Performance Reporting Measures vs Performance Management Measures – Part 5

12/02/2020

Sophisticated Statistical Treatment of Measures – Part ii

You may have read my previous blogs comparing Performance Reporting Measures vs Performance Management Measures.

Performance reporting is littered with measures that may appear to carry meaning for some people, but in our observations, have been misleading and impenetrable to many. And certainly don’t help understanding nor how to improve!

Here are some examples of reporting measures that we introduced previously:

- % items completed: % implies a ratio – with a numerator and denominator. E.g. % Repairs Completed defined by (Number of Repairs Completed / Total Number of Repair Calls) * 100

- % completed within some timeframe: E.g. From a previous blog’s A&E Figures, we saw % A&E attendants seen in 4 hours or under.

- Complicated Measure Combinations: E.g. % Forecast Accuracy in Supply-chain

- Applying sophisticated statistical treatment to raw performance measures that only stats specialists can read: E.g. Exponentially weighted moving averages

- Statistical representation of a population of people or things: E.g. Electric Car Use by Country

This week we’ll look at a second example of the sophisticated statistical treatment of simple performance measures – moving average charts

Moving Average Charts

So we already know from our previous 5 blogs on this subject that % measures present problems, and measures that use % success within a constraint (usually time) / target inhibit understanding, complicated measure combinations are dangerous, and how out of context correlation can be misleading – so we’ll not revisit them here.

So why can the sophisticated statistical treatment of simple performance measures, in this case moving averages, confuse or mislead?

First, we ask, what is a moving average. In fact there are several kinds of moving average, and Wikipedia does a pretty good job of explaining what they are:

https://en.wikipedia.org/wiki/Moving_average

Remember the rule of thumb from our previous blogs – the more sophisticated the algorithm you apply to a measure, the more distant you become from what is actually going on. Let’s look at the simplest moving average, which is referred to, funnily enough, as a Simple Moving Average.

Simple Moving Averages can often be used to smooth a series of data points, for example if the number of orders for a particular vaccine peak before and during the flu season, and drop in between, financial types might want to look at some averaged result in order to establish budgets / forecasts. We’ve seen in previous blogs how some crimes (e.g. burglary) are seasonal, volumes of people attending A&E are seasonal, GDP on a monthly basis bounces up and down over the year, and so on. Statisticians often resort to smoothing these results by taking a 3, 6 or 12 month rolling average in order to try to establish potential trends and forecast forward.

Why can such statistical treatment potentially mislead, particularly when we’re trying to improve processes and systems?

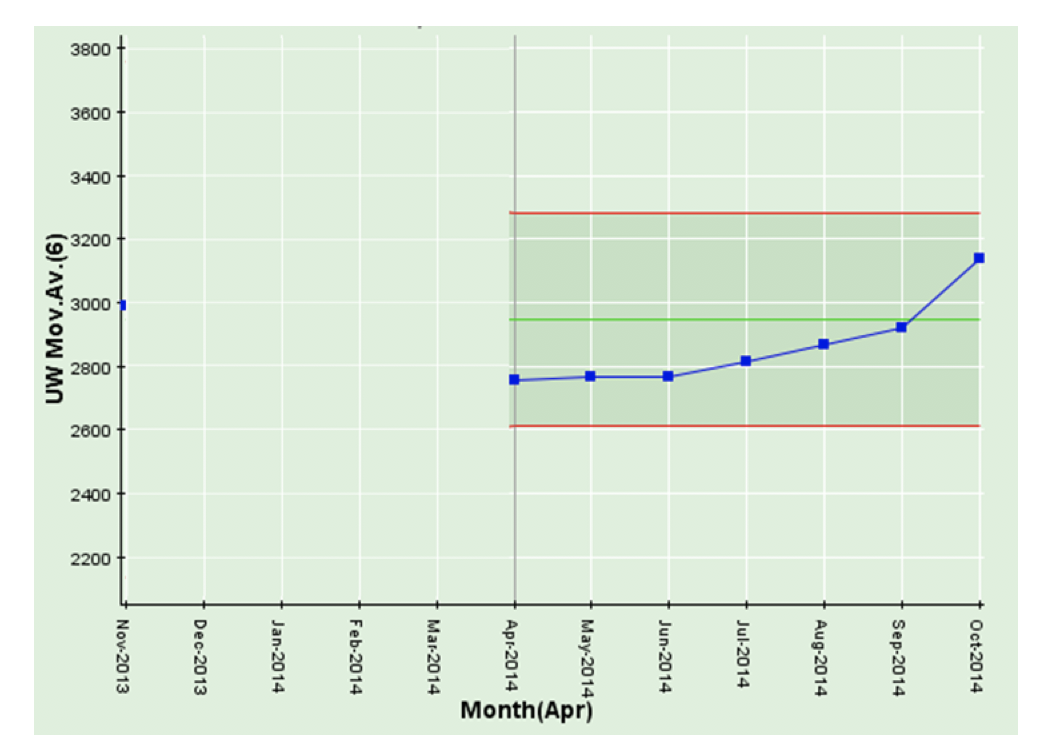

We’ll work with a simple 6-month moving average as illustrated in the chart below:

The critical thing to note is that more often than not, these moving average charts are presented out of context (i.e. without a chart of the underlying data). And this is the main problem as we’ll see below. But first, let’s explain the chart.

