How is FinTech accelerating financial inclusion?

15/03/2024

The goal of many banks, emerging digital banks and FinTech businesses is to make financial services more accessible to everyone, a goal best expressed by the phrase “financial inclusion.” It is difficult to define financial inclusion, but it includes the ability of individuals and businesses to obtain relevant and affordable financial products and services that satisfy their diverse needs, and which are delivered ethically and sustainably.

Technology has played a critical role in improving access to financial products and services helping millions become included in the financial ecosystem across the world as per the most recent Global Findex Survey data[1]. Consumers with mobile money accounts are more likely to have a bank account, send and receive money more frequently, and save more money. Mobile money helps small enterprises and entrepreneurs by expanding access to bank credit. Peer-to-peer lending, credit risk assessments, and cross-border transfers are just a few of the numerous FinTech products and services already on the market. We also see other popular digital choices available to consumers which include mobile banking, digital banking, marketplace lending, etc.

Recent evidence suggests that worldwide account ownership has reached 76 percent of the global population. The use of digital financial services has increased since COVID-19. Most adults who used a card, phone, or the internet to make a digital payment did so for the first time after the pandemic began. Financial inclusion has been made possible, particularly for women, particularly by mobile money. This is because women are more likely to hold and use accounts through mobile payments, savings, and borrowing.

Key enablers strengthening the FinTech and financial inclusion nexus

To maintain the advantages of FinTech, regulations need to evolve to reflect technological advancements and investor education to address security and platform issues. New technologies also increase the risk of cyber threats and scams. Therefore, a balanced and risk-adjusted approach to governing these technologies is required. Comprehensive digital infrastructure and well-designed data policies are required to exploit FinTech and achieve financial inclusion goals, so that such technologies help consumers.

Financial literacy is an important tool helping consumers make informed financial judgments. Financially literate consumers are equipped to make better financial decisions and improve their overall quality of life. Financial awareness and literacy will also support consumers against cyber financial crimes and misinformation. FinTech is critical for creating the next generation of financial instruments, as well as encouraging and facilitating financial education. People can interact with FinTech more successfully when they have greater technological and financial literacy. Furthermore, banks and other financial institutions play a critical role in improving financial literacy and enhancing consumer well-being.

Therefore, policymakers, banks, and other stakeholders should place a high focus on creating more inclusive financial systems that directly benefit the underprivileged and low-income groups as well as other vulnerable households by providing them with wider access to suitable financial services. FinTech can increase the use of financial services and products while also greatly enhancing access and usage. Financial inclusion powered by FinTech is a promising strategy to reduce inequality and achieve sustainable growth.

[1] https://www.worldbank.org/en/publication/globalfindex

Dr Lakshmy Subramanian is the Course Director of our new Banking, Economics and Finance MSc: https://www.cranfield.ac.uk/som/masters-courses/banking-economics-and-finance

Categories & Tags:

Leave a comment on this post:

You might also like…

Keren Tuv: My Cranfield experience studying Renewable Energy

Hello, my name is Keren, I am from London, UK, and I am studying Renewable Energy MSc. My journey to discovering Cranfield University began when I first decided to return to academia to pursue ...

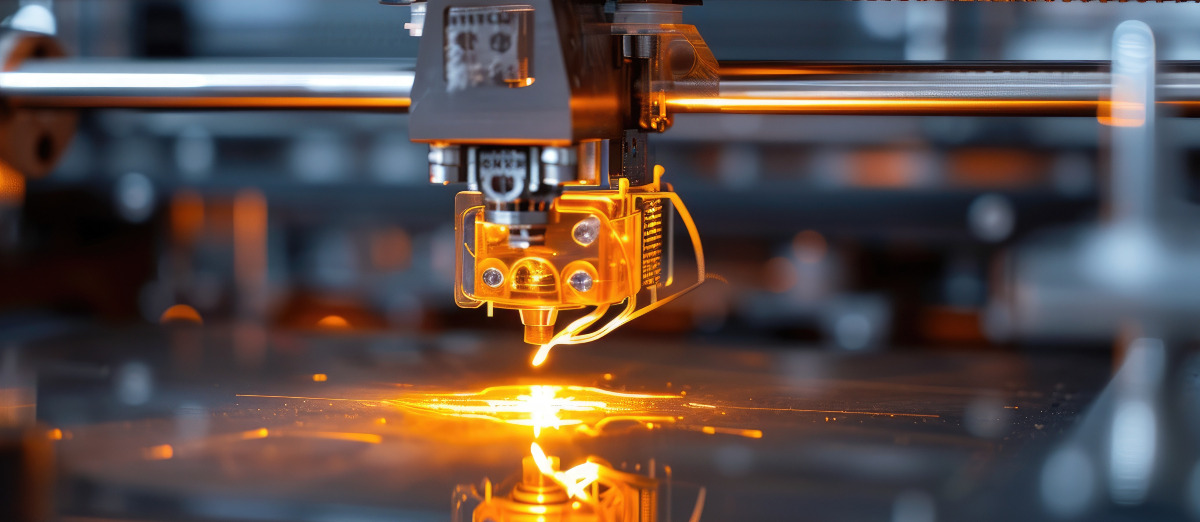

3D Metal Manufacturing in space: A look into the future

David Rico Sierra, Research Fellow in Additive Manufacturing, was recently involved in an exciting project to manufacture parts using 3D printers in space. Here he reflects on his time working with Airbus in Toulouse… ...

A Legacy of Courage: From India to Britain, Three Generations Find Their Home

My story begins with my grandfather, who plucked up the courage to travel aboard at the age of 22 and start a new life in the UK. I don’t think he would have thought that ...

Cranfield to JLR: mastering mechatronics for a dream career

My name is Jerin Tom, and in 2023 I graduated from Cranfield with an MSc in Automotive Mechatronics. Originally from India, I've always been fascinated by the world of automobiles. Why Cranfield and the ...

Bringing the vision of advanced air mobility closer to reality

Experts at Cranfield University led by Professor Antonios Tsourdos, Head of the Autonomous and Cyber-Physical Systems Centre, are part of the Air Mobility Ecosystem Consortium (AMEC), which aims to demonstrate the commercial and operational ...

Using grey literature in your research: A short guide

As you research and write your thesis, you might come across, or be looking for, ‘grey literature’. This is quite simply material that is either unpublished, or published but not in a commercial form. Types ...