Marketing in this Covid-19 driven recession

25/03/2020

Professor Malcolm McDonald offers these thoughts during these difficult times in order to encourage all those of us who are intensely worried by the effects of the COVID-19 driven recession.

It is pure fiction to imagine that the impending recession is going to disappear soon.

The typical reaction to such misfortune is what Andrew Lorenz in the Financial Times describes as “anorexia industrialosa”, an excessive desire to be leaner and fitter, leading to emaciation and eventually death. Yes, of course there is a necessity for cost cutting, but it has to be done sensibly, as I shall spell out later.

But if this is the only response to recession, it is doomed to failure, largely because it results in even worse service to customers and customers just will not stand for this anymore.

Why is this?

Perhaps we need reminding briefly that the rules of competition have changed. The “make and sell” model has been killed off by a new wave of entrepreneurial technology-enabled competitors unfettered by the baggage of legacy bureaucracy, assets, cultures and behaviours. The processing of information about products has been separated from the products themselves and customers can now search for and evaluate them independently of those who have a vested interest in selling them. Customers now have as much information about suppliers as suppliers have traditionally accumulated about their customers. This new state has created a new dimension of competition based on who most effectively acts in the customers’ interests. So, this is the backcloth against which we face this new challenge in the early part of 2020.

I have 120 pieces of scholarly research to prove that long term successful companies take the trouble to segment their markets. Segments are groups of customers with the same or similar needs, not sectors. They work hard at understanding these needs and their behaviour patterns. They prioritise these segments according to their likelihood of enabling the company to achieve its profit objectives and they then develop appropriate product/services packages for each. They are ruthless in times of recession at focusing their attention on the segments they intend to keep in the long term, and they prune out those which are a drag on their resources. Only then is cost cutting and downsizing justified.

I am, of course, referring to Pareto’s Law (the 80/20 “rule”) About 20% of your customers will deliver about 80% of your revenue and profits, so trying to delight everyone with all of your offers guarantees average service that will delight no-one. By identifying your core market of primary customers and delighting them with selected differential offers, you will successfully preserve a resilient customer base.

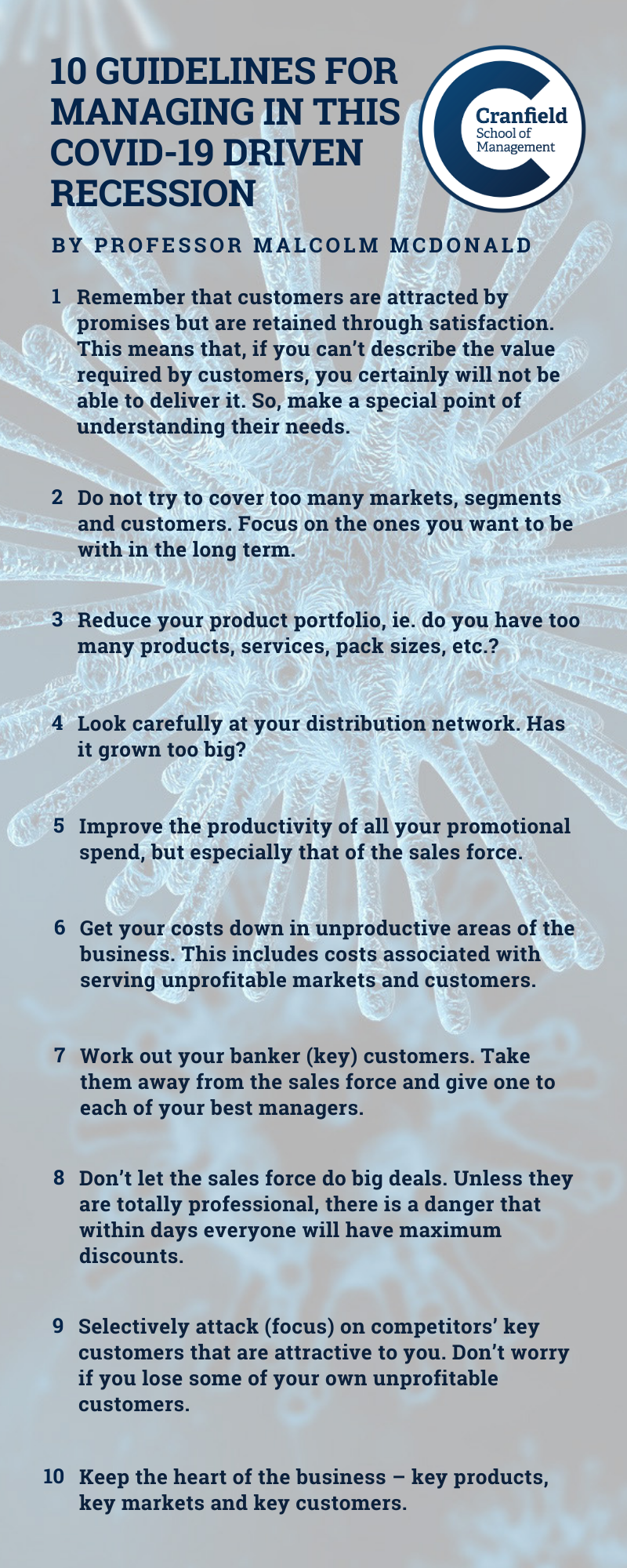

Although this will not apply to all organisations, here are some guidelines for managing in this COVID-19-driven recession based on what I have said above.

The problem, of course, for certain types of businesses with massive fixed costs such as airlines, is on an entirely different scale and whilst the principles are the same, this short article is not intended for them.

Categories & Tags:

Leave a comment on this post:

You might also like…

Commonwealth Scholarships play a critical role in developing sustainability and leadership in Africa

Q&A with Evah Mosetlhane, Sustainability MSc, Commonwealth Distance Learning Scholar What inspired you to pursue the Sustainability MSc at Cranfield? I was inspired to pursue the Sustainability MSc at Cranfield because of the university’s ...

How do I reference a thesis… in the NLM style?

You may be including theses within your research. When you do so you need to treat them in the same way as content taken from any other source, by providing both a citation and a ...

Introducing… Bloomberg Trade Flows

Are you interested in world trade flows? Would it be useful to know which nations are your country's major trading partners? If so, the Bloomberg terminal has a rather nifty function where you can view ...

Cranfield alumni voyage to the International Space Station

Seeing our alumni reach the International Space Station (ISS) has a ripple effect that extends far beyond the space sector. For school students questioning whether science is “for them”, for undergraduates weighing their next ...

From classroom to cockpit: What’s next after Cranfield

The Air Transport Management MSc isn’t just about learning theory — it’s about preparing for a career in the aviation industry. Adit shares his dream job, insights from classmates, and advice for prospective students. ...

Setting up a shared group folder in a reference manager

Many of our students are now busy working on their group projects. One easy way to share references amongst a group is to set up group folders in a reference manager like Mendeley or Zotero. ...