The chart above is an (unweighted or simple) 6-month moving average. The first point on the 6-month moving average is 6 months in, since, obviously, it needs 6 months (November 2013 through April 2014) to calculate a 6-month moving average for April 2014. The 6-month moving average for May 2014 is calculated from December 2013 through May 2014, the 6-month moving average for June 2014 is calculated from January 2014 through June 2014 and so on.

You’ll note that the latest result in October 2014 is the highest in the series of points. It might get some people excited about trying to find the cause of this. But let’s have a look at the underlying data – and we might draw a different conclusion.

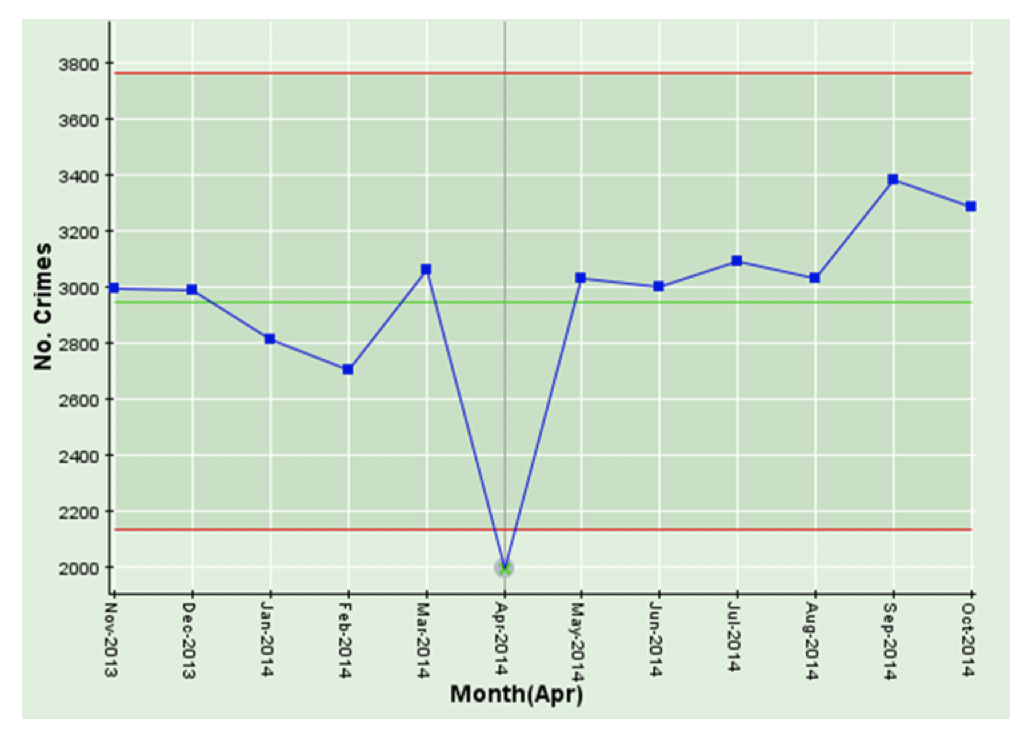

This chart is a simple time-series chart of crimes per month from November 2013 through October 2014. Note the significant drop in April 2014!

