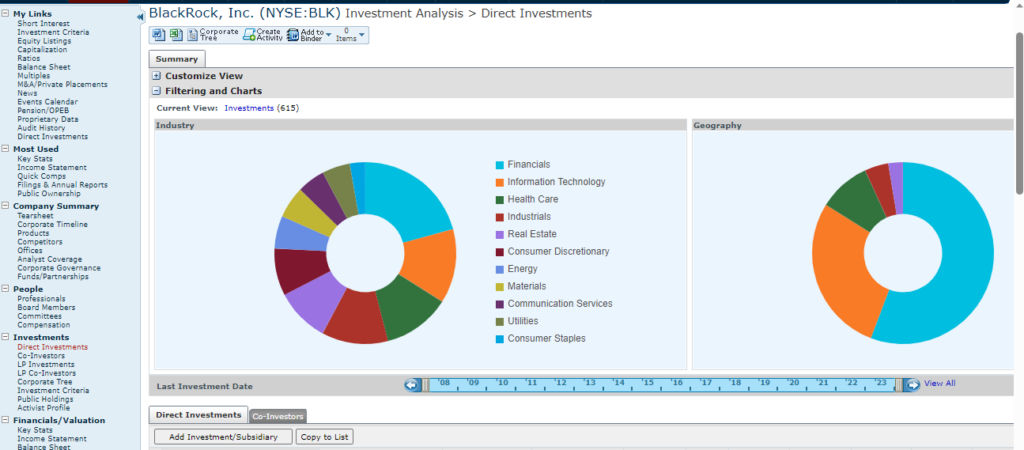

For details of where your private equity company invests, select Investments from the left-hand menu. Direct Investments shows a breakdown by industry and geography. You can also access this from the company tearsheet’s current and pending subsidiaries/investments section.

For information on BlackRock’s funds, select the option for ‘Funds/Partnerships‘ in the Company Summary menu. Funds are categorised by type. Click through on any fund name for more information.

In the left hand menu, towards the bottom, look for the heading for Investors. Here you can view both public and private ownership of your company. Public ownership will show the fund portfolio’s disclosures whilst Private ownership shows the PE/VC investments.

Identifying Private Equity/Venture Capital companies

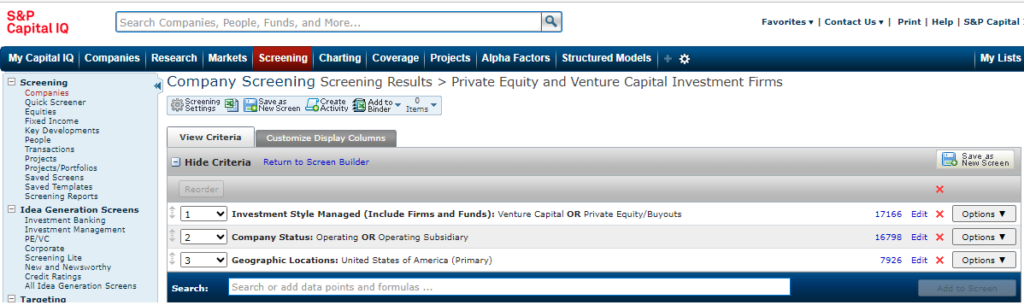

First select the Screening tab at the top of your screen.

From the Criteria options displayed in the Screening criteria menu (see below), find the ‘Investment/Advisory Firms’ section and select ‘Investment style managed’ then select Venture Capital and Private Equity. Click on ‘Add Criteria’ to add your selections into your search.

- Then select from company status – operating or operating subsidiary

- Select a geographic location from Company Details, in my example United States of America.

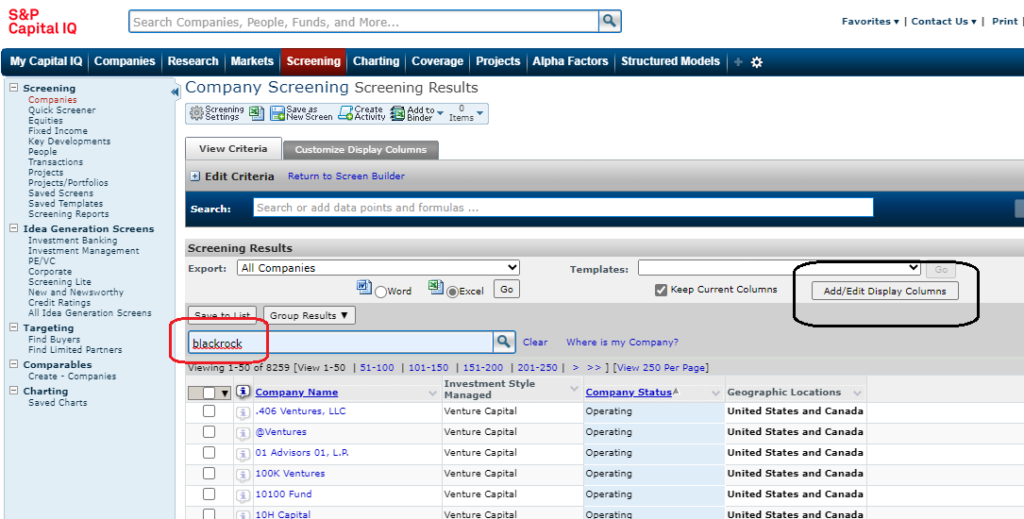

When you are ready, click ‘View Results’. Results will show lists of PE/VC companies with company name, investment style, location etc. You can search within the results to locate a specific company name or you can add extra columns of data to your results. Results can be exported to Excel.

Any questions at all on any part of your PE/VC research, please contact us or visit us in the SOM Library.

Feature image from Pixabay. Available at: https://pixabay.com/photos/savings-budget-investment-money-2789112/

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...