The Future of Operational Performance Management – Part 2

20/02/2017

The first post on this subject was posted on 9th January, which, some readers reminded me, promised answers to the questions asked. It compared Financial Performance Management (500 years and more of history) with Operational Performance Management (50 years of history – maybe). But first, we continue to hear every day about the trials and tribulations of the NHS. One report quoted an NHS “Chief Executive” as stating they didn’t have enough beds – as if that was the critical problem. There are several critical issues about the NHS, but one is that they make the same mistakes as almost every organisation we come across in our journey, namely they measure the Wrong Things from an improvement perspective, and the Care Quality Commission doesn’t help!

Back to our blog: What questions did we pose about what a standard way of reporting Operational Performance Management might look like, comparing this with standard accounting ways of assessing an organisation’s Financial Performance Management?

- Would it contain just a standard set of measures?

- Would it be presented in a standard way?

- Would it be presented on a monthly basis?

We’ll focus on the first bullet in this post, and the answer is yes, and it is no more than 10! To see this, we’ll introduce a fundamental concept – critical Generic Processes – that we believe is as important to Operational Performance Management as the concepts of Profit & Loss, Balance Sheet etc., when they were created in the mists of time by the accounting profession.

The Operational Performance Management equivalents to Profit & Loss, Balance Sheet etc. – Generic Processes

In assessing Financial Performance, there are some standard critical “objects” that are looked at, for example, Profit & Loss Sheet, Balance Sheet etc.

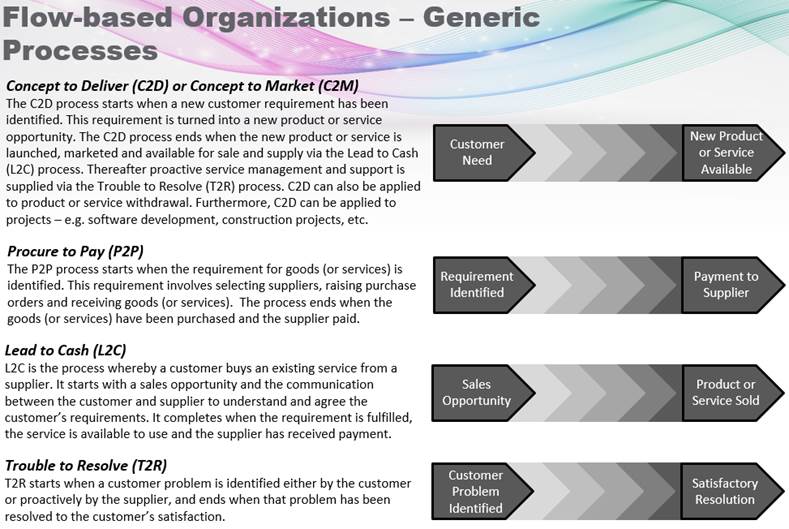

In Operational Performance Management, the author together with some colleagues has identified 4 critical Process Types (Processes were introduced in our previous Systems-Thinking blogs), and we see between 1 and all 4 of these in every organisation we work with. These are Operational Performance Management equivalents to P&L, Balance Sheet etc., and they are the core objects to which we will apply our standard sets of measures. What are these 4 critical processes?

There will, of course, be Supporting Processes and Technical/Financial Processes, but they are not core to the organisation. Let’s look at some examples:

- Police: Generically speaking, their main process is T2R – the Public has a Problem, and the Police are required to solve it or prevent it (Trouble to Resolve)

- Ambulance: Generically speaking, also T2R – a patient has a problem, and needs help to recover or transport to a facility where they can be cured/cared for until resolved (Trouble to Resolve)

- Insurance: Generically speaking their main activities are L2C – a customer requires a quote/policy, pays premium, monies collected via direct debit (Lead to Cash) and T2R – a customer has an accident and requires some sort of resolution (Trouble to Resolve)

- Pharmaceutical Companies: As well as L2C and T2R, they operate C2M – laboratories around the world come across new diseases/complaints and they develop new drugs which must go through development, pre-clinical and clinical testing before they come to market (Concept to Market or Concept to Deliver)

- And so on…

These are like the fundamental building blocks of physics. You might say, what about Supply-chain? Well, Supply-chain is a combination of L2C and P2P. What about Asset/Infrastructure Management? This is a combination of L2C and T2R.

Having introduced these 4 fundamental generic processes we see everywhere, the P&L and Balance sheet equivalents of Financial Performance Management, we can now definitively consider what has to be measured in order to improve them.

This will be the subject of the next blog…

Categories & Tags:

Leave a comment on this post:

You might also like…

Company codes – CUSIP, SEDOL, ISIN…. What do they mean and how can you use them in our Library resources?

As you use our many finance resources, you will probably notice unique company identifiers which may be codes or symbols. It is worth spending some time getting to know what these are and which resources ...

Supporting careers in defence through specialist education

As a materials engineer by background, I have always been drawn to fields where technical expertise directly shapes real‑world outcomes. Few sectors exemplify this better than defence. Engineering careers in defence sit at the ...

What being a woman in STEM means to me

STEM is both a way of thinking and a practical toolkit. It sharpens reasoning and equips us to turn ideas into solutions with measurable impact. For me, STEM has never been only about acquiring ...

A woman’s experience in environmental science within defence

When I stepped into the gates of the Defence Academy it was the 30th September 2019. I did not know at the time that this would be the beginning of a long journey as ...

Working on your group project? We can help!

When undertaking a group project, typically you'll need to investigate a topic, decide on a methodology for your investigation, gather and collate information and data, share your findings with each other, and then formally report ...

From passion to purpose: My journey at the Pinnacle of Aviation

By: Sultana Yassin Abdi MSc Air Transport Management, Current Student Born and raised in the vibrant landscape of the UAE, with roots stretching back to Somalia, my life has always been ...