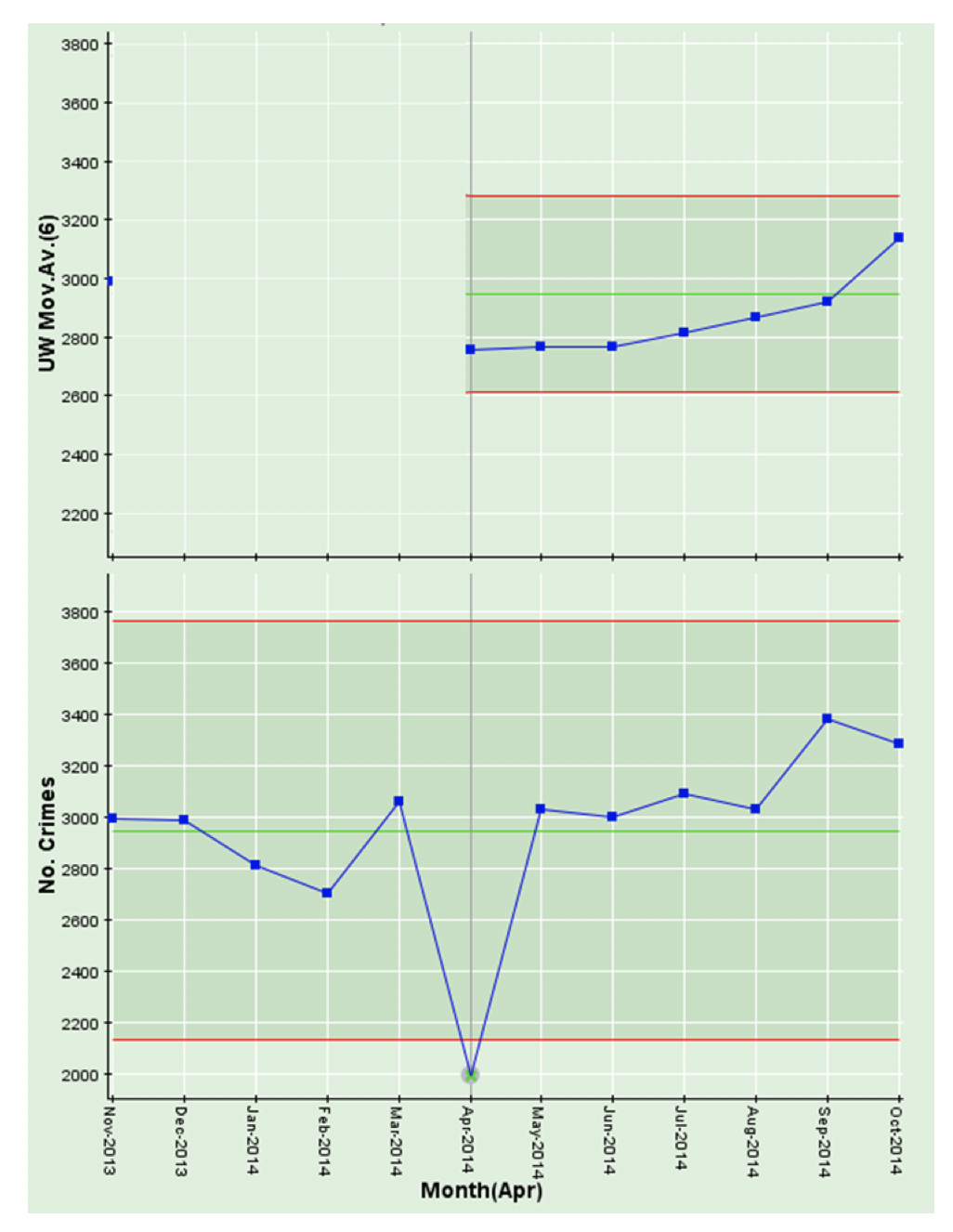

You’ll note that the last month (October 2014) on the time-series chart below is not unusually high, but, as we saw above, the last result in the moving average chart is the highest of any of the previous 6 results. This is not because October 2014 is unusual, it is because the calculation for October 2014 6-month moving average uses May 2014 through October 2014, and the very low result of April 2014 has dropped out of the calculation. We have observed in our travels, that these spurious “highest results” (or the opposite “lowest results”) can get people pretty agitated and can kick off wasteful investigations around what happened in the latest month, when, in fact, the issue was, in this case, 6 months earlier!

Our recommendation is, in order to maintain context, you ALWAYS display moving average charts (or any other kind of sophisticated statistically treated measure) with their corresponding time-series chart.

That would keep Dilbert happy!

We’ll use the next and final part in this series, to look at statistical representations of populations and when they are useful and when they are not! Dilbert would be super-impressed!

Categories & Tags:

Leave a comment on this post:

You might also like…

My journey to Cranfield as an FIA Motorsport Engineering Scholar

"You don’t need to fit a stereotype to succeed in engineering or motorsport. You need curiosity. Resilience. And the confidence to take up space." In this blog, Sanya Jain, current MSc student and FIA ...

‘Getting started with Bloomberg’ training – discover the power of Bloomberg terminals

Perhaps you've heard people talking about Bloomberg or heard it mentioned in the news and are wondering what all the fuss is about? Why not come along and find out at our Getting started with ...

Commonwealth Scholarships play a critical role in developing sustainability and leadership in Africa

Q&A with Evah Mosetlhane, Sustainability MSc, Commonwealth Distance Learning Scholar What inspired you to pursue the Sustainability MSc at Cranfield? I was inspired to pursue the Sustainability MSc at Cranfield because of the university’s ...

How do I reference a thesis… in the NLM style?

You may be including theses within your research. When you do so you need to treat them in the same way as content taken from any other source, by providing both a citation and a ...

Introducing… Bloomberg Trade Flows

Are you interested in world trade flows? Would it be useful to know which nations are your country's major trading partners? If so, the Bloomberg terminal has a rather nifty function where you can view ...

Cranfield alumni voyage to the International Space Station

Seeing our alumni reach the International Space Station (ISS) has a ripple effect that extends far beyond the space sector. For school students questioning whether science is “for them”, for undergraduates weighing their next ...